Elastic: Attractive Expansion Around Its Core Competencies

by Tech and GrowthSummary

- Elastic is leveraging its core competence in IaaS search technology to expand into the fast-growing cloud security and APM markets.

- It also continues to maintain a strong reputation within the open-source community, which has helped in landing high-profile clients.

- The 70% growth and 130% net retention have been solid and best-in-class, while the valuation offers enough margin of safety for investors.

Overview

Elastic (ESTC) presents an attractive investment opportunity in the area of software and IaaS (Infrastructure as a Service) spaces. As Venture Capitalists, we first learned of its open-source Elasticsearch offering maybe a year or two before the incorporation of Elastic. Its open-source search technology has been popular among the engineering teams in and outside Silicon Valley and is well known for its reliability. Having been in the search technology business for almost 10 years, Elastic has also acquired a core competence in building SaaS and scalable IaaS-based offerings. As the company scales its business and monetizes around this core competence, we maintain our long-term bullish stance on the stock.

Catalyst

R&D teams leverage Elasticsearch's search algorithm and scalable cloud services when developing search-related features for any software applications. It powers all search-related use cases such as searches for particular items in eBay (EBAY) or riders-drivers searching and matching in Uber (UBER) mobile application. The fact that high-profile tech companies such as Uber, eBay, or Netflix (NFLX) have chosen Elastic to be the backend service provider for their most mission-critical activities like searches has proven its reliability.

There are two things we like about the company in particular, which also serve as the long-term catalysts for the business: the management's vision to build an attractive business around its core competence and the community-driven growth approach stemming from its early origin as an open-source developer.

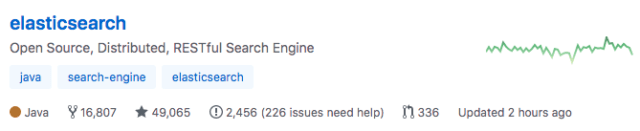

(Source: github)

Within the most popular open-source community platform, Github (MSFT), ElasticSearch's codebase has been one of the most active repositories. It has received over 16,000 forks, 49,000 favorites, and has over 1,400 contributors.

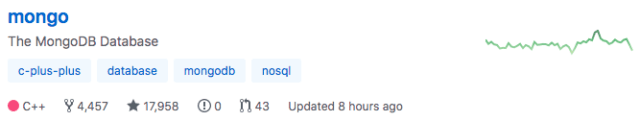

(Source: github)

Relatively, ElasticSearch is more refined and discussed than Mongo (MDB)'s open-source non-relational database offering, MongoDB. There are only over 400 contributors in MongoDB at present. Despite having a different offering, Mongo is a good benchmark for Elastic. Both have similarly humble beginnings where they started as software development firms maintaining popular open-source projects. Now, both are publicly-traded fast-growing companies in equally attractive technology markets.

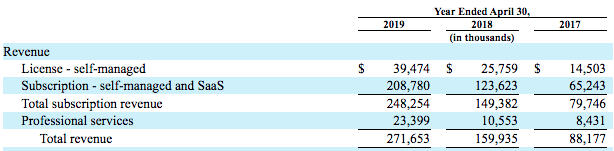

(Source: elastic's 10-K)

Furthermore, Elastic's community-driven growth approach will allow the company to maintain its strong popularity within the R&D and open-source communities, leading to the adoption of its services by more high-profile tech clients. In the last two years alone, revenue has tripled, driven by the increase in the number of high-ACV (Annual Contract Value) clients. In Q3 2020, the company continued to maintain its strong traction as it posted a 60% growth in revenue, over 10,000 subscription customers, and 570 clients with ACV higher than $100,000.

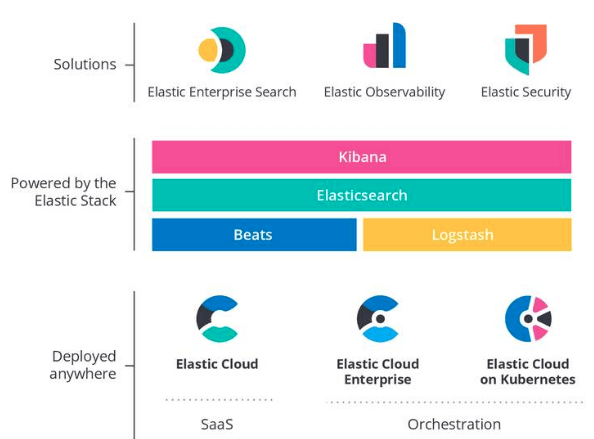

(Source: company's earnings call slide)

As a company with an open-source beginning, the business vision is unexpectedly impressive. The company has used the core competence in building a complex IaaS search technology to expand the business to other high-valued areas in technology markets today, such as SIEM, APM, log management, and multi-cloud deployment. These are some of the most sought-after and critical areas in the context of enterprise digital transformation, where we see fast-growing players like Datadog (DDOG), Splunk (SPLK), and various cybersecurity companies.

(Source: company's Q3 earnings call slide)

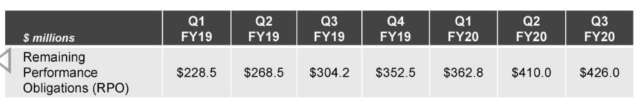

All these high-valued expansions have allowed Elastic to achieve a best-in-class +130% net retention rate, while at the same time growing the value of its RPO by ~1.8x in just a year. In Q3 2020, the company also strengthened its security offering by acquiring Endgame Inc., an endpoint solution that will complement its SIEM offering. Going forward, this will give Elastic an edge against the existing cybersecurity players and log management players like Splunk. Moreover, the acquisition will also strategically allow Elastic to tap into Endgame's public sector client base, which includes the NSA.

Risk

Given the early investment phase to acquire more customers through its high-valued offerings, we do not expect Elastic to be a profitable business for some time. In Q3 2020, the company burned through ~$24 million of FCF (Free Cash Flow), up by 2.5x from last year. The company is also yet to realize the operating leverage reflected in gross margin expansion as a result of its continuing new investments in cloud infrastructure. In Q3, the company invested about $4.2 million in CAPEX, aside from paying the ~$24 million in cash for Endgame acquisitions.

Valuation

Despite its unprofitable operation today, Elastic's strong balance sheet and predictable deferred revenue will help maintain the cash burn at a sustainable level. Pre-IPO, Elastic had also historically been a sustainable business with predictable cash-flow generation.

(Source: stockrow)

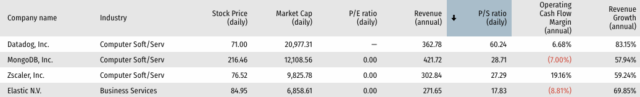

Among the recent tech IPOs, Elastic has also been the cheapest stock in the peer group. While all these stocks pass the rule of 40, Elastic's score of +60 is higher than Mongo's ~50, which should have awarded Elastic with a higher premium. Furthermore, Elastic's ~70% YoY growth means it is not only faster-growing than Mongo, but also the second-highest in the group after Datadog. YTD, the share price has appreciated by over 20% to $78 today. Given the current valuation, we have got the impression that Elastic may be misunderstood. With that in mind, we feel comfortable paying the 17x P/S for its ~70% growth and the rest of its upside potential.

Disclosure: I am/we are long ESTC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.