A Few Safe-Haven REITs To Help You Sleep Well At Night

by Brad ThomasSummary

- This isn't the financial crisis.

- It isn't the dot.com crash before that.

- Nor is it the Great Depression.

- So, we have to treat it differently.

Technically, the term "safe-haven" is redundant.

Havens are, by their very definition, safe. Just ask Dictionary.com, which describes the noun as "any place of shelter and safety; refuge; asylum."

So, to any hardcore logophiles (word-lovers) out there, if you're objecting to my title, I understand. But here's why I'm leaving it as-is anyway, starting - and perhaps ending - with a simple question...

Do you really think you can get enough safety these days?

If that thought isn't enough, let's consider these actual facts:

- Almost the whole world went into or is still in some form of lockdown, putting intense pressure on the global economy.

- At last check, the U.S. unemployment rate was 14.7%.

- As of mid-February, the S&P 500 was sitting at over 3,300, only to plunge more than 1,000 points by the end of March. It has since recovered a good chunk of that, but it's still struggling comparatively speaking.

- So far, dozens of real estate investment trusts (REITs) have cut or suspended their dividends due to the unprecedented situation they find themselves in. And who knows how many more will have to follow from here.

- Doomsday predictions abound about "the new normal" we should expect. Essentially, they say, get used to wearing a mask and staying close to home for the rest of your life.

With all that going on, don't you want the safest kind of safety you can possibly get right now?

Say No to the Doom...

For the record, I don't actually expect the worst of the worst predictions to come true. They almost never do, as evidenced by the Mayan calendar and Y2K scares.

I will, however, grant you that this time really is different in many ways. Certainly, there's no other point in history when the entire world has acted, reacted, or overreacted like it has, depending on your perspective.

No matter which way you say it or see it, we are dealing with "unprecedented" times. I'm sure you're sick of seeing that word (I know, I'm sick of using it), but it's true nonetheless.

This isn't the financial crisis. It isn't the dot.com crash before that. Nor is it the Great Depression. So, we have to treat it differently.

That's both a negative and a positive for us. A negative because we have to navigate troubled waters without historical models to help keep us afloat. Yet, a positive in that there's apparently at least some instant relief available.

As The Washington Times wrote last week:

"Positive economic news poured in from reopened states Wednesday… Arkansas [Governor] Asa Hutchinson, a Republican, told the president in a White House meeting that his state is 'back to work' and that the state's sales tax revenue likely will bounce back faster than expected. "'All of our retail stores are open… Our gyms are open,' Mr. Hutchinson said. 'Our barbers are open, our restaurants.' "Echoing the president's prediction of 'pent-up demand,' Mr. Hutchinson said he now projects the state's sales tax revenue will be down only 5%, instead of the 10% he had projected."

Down 5% is still bad. Don't get me wrong. But it's still much better than it could be.

And it's certainly not the end of the known world.

But Be Wary of the Gloom

With that all stated, acknowledged and stood by... it's still a time to be safe. Safe-safe, even. As safe-safe as safely possible.

Obviously, I hope that Governor Hutchinson's predictions about Arkansas are correct. But we just don't know yet.

I hope that other states will soon report similar stories. But, we just don't know yet.

For that matter, I hope the whole world will go on to recover, returning to a new normal that's better and smarter than before. But again, we just don't know yet.

We're still in a wait-and-see state of existence, where we've proven we're not all going to die... but haven't proven which companies will survive.

That's why we're sticking with our "old normal" of assessing each stock individually, looking at its numbers, and analyzing accordingly. Yet, we're taking that caution to unprecedented levels in this "new normal" of ours.

We're only willing to label something a Buy if it's got the cash to survive months - and maybe even years - more of the status quo.

There's still certainly money to be made in the markets. That, at least, hasn't changed.

Let's just focus on safe-haven ways of getting it.

3 Safe-Haven REITs We're Buying

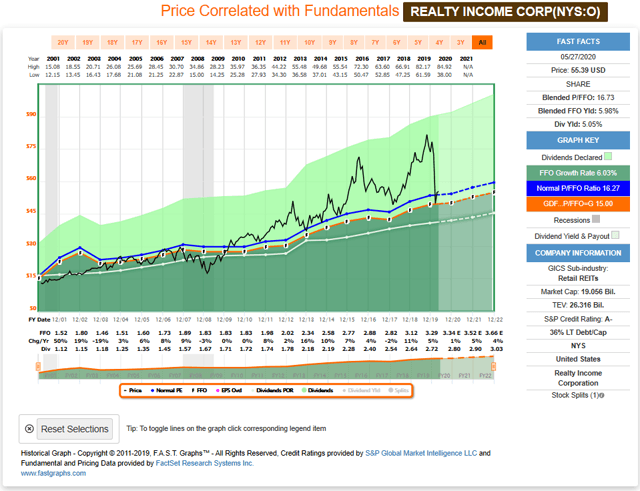

Realty Income (O) is a bellwether favorite among the dividend income crowd. I'm certainly a fan of the "monthly dividend company" even during these chaotic times. And I've more recently been gobbling up the shares.

In March, O began to fall by around 23% to a level where we identified a wider margin of safety. Our price target pre-COVID-19 was $61.75, and it remains unchanged (that's a 10% discount to fair value).

Meanwhile, the company collected around 83% of the rent in April, which was better than we expected. This put the company's payout ratio at around 95% for the month.

We expect comparable rent collection in April and anticipate collections normalizing in Q3 into Q4.

Realty Income has ample liquidity today at around $4 billion. And its credit profile is very strong as well:

- 5x net debt to adjusted EBITDAre

- 30% total debt/total market cap

- A3/A- rating.

We believe this REIT is extremely well-positioned to weather the storms. In short, this "safe-haven" stump helps me sleep well at night.

Source: FAST Graphs

Another Dividend Aristocrat Worth Talking About

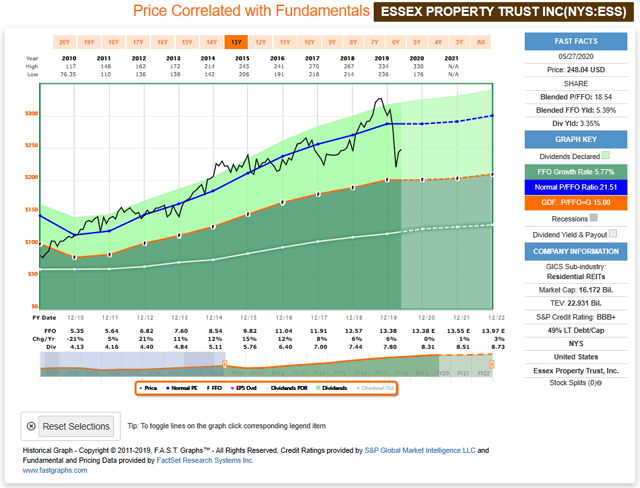

Essex Property (ESS) is another "safe-haven" selection and one that has a similar track record to O. Both REITs are considered dividend aristocrats for their 25-year streak of increasing their dividends.

ESS is actually over 26 years now.

A multifamily REIT, Essex is known as a Westcoast sharpshooter because it's dedicated to three markets:

- Seattle

- Northern California

- Southern California

Since 2007, it has generated superior expansionary moves, including 77% net operating income (NOI) versus 56% for its peers... funds from operations (FFO) growth of 168% versus 40%... and dividend growth of 125% versus 32%.

Prior to COVID-19, ESS had already begun making investments in technology. It now provides residents with paperless leasing, mobile maintenance accessibility, and smart home technologies.

Obviously, this has all been very valuable during the current shelter-in-place environment.

ESS now has over $1 billion in liquidity, with no debt maturities in 2020. And it has maintained a strong balance sheet, as evidenced by its BBB+ rating from S&P and consistent dividend growth profile.

The company even raised its annual dividend by 6.5% last quarter.

Our fair value target for ESS is $275 - which is 10% above the current price of $248. Shares are also trading at 15% below normalized P/FFO, at a current multiple of 18.5x.

The current dividend yield is 3.4% and well-covered since rent collection was 95% in April. We're upgrading shares to a Buy with expectations they'll return 15% over the next 12 months.

Source: FAST Graphs

And One More Bellwether for the Road

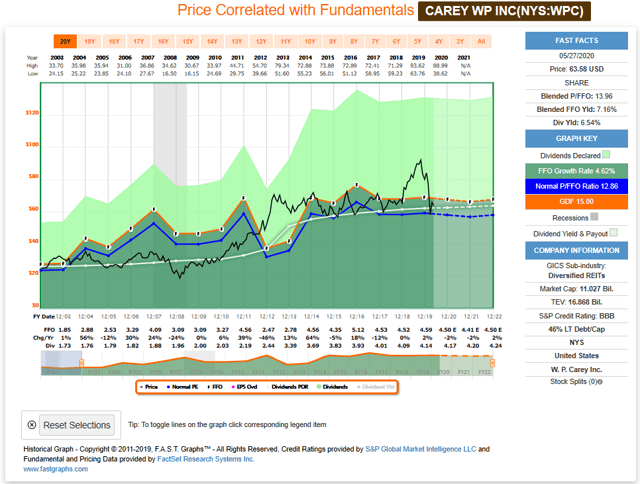

Our final "safe-haven" pick is W. P. Carey (WPC), another bellwether name that keeps on paying and increasing dividends. Since going public in 1998, this net lease REIT hasn't missed a beat.

One of the key differentiators for this REIT though is that it has limited retail exposure. It has also managed to diversify beyond the U.S., with 34% exposure to Europe.

Also, the properties in its portfolio are considered "mission critical." And their leases are longer duration, with a weighted average term of 10.7 years.

W. P. Carey has maintained stable occupancy during the credit crisis and economic downturns. That includes the current pandemic, with 95% of rent collected in April.

In addition, WPC's balance sheet is in great shape, with debt-to-assets of 41% and net debt to adjusted EBITDA of 5.6x. It targets debt to gross assets in the low-to-mid-40% range and net debt to adjusted EBITDA in the mid-to-high 5x.

At current leverage levels, the company has the capacity to absorb further downside scenarios... even if rent collections deteriorated in May. It's also important to note that WPC is BBB rated by S&P.

Our fair value target for WPC is $72.20, which is 12% above the current share price of $63.58. In addition, it trades at -7% below the normal P/FFO range.

Its dividend yield is 6.5%, and, based upon April rent collections, we believe it has adequate cushion for the dividend. Given the discount, we're targeting shares to return around 15% annually over the next few years.

As such, we maintain a Buy.

Source: FAST Graphs

In Conclusion

The markets might be rough right now, but that doesn't mean there aren't some safe spaces to be found. Better yet, the way some of these companies are trading, they're looking like truly stellar buys.

As I implied earlier in the article, there could be plenty more stellar buys out there right now - iffy-looking stocks that are actually being unfairly valued due to understandable yet, ultimately, unsubstantiated fears.

Only time will tell what some of those are. Though we hope there are a lot of them in the end.

Thing is though, only time will tell which ones will fall further from here as well. So, I'd rather play it as "safe-safe" as possible until it becomes clearer how the larger economy will emerge from this crisis.

That's why I'm recommending the three stocks above. Realty Income. Essex Property. W.P. Carey...

I can't absolutely guarantee investors will see them rebound and then some. But they're each well-managed, well-positioned, and very well-priced as I write this.

That's a combination I'm not about to ignore.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Markets will eventually recover and may reward patient investors...

Investors need to remain disciplined with their investment process throughout the volatility. At iREIT on Alpha we offer unparalleled research that now includes a "daily" vodcast and mortgage REIT coverage. "There is a great opportunity" to take advantage of the selloff.. subscribe to iREIT on Alpha (2-week free trial).

Don't miss our latest CEO interviews including Essex Property (ESS), Farmland Partners (FPI), and Getty Realty (GTY).

Disclosure: I am/we are long ESS, O, WPC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.