Unique ETFs With Downside Protection | Part 1 - SWAN ETF

by Alpha Gen CapitalSummary

- SWAN ETF is a means of participating in the upside of the S&P 500 (not by 100%) while limiting your downside significantly.

- Think of this as a treasury fund with a small equity (through the S&P 500) kicker.

- The strategy is unique but a simplified way to get S&P 500 exposure, intermediate and long-term treasury exposure, with negative cash.

- It does reduce your downside so for those that are in accumulation mode they can use this (and augment it via more lower delta options) for lower risk.

(This article was published to member of Yield Hunting on May 4th)

On the chat recently, there has been some discussion on a couple of new, unique exchange traded funds ("ETFs") that were created in the last couple of years. Now, just to be sure, two years of a track record in a unique strategy is simply not enough to make an accurate assessment of the performance and "if it works." That said, I do want to bring these to your attention for future consideration.

Amplify BlackSwan Growth & Treasury Core ETF (SWAN)

This is a fairly unique (though replicable) ETF for investors who want to have some participation in the S&P 500 but also protect against a downside move. It is an index-based ETF that uses the S-Network BlackSwan Core Index (SWANXT). The objective is to get some of the upside of the S&P 500 without much, if any, of the downside.

The key word there is "participate", not match. They do that by buying long "in the money" call options on the S&P 500 and investing the rest of the capital (the majority) in US treasury notes and bonds. To see how this one performed in 2020, the fund is up 36 bps compared to the S&P 500 being down 19.6%. The fund has only been around since late 2018 so we really do not have a long enough track record here to make a good judgement.

SWAN Investment Objective:

The BlackSwan ETF seeks investment results that correspond to the S-Network BlackSwan Core Total Return Index (the Index). The Index's investment strategy seeks uncapped exposure to the S&P 500, while buffering against the possibility of significant losses. Approximately 90% of The BlackSwan ETF will be invested in U.S. Treasury securities, (with a targeted duration of the 10-year Treasury note), while approximately 10% will be invested in SPY LEAP Options in the form of in-the money calls.

Basically, they want to place the majority of the capital in treasuries while buying LEAPs. LEAP stands for "Long-Term Equity Anticipation." They are options that expire at least one year from the date of purchase. On the S&P, you can buy options out (as of this writing) to December 2022, a full 19 months out. One of the issues with LEAPs is the cost of that long-time to expiration (theta). The longer the time to expiration, the greater chance of being exercised and thus the more costly the premium.

They also buy these options "in-the-money" which means that the strike price is already below the current market price. This provides more "index-like" returns as opposed to buying 'out-of-the-money' options which provide cheaper access and some leverage but more downside.

Fund Characteristics

- Ticker: SWAN

- Expense Ratio: 0.49%

- SEC Yield: 1.15%

- # of Holdings: 8

- Total assets: $194.4M

- Manager/Sponsor: Amplify

The Index Construction

Given that the ETF follows a "passive" index, there are rules that guide it on a daily basis. Here are some of those rules:

- The portfolio is rebalanced semi-annually on or around the first business day of the last month of each calendar half- December and June.

- Additions or deletions to the index are made on the closing date of trading on the semi-annual reconstitution date (about the first business day of the last month of each calendar half).

- On that rebalancing date, the index places 90% of its index market cap in treasuries and 10% in SPY LEAP options.

- The treasury portion replicates an initial duration of the 10-year US treasury.

- The option portion holds 5% of the index market cap in June 70-delta SPY call options and 5% in December 70-delta SPY call options. 70-delta means there's effectively a 70% probability that the option will be in the money on expiration day.

- Upon index reconstitution date, if the option is at a gain, they will rebalance at one year plus one trading day to make its gains long term. If at a loss, they rebalance on the last possible day for it to be a short-term loss.

Performance

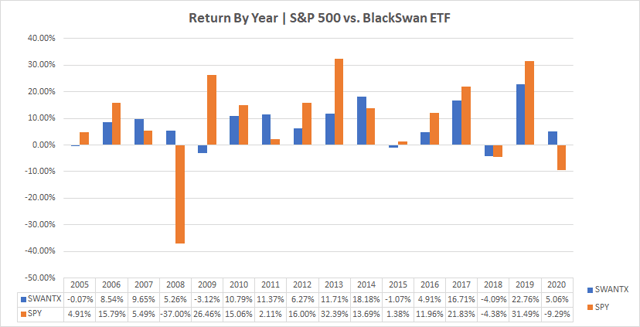

The problem with this ETF is the lack of history. But we can look at the index which has a long, albeit backtested, history. It won't match perfectly but it will be very close and close enough for this analysis. The start date of the data is 2005, which is not really long enough for a complete analysis but can give us a moderate assessment.

One thing you will notice is the lack of blue below the zero bound. In other words, the fund rarely has a negative year and when it does, it is a marginal amount. Since 2005, SWANXT has seen just four down years with an average decline of 2.09%. The worst year the index has had was in 2018 with a -4.09%, which still bested the S&P 500 by 29 bps.

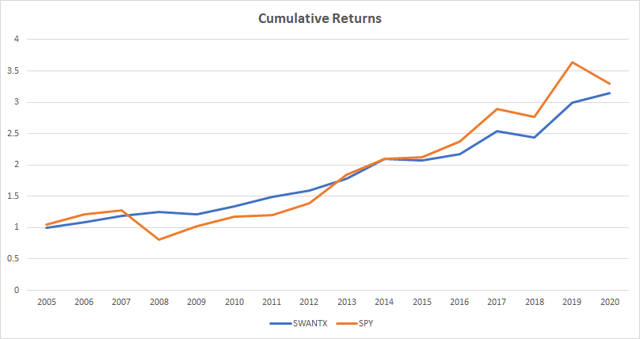

Obviously, for that lack of downside, you are giving up some of the upside. However, cumulative returns over the last 15 years are fairly close with the S&P rising 230% and the SWANXT index rising 215%. More intriguing is the standard deviation of returns for the index is just 7.1% compared to 17.2% for the S&P over that time period. The resulting Sharpe ratio (or return per unit of risk) that is nearly twice as high for SWANXT. That is demonstrated by the much smoother blue line compared to the orange.

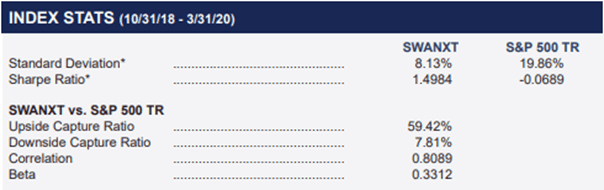

Here are the statistics since the ETF itself starting in October 2018. The standard deviation data is not much different than what we calculated (slightly higher) with just over twice the volatility. Since the start (which is too recent to be meaningful) they calculate a 59% upside capture and just 7.8% downside capture.

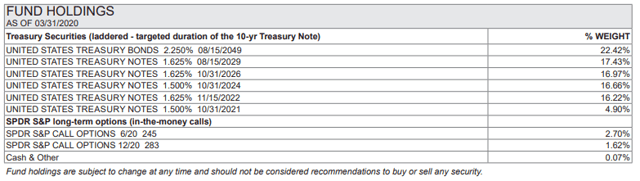

Holdings

Above you can see the 8 holdings. Of the eight, five of them are treasury notes maturing from a range of dates between 2021 to 2049. They then have the call options expiring in June and December of 2020. Those are the call options that provide the exposure to the S&P 500.

Concluding Thoughts

Several points to be made before people jump all over this because they are excited.

One, a lot of the exposure in the fund comes from being long duration via treasury bonds. Over the last ~40 years, interest rates have been falling almost uninterrupted. That has been a nice tailwind to the returns of the strategy (even when starting in 2005). With rates near zero across the board- and near record lows for all maturities- there is not much juice left to squeeze from the orange. It could be that these securities go from a tailwind to a headwind in the future.

- Interest rates have nowhere to go but up. That doesn't mean that they have to go up. But it also means that the risk is skewed that way because the lower bound is so close.

- With all the deficits and stimulus money floating around, there is a chance of inflation, which would have a negative effect on the treasury piece of the portfolio.

Second, the fund costs 49 bps for something that is relatively easy for an investor to construct. After all, there are only 8 holdings and in reality you could purchase the two options positions yourself and then invest the remainder in treasuries, cash or even something like Cambria Tail Risk ETF (TAIL).

Third, by doing it yourself you could vary the leverage by how much of a delta you select on your options. In other words, how deep-in-the-money the options are. In theory, you could even buy at-the-money or slightly out-of-the-money options to amplify the effect. But then you run the risk of the option expiring worthless creating more downside risk.

Fourth, I wrote a few years ago that one of the best ways to participate in the markets is simply through call options. By that method, you can avoid the massive downside and simply have the premium paid as your "at-risk" capital. In reality, the treasuries are not even needed.

Fifth (and lastly), I am not a huge fan of the lack of spread on the call options. For diversity of price, I would be doing the purchasing more often than semi-annually and at various strike prices.

Overall, this fund is very interesting and it is something that I'm going to be keeping a close eye on. We wouldn't be betting the farm on something like this but it could be an interesting way for risk averse investors to get some market participation. It's strange that no other provider has created such a strategy until now. Hopefully BlackRock does with a much lower expense ratio.

That being said, I'm mixed on this ETF. I think it serves a purpose but a much smaller one than many investors would perceive. Peter Lynch once famously said "far more money has been lost by investors preparing for corrections or trying to anticipate them, than has been lost in the corrections themselves."

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.