First Horizon National: A 6.5% Yield Your Portfolio Should Have

by KrakenSummary

- First Horizon National is one of the largest regional banks in the Southeast with more than $32 billion in deposits.

- The company has seen strong loan growth among the pandemic and has a diversified loan portfolio with limited risk.

- The company recently issued a new preferred issue that currently has a 6.5% coupon, which provides a great opportunity for income investors.

First Horizon National (FHN) is one of the largest regional lenders in the Southeast with nearly $33B in deposits. However, the company is currently in the middle of a merger with Iberiabank. Once the merger is complete this year, the total assets is expected to be greater than $75 billion.

The company recently issued a new preferred series. The series E preferred is currently yielding a 6.50% yield and is trading right around par value. I find this yield attractive primarily since the underlying company is fairly healthy even after factoring in the pandemic.

These are reasons why I feel the preferred is a safe investment:

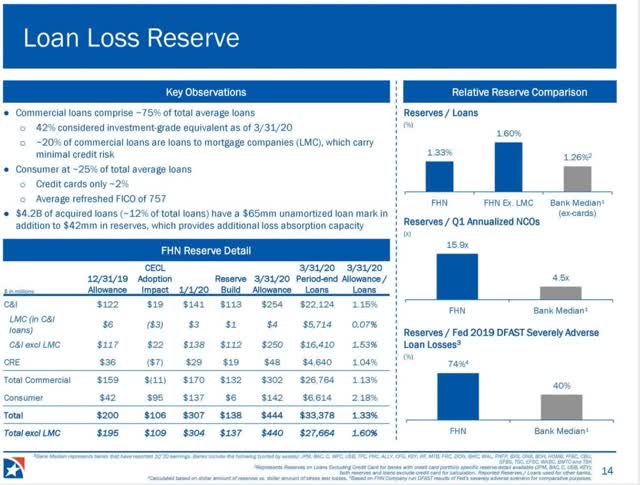

- For one, the company has a loan loss reserve of $444M (as of 3/31), which is fairly healthy compared to other peers. The company has made it clear they are well prepared by setting aside plenty of capital for losses related to COVID. However, the underlying credit of existing loans is quite strong so they are unlikely to see significant damage from COVID.

Source: Q1 Presentation

- From looking at the above chart, 75% of the loans are in commercial loans. Out of this 21% is loans to mortgage companies. These mortgage companies have limited downside since 90% of them are guaranteed by the government.

- Regarding consumer credit, only 2% is in credit cards, with the majority in home loans. Even with this, the average FICO score is 757. This shows that the company has maintained strong credit standards.

- When we look at stressed industries post-pandemic, I consider that to be related to lodging and energy.

- Lodging accounts for only 2% of the portfolio. The average equity in among the portfolio is 40%. This means there is a huge margin of safety in terms of any deterioration of asset value.

- The C&I portfolio totals nearly $4.3b, but only $700m of that is directly related to energy companies. The majority of these loans are to reserve based oil and gas companies. Though it may seem risky, the positive piece to note here is that 70% of them are hedged through 2020. 50% are hedged through 2021. In my opinion, this is the most important part of their credit portfolio to watch, but it shows that the borrowers are prepared for the whole year.

Some may ask why the stock is not a better option compared to the preferred. For one, being a strong company and having value in the stock are two different things in this market. I am also more of an income investor and I like preferreds as they tend to be less volatile as they are simply tied to the coupon rate.

Due to the company having a large loan loss reserve and good underlying credit quality, I believe the preferred makes for a great investment for income investors. The preferred has a strong 6.50% yield in an environment where it is difficult to find any substantial return.

Since the preferred was just recently issued, it has not begun trading under the NYSE yet. However, one issued, the preferred is likely to have various different symbols depending on your brokerage. Some examples include FHN-E, FHN-PE, FHN PRE, etc. Check with your respective broker on this.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FHN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.