Boyd Gaming: Vegas Locals Market Spurt Will Drive Faster Recovery Than Strip After June 4th Reopening

by Howard Jay KleinSummary

- The Las Vegas locals market has been one of the strengths of Boyd. Demos suggest a quicker revenue recovery than strip properties.

- Pre-virus growth showed balance of locals market and US regionals proved upside propellants for the stock.

- Boyd has much more room to recover and presents a good bull case now based on a faster ramp of its locals revenue base.

As Las Vegas nears its reopening June 4th, gaming sector shares are attracting buyer attention, sensing that even minimal revenues are the crocus of a recovery spring that may not be as far away as some may suspect. Yet, some of our Vegas colleagues have taken a contrary view that it could take up to two years for the town to recover even to 65% of its 2019 gaming revenues of $6.587B. This sober assessment envisions one watershed event that will rule the duration of the recovery: The arrival of an effective vaccine and the rapid inoculation of the mass US and global citizenry. Until then, the only weapons available for fighting the virus remain those which are currently deployed in the battle: hand washing, constant cleaning and sanitizing of surfaces, masks, gloves, social distancing and prudence. It’s what Vegas will be bringing to the battle June 4th.

Estimates as to when the vaccine will arrive for mass inoculation run from the earliest by the end of this year, to the latest by mid-spring 2021. In truth, nobody knows; we are living in a world rife with flawed data. So investors in the sector who are jumping in now do so in the belief that we are at least past the worst apex of the pandemic. Add to that the monumental beating gaming stocks have taken along with the entire travel/leisure sector and you do have a case for a well-thought-out toe dip in the gaming pond now. We think the recent upside move in the sector results from that thinking. We agree that what we are seeing now is no dead cat bounce off historical lows.

Moving forward from where the sector is now, up from its crushing that began last February, one can make a case that as Las Vegas and the US regionals reopen, the stocks can’t remain so cheap much longer. The risk on, of course, is the dreaded prospect of a second wave this fall/winter season that could destroy the improving sentiment. That prospect comes with the territory. You weigh that against the optimism evoked by the beginnings of the reopenings and pick your poison or ambrosia. The one certainty is that once the vaccine arrives and pent-up demand really gets under way, the stocks will never be this cheap again.

In looking at the sector now as it begins moving north, we think Boyd Gaming Corporation (BYD) still has a smart buy story to tell. It has two legs driving an upside now. One, the Las Vegas locals market, the value of which has gotten lost in the shuffle to some extent. And two, the reopenings in other states where BYD has 17 properties.

BYD: An overview

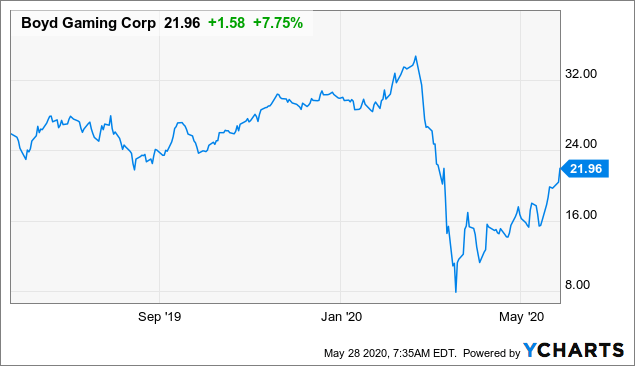

Data by YCharts

Price at writing: $20.87

Virus low: $11.13

52-week high: $36.22 Low: $6.44

Market cap: $2.29B

Capex: All suspended save $45m in standard maintenance and renovation projects well in progress.

Buybacks: The company bought back 638,000 shares in 2019 for $11m.

The stock trades at 7.5X EBITDA, less than BYD paid for its acquisitions of Peninsula and Pinnacle properties in 2012 (6.25X to 7X). The investment BYD has made in the locals market reflects its conviction about the future of Las Vegas’ buoyant economic prospects - post virus, of course.

Liquidity risk: Low. BYD has $250m in unrestricted cash on hand plus a recent offering of $660m in notes tucked away. With an estimated cash burn now of $3.2m a day and rent obligations to its REIT landlord, Gaming and Leisure Properties, Inc. (GLPI) at $2m per week, our estimate is that BYD has up to 2 years liquidity comfort.

2019 revenue: $3.38B

Long-term debt: $4.58B (Ex of capital leases: $3.74B)

Equity is 25% of enterprise value.

BYD operates a total of 29 casinos in ten states. But its ten locals properties in Las Vegas command our interest here. The reasoning goes this way. Initial revenue streams strip properties may generate in this early stage reopening phase will need propulsion from the drive-in market from Southern California, and mostly reopened air travel.

Locals casino revenues don’t need reopened airlines since most sit within very minimal driving distance from the bulk of their customers in greater Clark County. A second contributor to Las Vegas recovery is of course the discretionary spend of visitors who may or may not have gone back to work. The Vegas locals market has different demos. For BYD, in 2019, the locals market drove 30% of its profit. It had been a market trending down between 2007 and 2010 reflecting the great recession and its aftermath. But from 2011 onward, it has been up 20% spurred by above-average population growth around 2.5% to 3% annually. For context, the US population growth is continuing to decline. In 2018, it was 0.06%. So people fleeing the high-tax, lifestyle-challenged big states are landing in places like Las Vegas in ever greater numbers. (Below: The Boyd geography is well-balanced locals to regionals. Source: Boyd archives).

Add to that the diversifying non-casino employment base of Clark county and you have the ingredients of a recipe for growth clearly in the crosshairs of the ever savvy BYD management. It is a company with a near 50-year legacy of its birth in the locals market (Sam’s Town).

So for BYD as an entry point now at $20.87 a share, the devil is in the demos, so to speak.

BYD will benefit as one by one the states in which it operates will leave quarantine, especially in the Midwest. So that will be a plus during this very early stage of reopenings. We also like the sports betting strategic marketing partnership BYD has made with the Flutter (OTCPK:PDYPY) unit, Fan Duel, to co-promote each other’s customer bases in both live books and mobile betting. It will give BYD access to Fan Duel’s huge daily fantasy sports database and vice versa.

Boyd’s acquisition of the Valley Forge casino hotel in Eastern Pennsylvania for $280.5m in 2018 looks better than ever as that state’s sports betting revenue continues to churn upward. If the leagues can work out their obstacle course of health protocols, financial arrangements with the players and other bugs, we could have game schedules by mid-summer. This prospect has already spiked sports betting shares. Philadelphians will likely be able to bet on their beloved Eagles this fall at the property.

But the demos of the locals market signal a possible speedier percentage inflow of recovered revenue streams than strip properties heavily dependent on the still ruptured transportation infrastructure. (Below: Boyd's Aliante in Vegas -a flagship in the locals market: Source: Boyd Archives)

Here’s a snapshot of the positive Las Vegas metro demos we see helping BYD locals properties to a faster recovery than that on the strip albeit significantly more modest volumes.

The median age of residents is 38, around the national average.

The average income of residents ranges between $54,000 and $69,000 per year within the metro area. But its composition contains in-migration residents dominated by early retirees.

Total population: 1.153m

Employed full time: 673,000

Employed in casino industry: 164,000

Age 65+ retirees or still working: 301,845

Veterans: 143,797

What this implies to us here is that the locals properties will benefit from the high percentage of retirees and service veterans who have pension flow, who will return to the casinos once they open. They form the strong foundation of the slot business in all BYD locals properties. Secondly, casino employees will begin to trickle back to work, first in small numbers, but growing by late summer.

Thirdly, a large number of older residents own their own homes with a valuation in the $250,000 range.

A locals population with time and money on its hands

10,000 baby boomers are turning 65 every day in a nation of practically zero growth population trends. Many of them are moving away from old metro cities in the northeast to places like Las Vegas and taking their money with them. Baby boomers now hold over 57% of all US wealth, amounting to an estimated $15T. Contrast that to millennials who hold 3% of national wealth. The oldest boomers are in their mid-seventies, the youngest in their late fifties. All have shown a far greater proclivity to gamble than younger generations.

The bull case for BYD in summary

Blend solid management, smart asset allocators, excellent knowledge and skillsets marketing to locals market apt to return faster than tourists, good properties in Midwest regions about to open, and a really good sports betting deal with Fan Duel and you have a recipe for a buy.

At its current trade, this company, facing better ramping prospects from its locals market base, may have a lot of room to run beyond its current trading range.

The downside risk will be shared by the sector, of course. But the upside in BYD I don’t think has been recognized yet because the locals market does not have the sex appeal of a perceived ramping of the big strip properties.

My call: BYD is a buy now at anything below $30 a share.

The House Edge Moves Ahead

As of April 2020, my public picks are

- Returning 20.8% on average

- producing a 68% hit rate

- ranked in the top 1% of bloggers.

I share those picks early with members, as well as deep dive research and analysis based on my decades of industry experience.

To ensure the utmost quality for The House Edge, we are going to be raising prices on June 1st.

Sign up now and get in for a bargain basement price of $199/year. Get the House Edge on your side!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.