Semler Scientific: High-Quality Medical Stock With Cash Flow Growth And Zero Debt

by Risk Research IncSummary

- Semler Scientific's blood-flow measurement product, QuantaFlo, offers major advantages over the more widely-used blood pressure cuff technique.

- Semler achieved profitability in 2018 and has made significant further progress since then.

- Based on our probability analysis, the stock is a buy below $30.45 where it last traded in March, and a sell over $59.30.

This article was written by David Zanoni in collaboration with Risk Research Inc.

It is rare to find a company with ten years of above-average revenue growth, four years of operating cash flow growth and zero debt. Bought right, these stocks have the potential for major investment returns. Risk Research identifies companies with those characteristics, and then follows them, waiting for advantageous pricing. The software we’ve developed weighs the probabilities that a lower price will be achieved over the next twelve months with the potential that will be forgone if that price is not achieved. The program utilizes thousands of daily high low prices over the last thirteen years, and compares those prices to simple moving averages.

This analytical process identifies pricing that has generated returns of 20% or more annually. The primary risk to this approach is that history won’t repeat – that we enter a completely different market where past relationships are no longer relevant.

Semler Scientific (OTC:SMLR) is an example of a company that meets our financial statement trend and condition criteria, and its current pricing is relatively close to the buy target identified by the software. We offer this analysis to be ready if and when the target is reached.

Description of Business

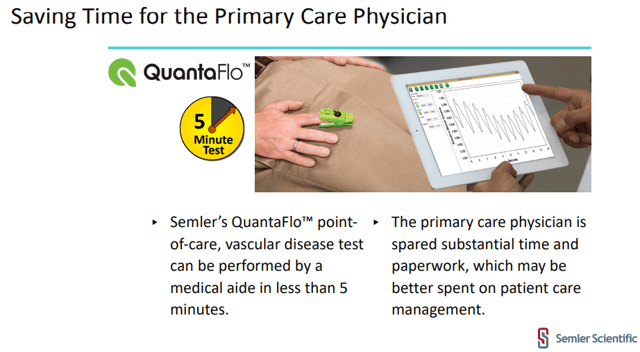

Semler Scientific is a medical device company that produces QuantaFlo, an FDA-approved device that measures blood flow in 4 or 5 minutes by simply attaching a clip to a finger or toe. The device is used to help diagnose PAD (peripheral arterial disease). PAD is an atherosclerotic disease and is associated with increased mortality risk from heart attacks or strokes. QuantaFlo is used by cardiologists, internists, nephrologists, podiatrists, family physicians, other medical specialists, healthcare insurance plans, and home risk assessment companies. The company estimates that there are 300,000-plus physicians in the United States that care for those aged 50 and over, the group at highest risk for PAD. If Semler can continue its successful efforts to establish QuantaFlo as the standard of care, a very substantial market awaits.

Although many patients are unaware of their status, about 10% of the U.S. population is affected by PAD, obviously representing a huge potential market. Quantaflow is faster (the test takes about 5 minutes) and is easier to use (requires much less skill than competitive methods). The alternative takes 15 minutes and requires a vascular technician using a blood pressure cuff. Anyone can be trained to perform a test with QuantaFlo. If you can clip a half-eaten bag of potato chips, then you can probably be trained to clip a QuantaFlo device to a patient’s finger or toe for an accurate reading, making the device highly cost-effective.

Semler offers Quantaflow under a license as opposed to an outright purchase. The license model allows the company to receive fixed monthly fees or variable fees based on device usage. No down payment or long-term commitments are required from customers, which makes for an easier sell. This also allows Semler to benefit from recurring revenue instead of just selling the product to a customer once.

Source: Semler Scientific March 2020 Presentation

QuantaFlo is protected by a patent that expires on December 11, 2027. The patent is for infrared technology to sense blood flow in the extremities.

Financial Statement Condition And Trends

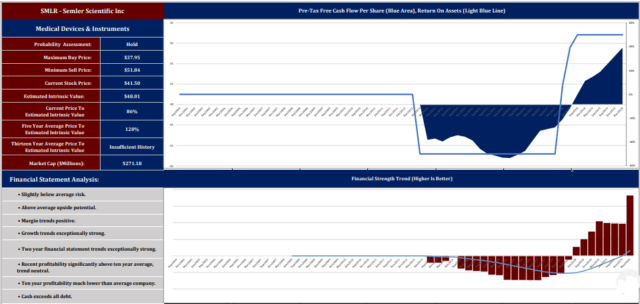

Source: Risk Research

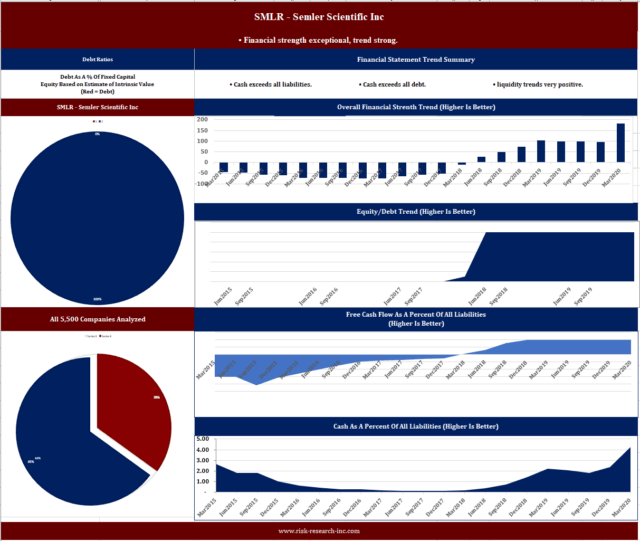

Semler Scientific has $11.2 million in total cash and no debt. As indicated in the charts above, free cash flow return on assets and financial strength returns are all exceptionally positive.

After turning profitable in terms of net income in 2018, Semler achieved strong growth in operating cash flow. Operating cash flow increased by 683% in 2018 over 2017 and 170% in 2019 over 2018. Free cash flow increased by 360% in 2019 over 2018. This year is off to a good start with a 117% increase in operating cash flow and a 340% free cash flow for Q1 2020 over Q1 2019.

For the past 12 months, Semler’s return on assets was 81%, return on equity was 145%, and return on total capital was 70%. The gross margin increased to 89.8% from its 5-year average of 78%, while the net income margin increased to 44.9% from the 5-year average of -29.9%.

The strong free cash flow trends are reflected in the company’s balance sheet.

Source: Risk Research

Risks

Test volumes decreased during the COVID-19 social distancing, causing a reduction in variable monthly fees (based mostly on usage during home visits). Analysts’ EPS estimates for 2020 were lowered by about 10% from $1.43 three months ago to the current estimate of $1.29. That approximates 2019 net income after deduction of the non-recurring tax benefit of $0.59 arising out of the recapture of deferred taxes.

Semler is highly dependent on one product – QuantaFlo. If one or more competitors produced a similarly easy to use and cost-effective product, it could limit Semler’s growth and reduce its market share. I didn’t see any evidence of Semler having a pipeline of new products in development.

The largest customer accounts for 49.4% of Semler’s total revenue (based on 2019). The next two highest customers account for 13.2% and 12.5% of total revenue. The reduction of business from these customers could have a negative impact on Semler’s financials.

Conclusion

Although Semler is a one-trick pony with QuantaFlo as its sole product, the company’s patent is protected through Dec. 11, 2027. There is currently no other competition on the market for fast in-office diagnosis other than the old blood pressure cuff method used by a vascular tech. This should enable Semler to continue to grow revenue at a strong pace. Of course, the company may experience a decline in revenue/earnings in 2020 due to reduced variable fees from home visits due to COVID-19-related social distancing practices.

The global market for blood flow measurement devices is expected to grow at an annual pace of 9.3% by 2024. This provides a good tailwind to help Semler drive revenue growth.

The Risk Research model says that current investors should hold the stock at the current price of $41.50. The maximum indicated buy price is $30.45 and the minimum sell price is $59.27. The stock last traded at our buy price in late March, two months (an eternity) ago. We offer this analysis in order that investors may be ready. Our philosophy simply stated:

Opportunity waits for no one, but the opportunist must wait. This is especially true for the opportunist who invests in quality. And an opportunist without cash is an amateur.

We offer these reports on Quality Compounders now, in anticipation of opportunity if and when it should present itself.

New Marketplace Service

On June 1, Risk Research Inc. will launch a new Marketplace service for professional investors: Quality Compounders.

Quality Compounders will keep investors in the highest quality US companies (highest quality defined as exceptional return on assets, steadily improving free cash flow and little or no debt) aware of probabilities pricing – entry and exit levels that have historically generated returns of at least 20% per annum. This proprietary software calculates probabilities based on daily highs and lows in relation to moving averages over the last thirteen years or a complete market cycle.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Business relationship disclosure: The article was written by David Zanoni in collaboration with Risk Research Inc.