Canopy Growth Stock Is Still Among the Most Compelling Marijuana Plays

Canopy is well-positioned to become a leader in the cannabis industry

Investors will learn a lot about Canopy Growth’s (NYSE:CGC) prospects going forward at its upcoming earnings call conference. The scheduled May 29 earnings conference will cover Q4 2019 and fiscal year 2020 through March 31. Investors will be looking to hear about efforts to consolidate operations and how they have affected the price and prospects of CGC stock.

CEO David Klein has been leading efforts to reduce cash burn and a focus on improving asset productivity. Canopy, and the cannabis industry at large are emerging into a new reality. The wild west days of overvaluation and volatility should become less the norm. Investors are now looking to see leaner, more strategic operations that lead to real increases in share price.

Therefore, the upcoming earnings conference call should shed some light as to whether the company is heading in that direction.

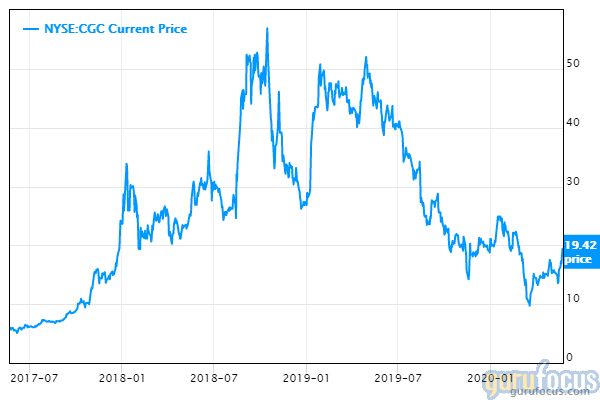

CGC Stock Has Been Volatile

Anyone who has owned Canopy’s stock over the past few years has ridden a roller coaster of volatility. The company’s share price over the past year has eclipsed $50 and dipped below$10.

Such share price volatility is indicative of the fledgling nature of the marijuana industry. Hype drives up the price of fundamentally lacking stocks as investors rush to the next great company in the newest boom industry. Suddenly, investors see their share price rocket upward. Then sentiment cools down as analysts sift through the fundamental truths of that company — the actual operation thereof — and the financial realities facing said company. This cycle can play out several times while a given company grows into maturity.

Roughly speaking, this has been the story of CGC stock.

However, it seems likely that the wild-west, speculative days are behind Canopy Growth and the cannabis industry. As the cannabis industry’s get-rich-quick hype and bullishness of earlier days subsides, Canopy can anchor itself on some real strengths. While cannabis isn’t a mature industry, it is moving in that direction. That said, CGC stock will still have many future price blips.

Constellation Brands and Canopy’s Stock

One of, if not the most important factor in Canopy Growth’s past growth and future success is Constellation Brands (NYSE:STZ). Canopy Growth is highly integrated with the alcoholic beverage industry giant. In fact, Canopy is so deeply integrated into Constellation’s business strategy that Constellation considers Canopy one of its four business segments. Constellation divides their company into Beer, Wine and Spirits, Corporate Operations and Other and Canopy.

Constellation is also a major shareholder in the company. It recently exercised warrants on Canopy allowing the company to buy 5.1% of the common shares of Canopy Growth. This increased Constellation’s ownership of Canopy to 38.6% of outstanding equity. It is likely that the company will exercise further warrants which will bring their ownership stake in Canopy to 55.8%.

There is another key aspect to consider when looking at the relationship between the two companies. Namely, former Constellation CFO David Klein is Canopy’s current CEO. Constellation has big infused-beverage and consumer product plans for Canopy that it will help enable under Klein’s leadership.

While it’s important to consider the business structure of Constellation, it’s also important to look at Canopy and its business structure before making an investment in CGC stock. Canopy, like Constellation, also has four operational areas: Canadian Consumer, Canadian Medical, International Medical and Other. Canadian Consumer is the largest, and most important space within the company.

Klein has been leading the company toward leaner operations of late. And the company will continue to leverage Constellation’s distribution channels for its consumer products. His charge toward company-wide efforts to increase operational efficiency is smart, and it should pay off. However, these efforts will lead to some losses short-term.

How Big of a Loss Will Canopy Suffer?

Canopy had to pare down assets in the oversupplied pot industry. The company stated on April 16 that it expects pre-tax charges of CAD $700-800 million for its operational restructuring efforts. On the upcoming May 29 earnings call, they will give their actual number for pre-tax charges which will then be subject to audit. Investors will be interested to see what they actually report. If this number is higher, expect the market to react negatively to Canopy’s stock.

As part of restructuring, the company decided to cease operations in Africa (Lesotho), Colombia, Canada and the U.S. Canopy is now focused on its belief that Canadian operations alone will provide it with enough raw material with which to operate.

An Optimistic View of Canopy’s Under-Performing Assets

Yes, the company purchased assets too quickly in a rush to expand in what it thought would be a rapidly expanding market. This led to asset growth outpacing revenue growth — a particularly bad sign for CGC stock. Had the cannabis industry exploded like many analysts believed, Canopy would’ve looked like savants. They would’ve had the raw material with which to produce high-margin products bringing in tons of cash.

Even though that didn’t happen, it shouldn’t lead you to believe that Canopy is mismanaged. CEO David Klein is well-regarded. Now that he has a clearer picture of what the industry might look like going forward, he’s leading the company to leaner, more-profitable days.

An important thing to remember here is that Canopy believes it has enough supply to produce its retail products. These are high-margin edibles, drinks, vapes and therapeutics. The company is also increasing revenues. This is a path to profitable operations.

Under capable leadership, the company is doing what is necessary to succeed. But that alone, does not ensure success.

The company has lots of retail products for the Canadian consumer and the backing of an alcoholic beverage giant which can push Canopy’s products onto shelves through deep Constellation sales channels. If any company is poised to succeed in Canadian cannabis, Canopy is it. Constellation’s ownership stake means that they have every reason to make Canopy a success. That they will likely exercise future warrants and purchase an even larger stake of Canopy shares, only further increases their desire to turn Canopy into a huge success.

The other half of that equation is the question of whether or not the macroeconomic factors conspire and the cannabis industry begins to stabilize and provide a real return in place of the previous hype. The answer is not yet clear, but Canopy will be part of the answer to that question.

Expectations for Canopy and Its Stock

I expect a few things: Constellation will exercise its warrants in the future, upping its stake in canopy to over 50%, Canopy Growth’s stock will remain volatile while trending up and the company will continue to become leaner.

If you believe in Constellation, you should believe in Canopy. Long-term, if Constellation begins to reduce their shares in CGC stock, investors should too. Fortunately, Constellation has shown zero sign of doing so. As of right now, Canopy looks like a solid play in the Canadian cannabis space.

As of this writing, Alex Sirois did not hold a position in any of the aforementioned securities.