Vanadium Miners News For The Month Of May 2020

by Matt BohlsenSummary

- Vanadium spot prices were flat in May.

- Vanadium market news - New battery tech revives vanadium interest.

- Vanadium company news - AMG commits $140m for construction and engineering contracts for investment in a second ferrovanadium plant.

Welcome to Vanadium miners news. May saw vanadium prices flat for the month and a busy month of vanadium company news.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries (VRFBs) are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide (V2O5) is used in VRFBs, and Ferrovanadium (FeV) is used in the steel industry.

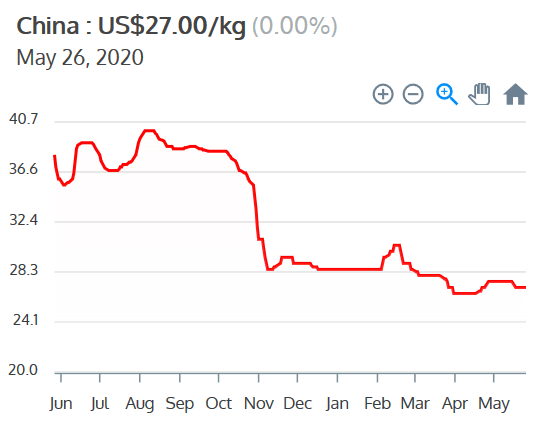

Vanadium spot price history

China Vanadium Pentoxide (V2O5) Flake 98% one-year chart - Price = USD 6.20/lb

China Ferrovanadium (FeV) 80% Price = USD 27.50

Source: Vanadiumprice.com

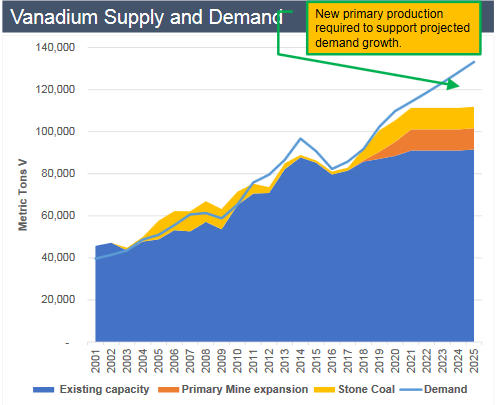

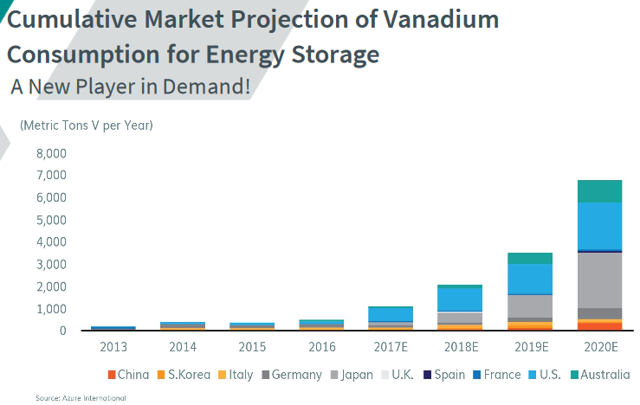

Vanadium demand versus supply

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand "for VRFB markets" could rise to 31,000 tons by 2025, amounting to a rise of 3,100% in a decade.

Source: Australian Vanadium presentation

Vanadium market news

In 2017 Robert Friedland stated:

"We think there’s a revolution coming in vanadium redox flow batteries,” he says. "You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid."

On May 22 Mining News reported:

New battery tech revives vanadium interest. Due to its importance to both the economic and strategic security of the United States, coupled with the fact that none of this high-strength metal is mined domestically, the alloying properties of vanadium alone would likely be enough to elevate vanadium to critical status......"Vanadium, when combined with titanium, produces a stronger and more stable alloy, and when combined with aluminum produces a material suitable for jet engines and high-speed airframes," USGS inked in its critical minerals report. "No acceptable substitutes exist for vanadium in aerospace titanium alloys."..... Vanadium's potential as a battery metal, however, could be a market disruptor. "Because of their large-scale storage capacity, development of VRBs could prompt increases in the use of wind, solar, and other renewable, intermittent power sources," USGS wrote. "Lithium-vanadium-phosphate batteries produce high voltages and high energy-to-weight ratios, which make them ideal for use in electric cars," USGS penned. In these batteries, the lithium-vanadium phosphate serves as the cathode, and lithium metal serves as the anode. While still early stage, this adds to the reason mining companies are looking for new supplies of vanadium.

The world’s largest battery in Dalian, China, to be completed in 2020: 200MW/800MWh vanadium flow battery (requires ~8,000 tonnes of V2O5)

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of its revenue.

On April 30, Glencore announced: "First quarter 2020 production report and general update."

Q1 production highlights:

- "For the most part, the disruptions noted above took effect close to or after 31 March. Q1 production was therefore largely unaffected by them.

- Attributable ferrochrome production of 388,000 tonnes was 14,000 tonnes (3%) lower than Q1 2019...."

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On May 5, AMG Advanced Metallurgical Group N.V. announced: "AMG Advanced Metallurgical Group N.V. reports first quarter 2020 results."

Strategic Highlights:

- "AMG and Shell Catalysts & Technologies received all regulatory consents necessary for the formation of the Shell and AMG Recycling B.V. joint venture, and have commenced operations.

- AMG has committed $140 million as of March 31, 2020 in construction and engineering contracts for investment in a second ferrovanadium plant.

- AMG Engineering successfully completed the installation of the first ceramic matrix composite ('CMC') vacuum furnace and passed the Final Acceptance Test at its customer’s location.....

- In light of ongoing demand uncertainty in the global aerospace market due to the effect of COVID-19, AMG has put the IPO of AMG Technologies on hold."

Financial Highlights:

- "EBITDA was $22.3 million in the first quarter of 2020 as the Company’s segments provided balanced earnings.

- SG&A declined 7% in the first quarter of 2020 to $34.9 million compared to $37.4 million in the first quarter of 2019 due to lower personnel costs and initial steps on cost reduction.

- AMG Technologies’ order backlog increased 9% to $242.2 million as of March 31, 2020, compared to $222.6 million as of December 31, 2019.

- AMG’s liquidity as of March 31, 2020 was $372.2 million and the Company has maintained its final 2019 declared dividend of €0.20 to be paid in the second quarter 2020."

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On May 4, Bushveld Minerals Limited announced: "Q1 2020 operational update." Highlights include:

Vametco:

- "Production for Q1 2020 was 652 mtV (482.5 mtV 74 per cent net attributable interest) in the form of Nitrovan, marginally ahead of Q1 2019 production of 649 mtV despite being impacted by the Covid-19 nation-wide lockdown as well as higher than usual rainfall during the quarter.

- Sales of 898 mtV (664.5 mtV 74 per cent net attributable interest) achieved in Q1 2020, 77 per cent higher than Q1 2019 as a result of additional production volumes in Q4 2019 and increased customer demand.

- Underlying production cost of US$18.90/kgV, an eight per cent decrease relative to Q1 2019, supported by a weaker ZAR:USD rate......

- In line with the Government's 'risk-adjusted strategy for economic activity', following a 35 days Covid-19 lockdown production is ramping up to normal levels."

Vanchem:

- "Solid operating performance, with production of 219 mtV despite being impacted by 10 days of power rationing as well as the Covid-19 lockdown during the quarter. Vanchem's production for Q1 2020 represented 31 per cent of total Bushveld attributable vanadium production.

- Sales of 182 mtV achieved comprised of a range of products during the quarter.

- The underlying production cost for the quarter was US$18.5/kgV, due to stock build up, as Vanchem has been ramping up production from December 2019. We expect inventory levels to normalise in Q2 2020.

- Completed the scoping study of a refurbishment programme and prioritised a total of around R85 million as critical capital spend required for 2020 to enable Vanchem to continue to sustainably operate. We expect to incur most of the spend during the second half of the year.

- As with Vametco, production is ramping up to normal levels following Government guidance."

Bushveld Energy:

- "Approved construction of vanadium electrolyte plant, including receipt of funding approvals for equity and debt from the Industrial Development Corporation ('IDC').

- In line with its strategy of partnering with Vanadium Redox Flow Batteries ('VRFB') companies, on 1 April Bushveld announced that it held a 8.71 per cent shareholding in Invinity Energy Systems plc ('Invinity') the entity created by the merger of Avalon Battery Corporation and redT energy plc.

- Completion of due diligence to acquire Enerox as part of an investment consortium. Bushveld Minerals will continue to update the market on developments around the progress and structure of the transaction."

Capital structure and liquidity:

- "As previously reported, on 30 October 2019, the Group secured ZAR375 million facilities from Nedbank, comprised of a ZAR125 million revolving credit facility ('RCF') and a ZAR250 million term loan which was drawn down at the time. The Group drew down the remaining RCF of ZAR125 million at the end of March 2020 to enhance liquidity and provide financial flexibility during this uncertain environment. Overall, the Group's unaudited gross cash and cash equivalent position as at 31 December 2019 and 31 March 2020 was US$34 million and US$34.4 million, respectively. The 31 March 2020 unaudited gross cash and cash equivalent position includes the full ZAR375 million facilities......

Outlook:

- "2020 production and cost guidance for both Vanchem and Vametco remains under review and will remain so until the Company is in a position to quantify the impact of the Covid-19 pandemic and the South African nation-wide lockdown."

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from its Maracás Menchen mine in Brazil.

On May 1, Largo Resources announced: "Largo Resources announces expiration of its vanadium off-take agreement and commences full commercial control of its own vanadium production." Highlights include:

- "Strategic sales and marketing transition proven successful: Over 85% committed on guided annual sales for 2020.

- Sales and trading team fully operational out of its two commercial offices in Dublin, Ireland and Washington DC, USA.

- The Company announced the launch of VPURE™ and VPURE+™, newly developed brands for the Company's vanadium products in January 2020."

On May 12, Largo Resources announced: "Largo Resources reports solid Q1 2020 results with net income of $5.7 million and maintains strong liquidity position." Highlights include:

- "Net income of $5.7 million and basic earnings per share of $0.01.

- Cash operating costs excluding royalties of US$2.79 ($3.69) per lb of V2O5, a decrease of 18% over Q1 2019.

- Production of 2,831 tonnes (6.2 million pounds) of V2O5, a 35% increase over Q1 2019.

- V2O5 sales of 3,170 tonnes, a 51% increase over Q1 2019.

- Revenues of $58.2 million (after a positive re-measurement of trade receivables / payables of $2.4 million on vanadium sales from a contract with a customer of $55.8 million), an increase of 31% over Q1 2019.

- Cash balance of $206.1 million exiting Q1 2020.

- Commercial independence: Over 85% committed on annual guided sales for 2020.

- COVID-19 Update: The Maracás Menchen Mine continued operations during Q1 2020 and the Company is maintaining its 2020 guidance on a 'business as usual' basis..."

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (NYSEMKT:UUUU)

Energy Fuels states it is "the No. 1 uranium producer in the U.S. with a market-leading portfolio", as well as being a recent vanadium producer.

On May 1, Energy Fuels announced: "Energy Fuels announces Q1-2020 results." Highlights include:

- "At March 31, 2020, the Company had $26.0 million in cash and marketable securities plus $22.4 million of concentrate inventory, including 520,000 pounds of uranium valued on our balance sheet at $23.13 per pound and 1,675,000 pounds of vanadium valued on our balance sheet at $5.37 per pound, both in the form of immediately marketable product.....

- On February 20, 2020, the Company strengthened its balance sheet by completing a bought-deal financing for net proceeds of $15.1 million and raised approximately $4.0 million on the Company's At the Market ('ATM') program in the first quarter of 2020.

- The Company suspended vanadium production at the end of 2019 and has substantial quantities of dissolved vanadium remaining in the Company's tailings management system for future recovery as market conditions warrant.

- No material uranium or vanadium sales were completed during the quarter, and the Company is strategically maintaining its uranium inventory for future sales in anticipation of higher uranium prices, potentially as a result of the creation of a new U.S. uranium reserve (as discussed below) or other U.S. government support, or due to generally improved uranium market fundamentals.

- The Company had an operating loss of $7.8 million during Q1-2020."

Ferro Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR states: "The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs."

On May 12, Ferro Alloy Resources announced: "VSA has issued their initiating research note on Ferro-Alloy Resources."

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. owns the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% owns the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie's Eastern Band is one of the highest grade hard rock titanium deposits globally.

On April 30, Neometals announced: "Quarterly activities report for the quarter ended 31 March 2020." Highlights include:

Corporate:

- "Balance sheet strength underpins 2cps partially franked dividend. Strategy of delivering cash returns to shareholders continues with approximately AUD$56m returned in the past 5 financial years.

- Continued focus on commodities linked to the electric vehicle [EV] and energy storage [ESS] thematic, with a pivot towards more sustainable resource recovery and recycling projects to compliment upstream resources with collaboration deal announced (post the quarter end) to recover vanadium from high‐grade by‐products of leading Scandinavian steel producer, SSAB.

- Cash $94.9 million, receivables, and investments at $6.0 million and no debt."

Core Development Activities

Barrambie Titanium and Vanadium Project:

- "Pilot scale processing trials support the technical feasibility of Neometals’ beneficiation flowsheet to produce concentrates and hydrometallurgy flowsheet to produce high purity chemical intermediates.

- ‘Product value in use’ has been demonstrated. Pilot results, concentrate and chemical samples shared with Chinese JV partner [IMUMR] as well as related titanium pigment production end users."

You can view the latest investor presentation here, or "An Update On Neometals", or my article - "Neometals Managing Director Chris Reed Gives A Brief Update With Matt Bohlsen Of Trend Investing."

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on its Australian Vanadium Project in Western Australia.

On May 1, Australian Vanadium announced: "Palladium nickel copper potential at Coates Project." Highlights include:

- "AVL has an approved Programme of Work to conduct drilling at Coates Project for magnetite-hosted vanadium, with the drill plan being refined to include nickel, copper and PGE targeting.

- Coates Project is approximately 60km east of Perth in the mafic-ultramafic rocks of the Jimperding Metamorphic Belt.

- The 2019 joint venture term sheet with Ultra Power Systems Ltd [UPS] is terminated."

On May 20, Australian Vanadium announced:

AVL signs water access agreement with Westgold.....Limited [ASX:WGX] for access to excess water from Westgold Operations to support the Australian Vanadium Project. Letter of Agreement to progress to a formal agreement within 3 years....The opportunity to provide community benefits with new pipeline and road.

On May 27 Australian Vanadium announced: "Strategic alliance formed to explore the Coates Mafic Intrusion for nickel sulphides. Key points:

- Lithium Australia NL [ASX:LIT] and Mercator Metals Pty Ltd hold adjoining tenements to AVL’s Coates Project.

- Combined contiguous tenement package covers 59km2 covering the entire Coates Mafic Intrusive Complex.

- Letter of Understanding signed by the three parties which envisages attracting a senior partner for the project.

- Tenements open to either joint venture development or combined sale.

- The Coates Project vanadium deposit is located on a southern extension of the mafic-ultramafic sequence, host to the recent nickel-copper-platinum group elements (PGE) discovery at Julimar project by Chalice Gold Mines [ASX:CHN]."

Catalysts include:

- Early 2020 - Possible off-take and/or JV partner announcements.

- 2020 - DFS due.

You can view the latest investor presentation here, or read "Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing."

Technology Metals Australia [ASX:TMT]

The company's primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On April 30, Technology Metals announced: "Quarterly activities report & appendix 5b for the quarter ending 31 March 2020." Highlights include:

- "Focus on progressing the development of the high grade, low cost, large scale, long life Gabanintha Vanadium Project [GVP].

- Binding offtake agreement signed with CNMC [Ningxia] Orient Group Company Ltd [CNMNC]: Take-or-pay offtake quantity of 2,000Tpa (4.4Mlb pa) V2O5’. Three year offtake term with three year option to renew. Pricing referenced to the European and Chinese domestic V2O5 price.

- Discussions ongoing with CNMNC’s sister company NFC regarding EPC and associated funding.

- Offtake MOU with Fengyuan extended until the end of June 2020 to enable orderly progression of mutual due diligence and conversion to a binding Offtake Agreement.

- Excellent drilling and metallurgical results at Southern tenement support Mineral Resource upgrade and scope to extend GVP mine life...

- Continuing to work with NAIF and other potential project development partners as part of the Company’s strategy in securing the funding required for the development of the GVP.

- A placement to international and domestic strategic and high net worth investors raised $2.1m before costs......

- As at the end of March 2020 the Company had cash of $1.96 million. As at 29 April 2020 the Top 20 shareholders held 51.6% of the fully paid ordinary shares.

- Cost reductions and remote working protocols implemented in response to COVID-19 pandemic."

On April 30, Technology Metals announced: "Excellent drilling and metallurgical results at southern tenement. Mineral resource update underway with scope to support mine life extension." Highlights include:

- "Southern tenement diamond drill core assays confirm wide, high grade massive magnetite mineralisation: 10m at 1.16% V2O5 from 81m in GBDD031. 22m at1.12% V2O5 from 33m in GBDD033. 12m at1.16% V2O5 from 28m in GBDD034.

- Metallurgical testwork yields excellent vanadium recovery to high grade magnetic concentrates....

- Scope to upgrade part of resource to indicated category and support GVP mine life extension."

On May 20, Technology Metals announced: "MoU signed with leading vanadium redox flow battery company." Highlights include

- "Memorandum of Understanding executed with Big Pawer Electrical Technology Xiangyang Inc. Co., Ltd.

- Agreement to investigate establishing a Joint Venture to produce vanadium electrolyte and VRFB manufacturing in Australia.

- MoU establishes the framework for a Binding V2O5 Offtake Agreement covering up to 5,000 Tpa of TMT’s proposed average 12,800 Tpa V2O5 production.

- Big Pawer is one of the world’s leading VRFB development and manufacturing companies, having deployed VRFB systems to over 20 locations globally.

- The MoU marks an important diversification of customer base and scope to participate in downstream processing.

- Significant portion of TMT’s proposed production covered under binding offtake and MoU, including the 2,000 Tpa under the recently announced CNMNC binding offtake."

Catalysts include:

- 2020 - Possible further off-take announcements. Possible funding or equity partner announcements.

You can view the latest investor presentation here, or read "Technology Metals Australia Executive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing."

TNG Ltd [ASX:TNG] [GR:HJI] [TNGZF]

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd. is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On May 12, TNG Ltd. announced:

TNG further expands patent and trademark coverage as part of its pre-development schedule for Mount Peake.

On May 19, TNG Ltd. announced: "Mount Peake vanadium-titanium-iron project development update. Progress update on key FEED Study and NPI work streams" Highlights include:

- "Confirmation of the expected performance of the processing plants.

- Ensuring that the design meets key requirements relating to integrity, operability, availability, safety and environmental aspects.

- Confirmation that a scale-up to a large commercial size is achievable.

- Confirmation that major equipment can be procured for the plant configuration and sizes engineered.

- Confirmation of construct ability.

- Process engineering and engineering, procurement and construction ('EPC') planning in sufficient detail to support an accurate cost estimate and a binding fixed, lump-sum price for the EPC process."

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100% owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

On May 1, Aura Energy announced:

March quarterly report 30th April 2020...."Aura Energy’s activities in 2019, particularly in completing the Tiris DFS with low cash cost and low capital, have positioned the Company in an exceptionally strong position given the rise in the uranium price in recent weeks."

On May 20, Aura Energy announced: "Aura Energy Limited–Panel receives application."

You can view the latest investor presentation here.

Silver Elephant Mining Corp. [TSX:ELEF] (OTCQX:SILEF) (Formerly Prophecy Development Corp.)

Silver Elephant Mining Corp. is a Canadian public company listed on the Toronto Stock Exchange. The company's objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America. It also has a huge silver asset in Bolivia.

On May 21, Silver Elephant Mining Corp. announced: "Silver Elephant announces closing of private placement, total $1,976,000."

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources)

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold, zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift (SPD) Project, in Gauteng Province, South Africa.

On April 29, Vanadium Resources announced: "Mineral Resource update confirms Steelpoortdrift’s global vanadium standing." Highlights include:

- "High grade Mineral Resource of 188Mt at 1.23% V2O5 in the Measured, Indicated and Inferred categories.

- Includes 110Mt at 1.23% V2O5 in the Measured and Indicated categories as a result of recent infill drilling and resultant improvements in geological model.

- Majority of 188Mt high grade resource at surface and open pittable.

- Includes 68Mt at 1.37% V2O5in massive magnetite layer [LM1A].

- Steelpoortdrift continues to have the largest resource above 1% V2O5 globally, with conversion into Measured & Indicated categories demonstrating increasing confidence in the geological and resource models.

- Updated Mineral Resource Estimate includes 377Mt at 0.78% V2O5 in the Measured and Indicated categories, 57% of the Global Mineral Resource of 662Mt at 0.77% V2O5 in the Measured, Indicated and Inferred categories.

- Focus now moves to updating open pit designs and mining schedules for input into the current Scoping Study into V2O5 production."

On April 30, Vanadium Resources announced: "Activities report March quarter 2020." Highlights include:

- "Updated Mineral Resource for Steelpoortdrift Vanadium Project confirms the world class nature of the deposit–specifically its high grade and substantial tonnage, making Steelpoortdrift the largest published global undeveloped Mineral Resource, as well as the largest published high grade undeveloped resource.......

- Vanadium Resources remains engaged with potential customers and partners given the potential of Steelpoortdrift to provide a long life supply of V2O5 and other vanadium products."

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company states on its website: "The focus of King River Copper Limited is the exploration for Gold, Silver and Copper." However, its deposits also contain vanadium.

On May 13, King River Resources announced:

Speewah PFS update.....KRR plans to initially scale the project to High Purity Alumina [HPA] production, with V2O5, TiO2and Fe oxide as co-products at a later stage but not part of the PFS.

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB] [GR:NWN] (OTCPK:APAFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The company also has royalties on the Raglan Nickel-PGM mine. The company is looking to take a vertically integrated approach and is also developing leading process technologies "VanadiumCorp-Electrochem Processing Technology" and "Electrochem globally patented Electrowinning" technology.

On May 21, VanadiumCorp Resources announced:

VanadiumCorp reports new high-grade V2O5 drill core intercepts at Lac Doré, Québec − 37.1 m grading 0.73% V2O5 and 55.72% Fe2O3; Additional Davis tube testing results include 8.3 m grading 22.9% magnetics with 1.5% V2O5.

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large-scale high-grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On May 11, First Vanadium Corp. announced: "First Vanadium announces positive preliminary economic assessment for the Carlin Vanadium Project in Nevada."

PEA Highlights (US$ unless otherwise noted):

- "Life of mine (LOM) of 11 years of mining plus 5 years of stockpile feed, with 1.0 million tons annually of process plant feed at an average grade of 0.71% V2O5 and average process recovery rates of 78%, resulting in an annual average payable production of 11 million pounds of V2O5 flake.

- Project includes a 4 year extension post-mineral processing of stockpiles, selling sulfuric acid and energy exclusively from acid plant.

- Total payable production: 180 million pounds of V2O5 flake.

- LOM average cash operating cost per payable V2O5 pound: US$5.17/lb V2O5; US$4.81/lb V2O5 over the first 10 years.

- Pre-Production capital requirements: US$535 million.

- Undiscounted cash flow Pre-tax: US$356 million, Undiscounted cash flow After-tax: US$301 million.

- Pre-tax NPV (6%): US$56 million, After-tax NPV (6%): US$29 million.

- Pre-tax IRR: 7.9%, After-tax IRR: 7.0%.

- Pre-tax Payback period: 7.5 years, After-tax Payback period: 7.7 years.

- Assumed metal price of US$10.65/lb V2O5.

- Potential for up to 230 jobs at the peak of production."

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N]

Other vanadium juniors

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Sabre Resources [ASX:SBR]

- Vanadium Resources [ASX:VR8]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were flat in May.

Highlights for the month include:

- New battery tech revives vanadium interest.

- AMG and Shell Catalysts & Technologies have commenced operations. AMG has committed $140 million as of March 31, 2020, in construction and engineering contracts for investment in a second ferrovanadium plant.

- Bushveld Minerals is ramping up vanadium production as COVID-19 impact declines. Bushveld Energy receives approval for construction of a vanadium electrolyte plant.

- Largo Resources reports solid Q1 2020 results with net income of $5.7 million with lower costs and higher production... Largo announces expiration of its vanadium off-take agreement and commences full commercial control of its own vanadium production.

- Energy Fuels - Strategically, no material uranium or vanadium sales were completed during the quarter due to low prices.

- Australian Vanadium terminates JV with Ultra Power Systems and forms strategic alliance to explore the Coates Mafic Intrusion for nickel sulphides (nickel-copper-platinum group elements (PGE)).

- Technology Metals announced a MoU with leading vanadium redox flow battery company Big Pawer Electrical Technology Xiangyang Inc. Co..

- Vanadium Resources Steelpoortdrift (SPD) Project - Updated Mineral Resource Estimate includes 377Mt at 0.78% V2O5 in the Measured and Indicated categories, 57% of the Global Mineral Resource of 662Mt at 0.77% V2O5 in the Measured, Indicated and Inferred categories.

- First Vanadium announces a positive PEA for the Carlin Vanadium Project in Nevada.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles:

- A Look At The Solar Sector And Some Top Solar Companies

- An Update On The Rare Earths Sector And Some Promising Rare Earths Stocks To Consider

Disclosure: I am/we are long GLENCORE [LSX:GLEN], AMG ADVANCED METALLURGICAL GROUP NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], AUSTRALIAN VANADIUM [ASX:AVL], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.