Writing Puts For Income With Downside Protection

by Retired InvestorSummary

- Readers of my prior articles know I like writing Put options to generate income. This has enhanced my return on the cash I want in some accounts.

- Some option trades resulted in large paper losses with the market crash. Readers suggested ways I could have added downside protection by using a spread strategy.

- This article covers what I learned about executing what is known as a Bull Put Spread trade.

Introduction

Last winter, before the COVID-19 economic effects were known, Delta Air Lines (NYSE:DAL) moved from the low $50s to $60. I took that opportunity to write April $50 Puts for $1 premium. This met my criteria of wanting a ROI greater than 8% with a 15% downside protection against being Put to. As we now know, the virus killed the airline industry and Delta dropped as low as $19, resulting in me owning the stock at a large paper loss. If I had executed a Bull Put Spread, it would have greatly reduced that loss depending how it was done.

After explaining what a Bull Put Spread trade is, I will cover what I could have done with my Delta trade and provide trade examples for Delta, Schlumberger Ltd. (NYSE:SLB), and Kohl's (NYSE:KSS) using data as of May 22nd.

Defining a Bull Put Spread Trade

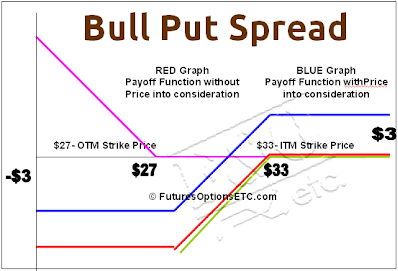

A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset. The strategy uses two put options to form a range consisting of a high strike price and a low strike price. The investor receives a net credit from the difference between the two premiums from the options. A bull put spread consists of two put options. First, an investor buys a put option and pays a premium. Next, the investor sells a put option at a higher strike price than the purchased put receiving a premium. Both options have the same expiration date. The premium earned from selling the higher-strike put exceeds the price paid for the lower-strike put. The investor receives an account credit of the net difference of the premiums from the two put options at the onset of the trade. Investors who are bullish on an underlying stock could use a bull put spread to generate income with limited downside. However, there is a risk of loss with this strategy.

Source: investopedia.com

Source: futuresoptionsetc.com

While a Bull Put Spread is designed to limit risk, it does not eliminate it. The maximum loss is equal to the Net Credit received minus the difference in the strike prices used times #of contracts times contract size, usually 100 shares. Between the two strikes, your loss increases until the stock reaches the lower strike price. To use my Delta trade as if I had done a spread:

Premium received was $1.00 thus $200 since I wrote two $50 strike contracts. I believe the $45 strikes of the same month cost $.50, or $100 for buying two contracts. Since the strike spread is $5.00, my maximum loss would be $900 for executing a 2 contract, $5 Bullish Put Spread trade. Since I actually did not buy the protective Puts and Delta dropped to $26 when the contracts expired, my paper loss was more than 5X bigger - ouch!

With any option trade, remember these two statements:

- Only write Puts on stocks you want to own at the strike price chosen.

- If your ROI is high, so is the risk as one main driver of option premium values is the underlying stock's volatility.

Bull Put Spread examples

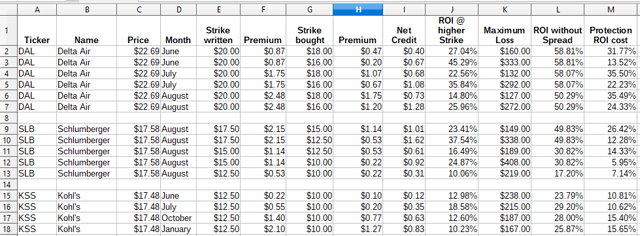

I chose three stocks highly effected by COVID-19 with uncertain futures, that still have decent ROIs and narrow bid-ask spreads on their Put options. As you will see, executing a spread trade, while limiting your potential loss, greatly reduces your ROI. My base for the ROI calcs assumes your broker requires the sold contract to be covered with cash in the account. Buying a lower strike Put doesn't change that requirement according to my broker. ROIs are all annualized.

Source: Fidelity as of the 5/22/20 close - compiled by Author

I tried to demonstrate different results for each stock chosen.

For Delta Air Lines, it shows the effect on ROI using the same strike for the written contract using different months and strike prices for protection. Little ROI is given up by writing longer-dated spreads, which is not always true. As expected, the reduction in ROI from writing contracts without protection is directly affected by the amount of protection the trader desires.

For Schlumberger LTD., I chose to show the effect within one month by the choice of both initial downside protection and overall protection. One tactic a writer can employ to minimize losses besides doing a Spread trade, is writing deep OTM Puts. Data shows writing a non-spread $12.50 Put has about the same ROI as the $15/$12.50 spread (cell L13 vs J11), but the Spread adds 100% loss prevention if SLB drops below $12.50 at expiration. SLB shows that the ROI cost of a Spread drops the greater the strike price spread is and the higher the potential loss is.

For Kohl's, I show the effect of time when comparing the same set of strike prices. In this case, the writer doesn't benefit, ROI wise, from using longer-dated contracts. The only reasons to write the JAN contracts versus the JUN contracts is to lock in the ROI with the expectation the volatility premiums will shrink or a belief KSS will start rising in price and they do not want to constantly write new contracts at a higher strike prices between June and next January.

The above three stocks' Implied Volatility measure all top 70%, whereas a stock little touched by the economic turmoil, Procter & Gamble (PG), has a IV of only 25%. ROIs on Bull Put spreads for PG are under 5% showing how much the added risk increases potential ROI.

Portfolio Strategy

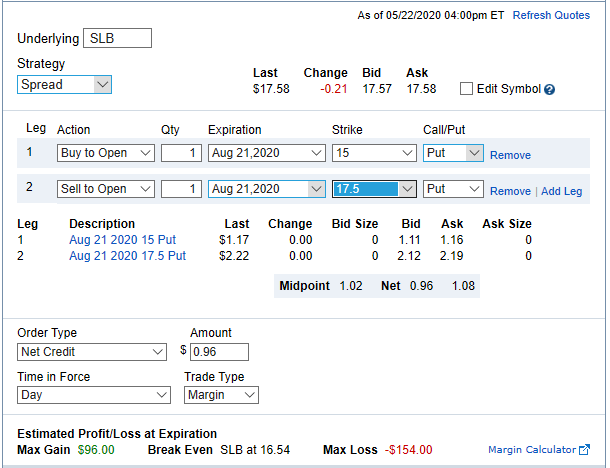

I highly recommend anyone executing a Spread trade to enter both parts as one trade, referred to as a Net Credit trade. This is what that trade screen looks like at Fidelity:

Here are some key takeaways Investopedia lists about this type of trade:

- A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset.

- The strategy pays a credit initially and uses two put options to form a range consisting of a high strike price and a low strike price.

- The maximum loss is equal to the difference between the strike prices and the net credit received.

- The maximum profit, which is the net credit only occurs if the stock's price closes above the higher strike price at expiry.

Writing Puts is income-generating strategy I and others use to increase the ROI on the cash we desire to hold, which can into play. Even with executing Spread trades, you could be Put to and executing the Put you bought for protection cannot be executed on the same day, which means you take ownership, or exercising the Put wouldn't make sense, i.e., the stock is still trading above its strike price.

So while Spreads will cap your potential losses, good research should prevent the need from using this strategy often. One good example of an exception to that statement is writing Puts while the market is in a freefall like last March.

Of course, you are not locked into the spread trade once executed. If you become convinced the stock won't crash, you can close out the lower strike. If convinced the stock turned into a dud, keep the lower strike and close out the higher strike. If enough time has past and volatility dropped, you might close out either option at a profit, depending on how the stock has moved since executing the Spread trade.

The bottom line is, as it should be for your entire investing strategy: Define your acceptable risk level and trade accordingly.

Option Premiums are taxed differently based on strategy used. These links will provide an overview of the IRS rules: Tax Info Schedule D

For those new to option writing, I suggest reviewing some of my prior articles on the subject:

Generating Income with Options

I found two sites that help investors explore possible Spread trades:

BarChart.com Marketchameleon.com

This article just scratches the surface when it comes to Spread trades. This site covers some of the others: option_spreads

If you appreciate articles of this nature, please mark it 'liked' and click the 'Follow' button above to be notified of my next submission. Thanks for reading.

Disclosure: I am/we are long DAL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I also own both Puts and Calls on DAL