Taiwan Semiconductor: Well-Positioned Despite US-China Trade War

by Simple Investment IdeasSummary

- TSMC is well-prepared to deal with near-term COVID-19-related headwinds.

- Growing US-China tensions will likely have long-term negative implications for TSMC.

- TSMC is in a great position to capitalize on promising technologies like 5G.

Taiwan Semiconductor (TSM), the leading semiconductor foundry pure play, is currently at the center of a geopolitical battle between the US and China. This battle involving TSMC highlights the growing importance of chips in the modern economy. TSMC plays an integral role in supplying the world with cutting-edge semiconductor technologies.

TSMC is one of the most important players in the global semiconductor supply chain, supplying the likes of Apple (AAPL), Nvidia (NVDA), and Huawei. The uproar caused by TSMC's decision to stop taking new orders from Huawei demonstrates TSMC's power in the semiconductor industry. While the new trade restrictions will negatively impact TSMC, the company is well-positioned to thrive regardless.

Growing Prevalence of Semiconductor Technologies

Semiconductor-based technologies are starting to impact nearly every aspect of modern life. With the growth of technologies like 5G and high-performance computing, chips have become a focal point in industry and society in general. As such, it is not surprising that the recent US export controls regarding semiconductors have sparked such a global response.

TSMC is one of the most important companies in the global semiconductor supply chain. The company produces some of the most advanced semiconductor technologies for a large number of technology giants. TSMC is even planning to build a $12 billion chip plant in Arizona. This plant will focus on producing 5-nanometer chips, which are the most advanced in the industry.

TSMC's ability to mass-produce some of the industry's most cutting-edge chips puts the company in an invaluable position. With the explosive growth of 5G, mobile, gaming, and a plethora of high-tech industries, demand for TSMC's chips will likely grow at a fast pace moving forward. TSMC's status as the world's largest pure play semiconductor foundry puts the company in a great position to leverage the growth of computing technologies.

TSMC's manufacturing expansion into the US showcases the company's growing global influence.

Source: globalconstructionreview

Strong Balance Sheet

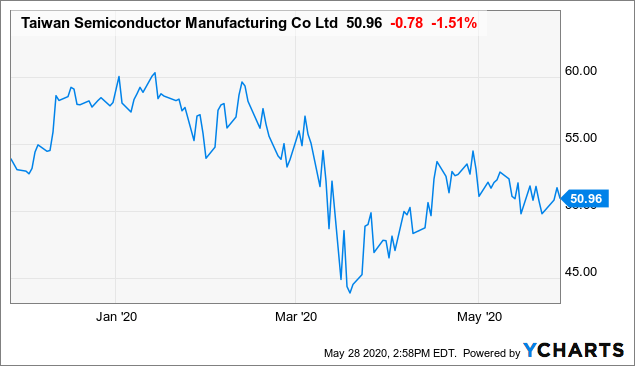

TSMC has clearly felt the impact of the coronavirus outbreak. The company's stock price fell to around $43 but started to rebound in recent months. While the coronavirus is expected to impact TSMC moving forward, the company is well-positioned to weather the storm. In fact, TSMC has yet to see any major disruptions to its fab operations.

TSMC also has an incredibly strong balance sheet, which should further mitigate any potential impacts of COVID-19. TSMC ended Q1 with ~$18.75 billion in cash and marketable securities. TSMC also posted a surprisingly impressive Q1 revenue of $10.3 billion, which represents a 45.2% Y/Y growth. The resources that TSMC possesses should help shield the company against disruptions posed by the pandemic.

TSMC has recovered some of its losses in recent months.

Data by YCharts

Threat of Growing Geopolitical Tensions

The worsening ties between China and the US could have long-term ramifications for TSMC. The US has already forced TSMC's hand with regard to China. Choosing between the Chinese and the US market will have a large negative impact on TSMC, given the size of the respective markets.

Tensions between China and the US are only ratcheting up as a result of China's response to the coronavirus. The West, in general, is clearly starting to take a more hostile stance towards China. Given TSMC's major role in the global semiconductor supply chain, such global tensions will only hurt TSMC's business.

TSMC appears to be siding with the US considering the company's $12 billion factory commitment to Arizona. If China retaliates to the US trade restrictions in a similar manner, TSMC will be further negatively impacted. It appears unlikely that the US-China relationship will get better anytime soon especially considering China's most recent actions.

US-China relations appear to be worsening as a result of recent events.

Source: Reuters

Conclusion

Despite the near-term challenges posed by the coronavirus and an escalating trade war, TSMC is continuing to invest heavily in R&D. With the opportunities emerging in 5G, high-performance computing, etc., TSMC is smart to focus on improving its technology given how competitive the semiconductor space is.

TSMC still has upside at its current market capitalization of $255 billion and forward P/E ratio of 19. The majority of the world's largest fabless semiconductor companies are customers of TSMC, putting TSMC in a great position to capitalize on emerging technology trends. TSMC is increasingly at the center of one of the world's largest and most important industries.