Five Things You Need to Know to Start Your Day

by Lorcan Roche Kellyfive things

Five Things You Need to Know to Start Your Day

By

Lorcan Roche Kelly

May 29, 2020, 6:32 AM EDT

Want to receive this post in your inbox every morning? Sign up here

Trump set to announce new China policy, Twitter censures another presidential tweet, and Powell due to speak.

Signing, responding

President Donald Trump appears poised to sign a measure passed by Congress which would target Chinese officials for abusing the human rights of the country's Muslim minority. In a parallel move, Trump told reporters he's preparing to announce new polices on China in response to Beijing's imposition of national security legislation on Hong Kong.

Tweet storm strengthening

Twitter Inc. is not backing down after Trump signed an executive order targeting social media companies yesterday. The company put a rule-violation notice on one of the president's late-night tweets citing "glorified violence." Trump had commented on the riots that spread across the U.S. after the death of George Floyd, a handcuffed black man who pleaded for air as a white police officer kneeled on his neck. Shares in the company were slightly lower in pre-market trading.

Powell control

Federal Reserve Chairman Jerome Powell takes part in a moderated virtual discussion with former Fed Vice Chairman Alan Blinder from 11:00 a.m. Eastern Time. While the market sees a lower chance of negative rates, the range of Fed tools is likely to be discussed. Latest data shows its holdings of corporate debt ETFs rose to almost $3 billion, while the weekly balance sheet added a line item for muni bond purchases. It is also likely that Powell will be asked to comment on whether policy makers will engage in yield-curve control, as flagged by New York Fed President John Williams earlier this week.

Markets slip

Equity investors are ending the week on a cautious note as they wait for Trump's announcement on China. Overnight the MSCI Asia Pacific Index slipped 0.2% while Japan's Topix index closed 0.9% lower. In Europe, the Stoxx 600 Index was down 0.9% at 5:50 a.m. with auto and travel stocks among the worst performers. S&P 500 futures pointed to a small drop at the open, the 10-year Treasury yield was at 0.669% and oil was lower.

Coming up...

U.S. personal income and spending data for April will probably post historic declines, while PCE inflation gauges will show dramatic drops when the data is published at 8:30 a.m. Canada March GDP, U.S. wholesale and retail inventories for April are also at that time. The latest University of Michigan consumer sentiment number is at 10:00 a.m. The Baker Hughes rig count may fall below 300 when it is published at 1:00 p.m.

What we've been reading

This is what's caught our eye over the last 24 hours

- U.S. stocks are expensive any way you cut it, says Oxford Economics.

- ECB about to turn up the printing press to finance Europe's recovery.

- Air traffic won't return for at least three years, S&P says.

- There U.K. auto industry only produced 197 cars in April.

- Fossil fuels are no longer considered "green" by China's central bank.

- The oil producer that got paid zero for its barrels last month.

- Remote work has its perks, until you want a promotion.

And finally, here’s what Emily's interested in this morning

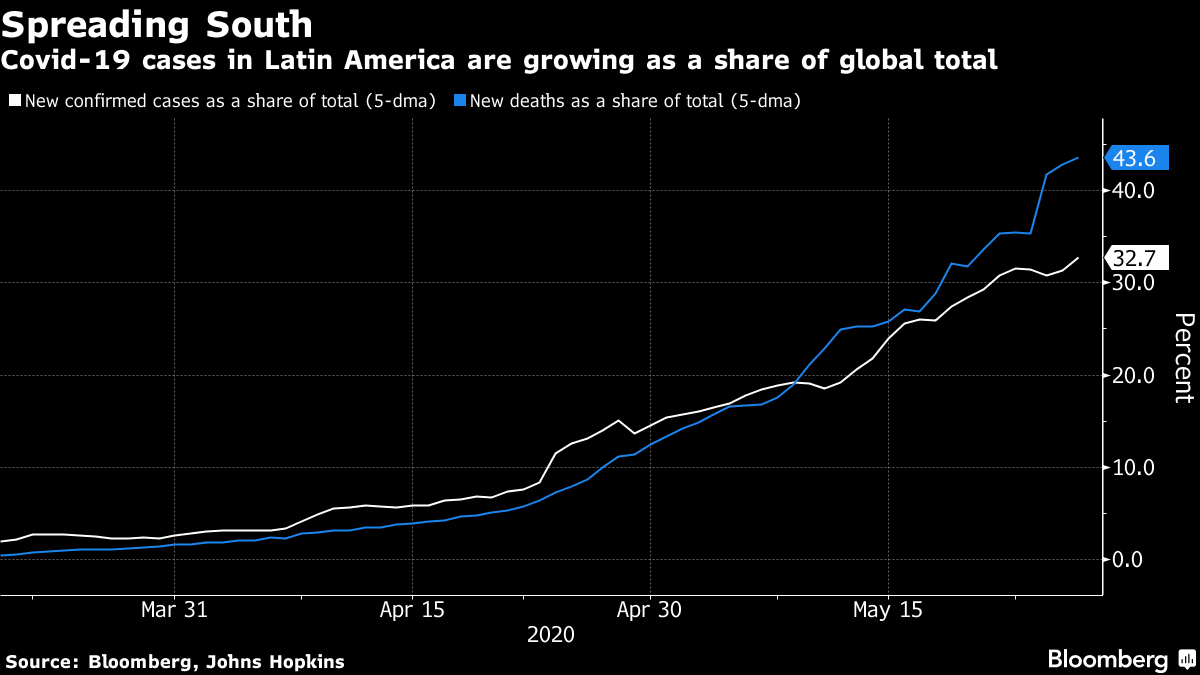

The resurgence of hostilities between the world’s two largest economies barely obscures the trauma unfolding in parts of the developing world. As economies in Asia and the U.S. gradually reopen, Latin America has become the epicenter of the crisis, accounting for roughly a third of new cases globally and more than 40% of daily fatalities. Alicia Garcia Herrero, chief Asia Pacific economist at Natixis, laid out the policy challenge facing developing countries, as “the first line of defense – namely, using a country’s monetary policy room to support growth – is becoming ineffective as investors shy away from weak currencies. Capital controls could provide a temporary relief but are costly as they would imply losing access to foreign funding altogether. Self-insurance and regional insurance schemes are an option for a select few, especially in Asia, but the duration and depth of the shock is uncertain, which justifies exploring other potential options.”

A former IMF economist herself, Herrero has joined calls for the organization to devise more efficient programs aimed at “a more targeted set of liquidity facilities with quicker disbursement and less conditionality.”

While official institutions and the G-20 have mobilized around relief efforts, including selective suspension of debt service payments, the response from private creditors has been … complicated. Forbearance isn’t simple -- fiduciary duties are one thing, and investors are also quick to point out that many governments are deterred by the risk of losing market access. And some have managed to sell hard-currency debt since the pandemic took hold – including Guatemala and Bahrain. But as this week’s Odd Lots podcast highlighted, some may face a terrible choice between servicing debt and investing in health care. The Institute of International Finance Thursday released a toolkit for talks between government and private creditors, to try and speed what could be an agonizingly slow and ultimately costly, case-by-case, approach to offering relief. Options include exchanging cash to help offset debt payments, or amending bond terms.

Follow Bloomberg's Emily Barrett on Twitter at @notthatECB

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.