The Indian Express

Sensex rises 224 points, Nifty ends above 9,500-mark lead by pharma, FMCG stocks

The S&P BSE Sensex rose 223.51 points (0.69 per cent) to settle at 32,424.10, while the Nifty 50 ended at 9,580.30, up 90.20 points (0.95 per cent).

by Express Web DeskThe topline equity indices on the BSE and National Stock Exchange (NSE) erased their morning losses and settled over 0.5 per cent higher on Friday lead by gains in the shares of pharmaceutical and fast-moving consumer goods (FMCG) stocks.

The S&P BSE Sensex rose 223.51 points (0.69 per cent) to settle at 32,424.10, while the Nifty 50 ended at 9,580.30, up 90.20 points (0.95 per cent). Both the benchmarks had opened over 1 per cent lower earlier in the day but as the day progressed they reversed their losses and turned positive in the afternoon session of trade.

On Thursday, the Sensex had risen 595.37 points (1.88 per cent) to settle at 32,200.59. Likewise, the Nifty 50 too had climbed 175.15 points (1.88 per cent) to end at 9,490.10.

On the Sensex, Oil and Naural Gas Corporation (ONGC), Bajaj Auto, ITC, Sun Pharmaceutical Industries, Nestle India and Larsen & Toubro (L&T) were the top gainers of the day. On the other hand, Infosys (Infy), Axis Bank, Bharti Airtel, Tata Consultancy Services (TCS), Titan Company and Mahindra & Mahindra (M&M) were the biggest losers. (see heatmap below)

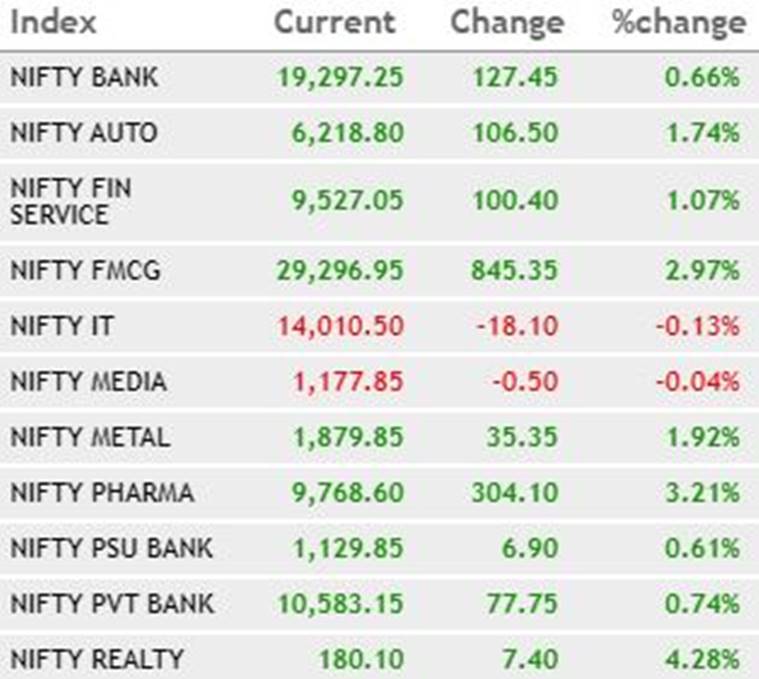

Among sectoral indices on the NSE, the Nifty Pharma index rose 3.21 per cent led by Divi’s Laboratories and Dr Reddy’s Laboratories. The Nifty FMCG index too climbed 2.97 per cent led by Colgate Palmolive (India) and United Spirits.

Here’s how the sectoral indices performed:

In the broader market, the S&P BSE MidCap index settled at 11,843.22, up 221.16 points (1.90 per cent), while the S&P BSE SmallCap index ended at 10,892.60, up 123.26 points (1.14 per cent).

“Markets have closed on a positive note, after a volatile day of trade, in anticipation of GDP data due out later today. Global cues also were negative, following heightened US-China diplomatic issues, which offset stimulus news and economies opening up. GDP is expected to slow down rapidly in the March quarter and markets will be looking at the associated commentary to understand the course of recovery,” Vinod Nair, Head of Research at Geojit Financial Services, said in a post-market statement.

Rupee

The rupee appreciated 14 paise to provisionally close at 75.62 against the US dollar on Friday as foreign fund inflows and weak American currency boosted investor confidence, news agency PTI reported.

The rupee opened at 75.71 at the interbank forex market, gained further ground, and finally settled at 75.62, up 14 paise over its last close. It had settled at 75.76 against the US dollar on Thursday.

Global markets

Global stock markets fell and safe havens such as bonds and the Japanese yen gained on Friday, as investors awaited Washington’s response to China tightening control over the city of Hong Kong.

China’s parliament on Thursday pressed ahead with national security legislation for the city, raising fears over the future of its freedoms and its function as a finance hub.

US President Donald Trump said he would hold a news conference on China later on Friday. Trepidation about a further deterioration in Sino-US relations put investors on edge.

European stocks opened lower, with the pan-European STOXX 600 index down 0.86 per cent. Germany’s DAX fell 1.2 per cent, Britain’s FTSE 100 by 7 per cent and France’s CAC 40 by 1 per cent. Futures for the S&P 500 slipped 0.4 per cent.

Earlier in Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.2 per cent. Japan’s Nikkei retreated from a three-month high and the yen rose to a two-week high of 107.06 against the dollar.

– with global market inputs from Reuters