NEA: I See Reasons To Remain Long

by Dividend SeekerSummary

- NEA continues to trade at an attractive discount to its underlying value.

- Investment grade munis have a positive spread over treasuries on all points on the yield curve.

- With equities pushing higher since April, I continue to build on my positions in fixed-income. NEA has indeed been a relative hedge in 2020.

Main Thesis

The purpose of this article is to evaluate the Nuveen AMT-Free Quality Municipal Income Fund (NEA) as an investment option at its current market price. NEA is a fund I continued to recommend at the beginning of the year, and I was quite disappointed with how it held up during the sell-off. Despite its investment grade focus, the market punished quality and risk alike. However, I remained invested, and now that the market is recovering, I am looking to add to my position.

The reasons for doing so are straightforward. Muni bonds have a strong track record in terms of steady income and little credit risk. With interest rates pushing lower, NEA's tax-exempt income stream above 4% is desirable. Further, while state and local governments will have liquidity concerns going forward, the Fed has announced support for the muni market, which will limit the downside risk. Finally, I see higher taxes in the near future, providing a boost to the muni sector in two ways. One, it will increase the attractiveness of tax-exempt income, and two, it will provide municipalities with additional revenue that should help restore faith in this very important sector.

Background

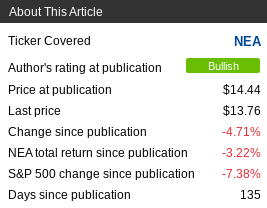

First, a little about NEA. It is a closed-end fund with an objective "to provide current income exempt from regular federal income tax and the alternative minimum tax applicable to individuals, by investing in an actively managed portfolio of tax-exempt municipal securities". Currently, the fund trades at $13.76/share and pays a monthly distribution of $.0535/share, which translates to an annual yield of 4.31%. NEA is a fund I have owned for a while and continued to recommend at the start of the year. Unfortunately, even quality muni bonds were not immune to the sharp sell-off that started in late February. However, now that markets have recovered, NEA has actually proved to be a useful hedge, as the fund has a smaller loss than the broader equity market since my January review, as shown below:

(Source: Seeking Alpha)

Considering all that has transpired so far in 2020, I figured now was a good time to take another look at NEA to see if I should change my outlook going forward. After review, I continue to find merit to holding NEA and I am reiterating my bullish rating, and I will explain why in detail below.

The Market's Rise Has Me Hunting For Value

To begin, I want to touch on a key reason why I have continued to add to my position in NEA. While I have been bullish on muni bonds for quite some time, there is a plethora of options to choose from. However, I was drawn to NEA for a couple of reasons. One, the fund historically trades at a discount to NAV, which I prefer as a more value-focused investor. In theory, I prefer discounted entry points because it should limit the downside risk, given the fund is trading on the open market for less than the underlying assets are worth. While I stand by this strategy for the longer term, it is true this reality did little to stem the losses for NEA during the recent sell-off. Fortunately, the fund has recovered quite a bit of ground since then, so its overall performance in 2020 has only been slightly negative, once we account for distributions.

Given NEA's subsequent rebound off its low in March, it is worth a look at the fund's current valuation to see if the discount argument remains. The good news is, NEA continues to trade for a healthy discount. In fact, it is very close to the same level from January and slightly wider than its 52-week average:

| Current Discount | 52-week Average Discount | Discount in Jan Review |

| -8.7% | -7.5% | -8.0% |

(Source: Nuveen)

My takeaway from this is NEA is trading at an attractive price, although investors should realize that the fund often trades at a discount to NAV. Therefore, this discount is not likely to narrow considerably in the short term, which will limit the potential upside. However, the fund often does not trade much lower, so downside risk is fairly limited as well. This appeals to me as an investor seeking tax-exempt income, as I would prefer stable price action while I collect that income.

While the valuation story can thus be viewed as either an opportunity or a sign for caution, I would be remiss if I did not touch on the fund's NAV performance in 2020. Unfortunately, the NAV movement has been quite negative, which explains why NEA's share price is down despite trading at a similar valuation. To illustrate, consider the year-to-date move of the fund's NAV, shown below:

| NAV on 12/31/19 | NAV on 5/28/20 | YTD Gain |

| $15.55/share | $14.45/share | (7.1%) |

Clearly, this is a sign of caution, so investors would be wise not to go "all in" at these levels. Rather, I would initiate, or build on, positions slowly and keep a keen eye on the broader muni market to gauge its recovery in the months ahead. But we also must consider that this drop of 7% to the NAV is not as bad a as it looks on the surface, since NEA has also delivered five months of distributions to investors, which accounts for a few percentage points of this drop. Therefore, while the underlying story for NEA has been challenging in 2020 so far, I see reasons for optimism going forward.

Good Option For North Carolina Residents

A second reason I like NEA has to do with a development that occurred at the end of last year. As a resident of North Carolina, tax-exempt muni funds are hard to find. Unlike states such as California, New York, Illinois, New Jersey, among others, North Carolina does not have a large, or overly active, muni market. The states I mentioned above have much larger state and municipal budgets, as well as a large high-net worth residency, which is drawn to the tax-exempt debt issued by those states. Because the muni market is dominated by just a handful of states, for residents outside those core jurisdictions, such as myself, I am essentially restricted to buying national muni funds for the largest tax benefit. Of course, there is nothing "wrong" with this, but it does stand in contrast to residents of states such as California or New York, who have many options to choose from that are individual state-specific. In fact, PIMCO, which is an asset management company whose CEFs I regularly cover, has nine different muni CEFs. Of those nine, three are specific to NY, three are specific to California, and three are national.

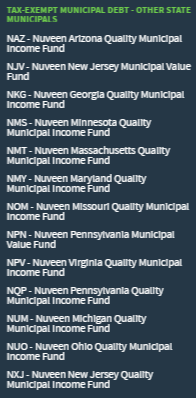

Nuveen, which manages NEA, is a bit more diverse in its offerings. While the fund has five offerings for both California and New York, there are multiple options for residents in different states, as shown below:

(Source: Nuveen)

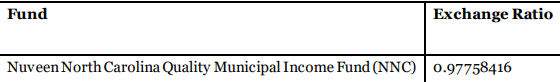

As you can see, these options are quite diverse, but it still limits North Carolina residents such as myself. This brings me to a point on why I like NEA over some other options from Nuveen with similar valuations. Specifically, the fund has absorbed the assets from the Nuveen North Carolina Quality Municipal Income Fund, which was retired in November 2019, as shown below:

(Source: Nuveen)

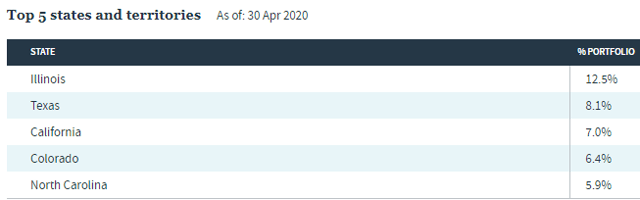

The end result of this action is that NEA now holds more North Carolina muni holdings than it did before, which I view positively. In fact, North Carolina is one of the top state's represented in NEA's portfolio, as seen below:

(Source: Nuveen)

My overall point here is not that NEA is a substitute for a North Carolina-specific fund. While it is one of the top states represented, the exposure comes in at only 6%, so it is not overweight this state by any means. But I was long on NEA prior to this reorganization, and the inclusion of more North Carolina debt is just one more reason for me to continue adding to this holding, as opposed to branching out to other Nuveen alternatives.

Investment Grade Munis

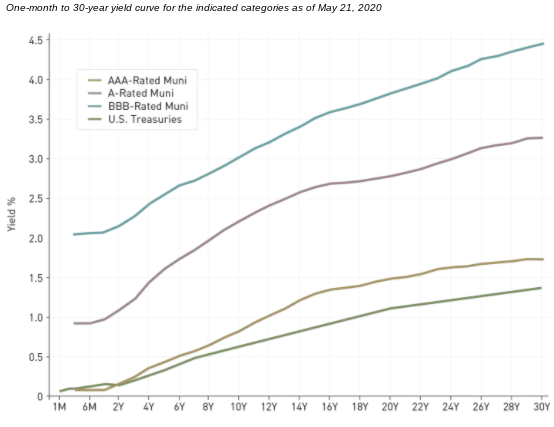

I now want to turn to the muni market more broadly, with a discussion on why I continue to favor this sector today. When looking at munis, investors can choose investment grade or high yield, and I typically prefer investment grade. I use them as a way to smooth out portfolio volatility, and to balance my equity positions with a stable income stream. As a result, when I consider adding to my muni position, it is often a question of doing so at the expense of U.S. treasuries, since they often have the same risk profile. At the moment, both sectors are getting support from the Fed, but the Fed has directed more of its resources towards buying treasuries than munis (for now). As a result, muni yields have not been pushed down as aggressively as the yields for treasuries. This imbalance has allowed the yields on investment grade munis to be higher than U.S. treasuries for all maturities, as shown below:

(Source: Lord Abbett)

This means investors are obtaining a higher level of income for a similar amount of credit risk. Furthermore, it is especially important because the above graph does not factor in the tax exemption of muni bond interest. Therefore, once tax savings are accounted for, the yield spread is even more beneficial to holders of muni bonds.

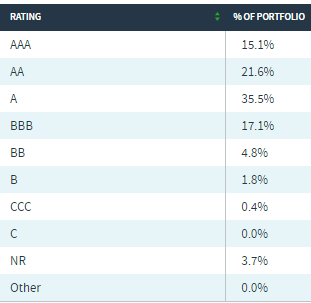

With that in mind, we should understand how this is relevant for NEA. While the fund is leveraged, and therefore inherently has more risk than a non-leveraged alternative, NEA is made up almost exclusively of assets with an investment grade credit rating, as shown below:

(Source: Nuveen)

As you can see, this is a pretty conservative make-up, which helps put my mind at ease. When I couple these strong credit ratings with a positive yield spread over treasuries, the merit to buying NEA is quite clear.

What's The Risk? State Revenues Have Been Under Pressure

Of course, investing in NEA is not without risk. As with most asset classes today, the COVID-19 crisis has hit the muni sector hard. While a rallying stock market, driven by state re-openings and Fed support, have broadly helped munis recover most of their losses, the short-term history for munis likely has some investors unnerved. And there are good reasons for this. State and local governments were not in the best financial position leading up to this crisis, which means the following months and years will be even more challenging now. Fortunately, municipalities have the ability to tax, and I would absolutely expect local taxes - whether sales, property, or income - to rise in the near future. While this may not be a positive for the average citizen, it is especially helpful for muni bond investors.

That said, I am not blatantly ignoring the risks facing the sector, and that is a primary reason why I am focusing on investment grade munis. While high yield munis also have a fairly strong history, I do not have the desire to take on extra credit risk right now. For now, it seems most investors tend to agree with me, as high yield munis have lagged the broader muni market during the recovery, as shown in the graph below:

(Source: Bloomberg)

Of course, this opens up a contrarian play. Some investors may view this chart and recognize a potential value opportunity for high yield munis. While the broader markets, including investment grade munis, have recovered, high yield munis have clearly lagged. For investors with a bullish outlook on the sector, this could absolutely be a reason to buy, as there is relative value to be had. For myself, however, I am playing it cautious. I am not diving in to below-investment grade assets, whether in muni or corporate bonds, even though the relative income spread is above the norm.

My takeaway here is to stay within your risk tolerance. It will take a while for state and local municipalities to make up the lost revenue that resulted from the lockdowns. Taking additional risk now, such as through high yield munis, could result in higher gains, but until I see more clarity from the phased state re-openings, I am sticking with a more conservative approach at this time.

Bottom line

NEA has had a rocky year, but has recovered the majority of its losses from the sell-off. Looking ahead, I see a challenging market environment, so it is making me especially selective on what purchases I make now. While muni bonds have a unique set of risks given the complexity of recent government lockdowns, the re-opening of many state economies is a positive sign that should allow lost revenue to begin to be made up. Further, the Fed has extended support to the muni market, which should limit downside. Finally, investment grade munis have a very strong historical track record, so I feel confident using this asset class as a way to balance out my equity positions. Therefore, I remain long NEA going forward, and would encourage investors to take a serious look at the fund at this time.

Disclosure: I am/we are long NEA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.