Pacific Premier Bancorp's Temporarily Elevated Expenses, External Factors To Pressurize Earnings

by Sheen Bay ResearchSummary

- The acquisition of Opus Bank will lead to high expenses in the second and third quarters.

- External factors, including the decline in interest rates and the worsening of asset quality amid the economic downturn, will pressurize earnings this year.

- Addition to Opus Bank’s earning assets to PPBI’s balance sheet will likely support earnings.

- The unusually high probability of an earnings miss this year poses risks to the valuation.

Earnings of Pacific Premier Bancorp, Inc. (PPBI) declined by 37% sequentially in the first quarter to $0.43 per share due to a hike in provision expense. Earnings will likely drop further in the coming quarters as a result of the initial impact of the Opus Bank acquisition in the second quarter. Expenses will likely remain elevated until the system conversion in the fourth quarter of 2020; therefore, earnings will likely face pressure in the second and third quarters. Moreover, provision expense will likely be high in the second quarter due to the deterioration of macroeconomic factors since the end of the first quarter.

Additionally, the net interest margin compression following the interest rate decline will pressurize earnings. On the other hand, the addition of Opus Bank’s loans and participation in the Paycheck Protection Program will support the bottom line. For the full year, I’m expecting earnings per share to decrease by 59% year-over-year to $1.07. There are chances of an earnings miss due to the uncertain economic environment. The December 2020 target price suggests a high upside from the current market price; nevertheless, I’m adopting a neutral rating on PPBI due to the risks and uncertainties.

Opus Bank’s Acquisition To Temporarily Lift Expenses

As mentioned in the first quarter’s conference call, PPBI is planning to close the acquisition of Opus Bank on June 1, 2020. Further, the company plans to convert Opus Bank’s systems in October this year. I’m expecting the parallel run of the legacy Opus Bank and PPBI systems to keep expenses up in the second and third quarters. Moreover, one-time merger-related expenses will likely increase non-interest expenses in the remainder of the year. Furthermore, bonuses for essential on-site employees and other COVID-19-related costs will likely increase expenses in the second quarter. Consequently, I’m expecting the efficiency ratio to worsen to 91% in the second quarter from 54% in the first quarter, before trending down in the second half of the year.

Acquisition To Adversely Impact Margin, But Benefit Earning Assets

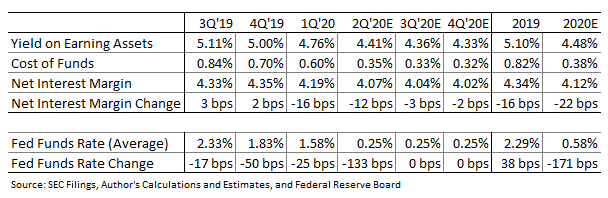

The 150bps federal funds rate cuts in March will likely pressurize yields, and consequently net interest margin, NIM, in the second quarter. Moreover, the acquisition of Opus Bank will lead to a more costly deposit mix. After the acquisition, the proportion of non-interest demand deposits in total deposits will decline to 30.3% from 43.4%, as mentioned in the first quarter’s investor presentation. Additionally, the proportion of certificates of deposits will increase to 12.2% from the current 11.8%. Furthermore, Opus Bank’s loan portfolio carries an average yield of 4.13%, which is lower than PPBI’s average yield of 5.27%. As a result, PPBI’s average yield will decline after the acquisition. Considering these factors, I’m expecting NIM to drop by 12bps in the second quarter, and by 22bps in the full year. The following table shows my estimates for yield, cost, and NIM.

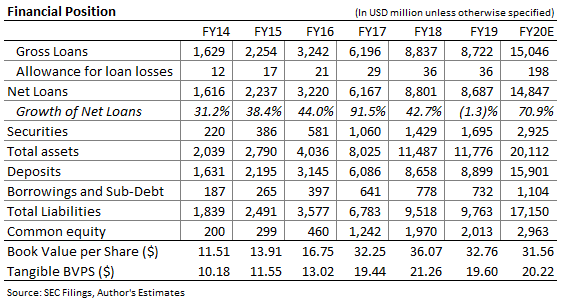

A jump in loan balance due to the Opus Bank acquisition will partially offset the NIM decline. As mentioned in the presentation, Opus Bank will likely add around $6.0 billion in loans to PPBI’s balance sheet in the second quarter. Moreover, PPBI’s participation in the Paycheck Protection Program, PPP, will increase loans in the second quarter. As mentioned in the presentation, PPBI processed loans worth $809 million in April and intends to process $328 million worth of loans in the second round. However, I’m expecting a majority of the PPP loans to get forgiven before the year-end. Overall, I’m expecting a loan balance of $14.8 billion at the end of 2020, up 71% from the end of 2019. I’m expecting other balance sheet items to grow in tandem with loans. The following table shows my estimates for balance sheet items.

Another Sizable Reserve Build Likely For The Second Quarter

PPBI’s provision expense surged to $25.5 million in the first quarter from $2.3 million in the fourth quarter. The management used a blend of base case, critical pandemic, and downside scenarios in its model to determine the loan loss reserves. Most assumptions for the key economic variables used in the model, as given in the 10-Q filing, appear reasonable under the current economic environment. However, I believe that the assumption for the unemployment rate is too optimistic. In the worst scenario, the management assumed that the unemployment rate would peak at 7.4% in the next six quarters. The unemployment rate was at 14.7% in April and is likely to be higher in May given the rise in jobless numbers. As a result, I believe PPBI will need to adjust its reserves upwards in the second quarter.

As can be gleaned from the presentation, Opus Bank has a better asset quality than PPBI; therefore, I’m expecting the merger to have a limited adverse impact on provision expense. Overall, I’m expecting the provision expense to be 28bps of total loans in 2020, up from 7bps of total loans in 2019.

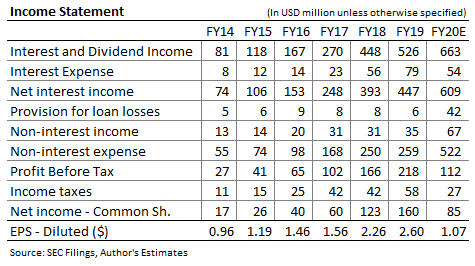

Expecting Earnings Of $1.07 Per Share

The increase in non-interest expenses, decline in NIM, and hike in provision expense will likely pressurize earnings while earning asset growth will support earnings this year. Overall, I’m expecting earnings per share to decrease by 59% year-over-year to $1.07 in 2020. The following table shows my income statement estimates.

The uncertain economic environment can lead to earnings surprises in the year ahead. If the economy takes longer than expected to recover, then provision expense can surpass its estimate. Additionally, if the forgiveness of a majority of PPP loans gets delayed to next year, then PPBI will book lower than expected PPP fees this year. Furthermore, the COVID-19 pandemic can affect the timing of closing and system conversion of Opus Bank. These uncertainties have increased the chances of an earnings miss.

Risks And Uncertainties Tarnish The Attractive Valuation

I’m expecting PPBI to maintain its quarterly dividend at the current level of $0.25 per share in the remainder of 2020. Although the dividend expectation suggests a payout ratio of nearly 100% for 2020, I’m not expecting a dividend cut because the surge in payout ratio will most likely be temporary. The payout ratio will return to a normal level when earnings recover next year. The dividend estimate implies a dividend yield of 4.4%.

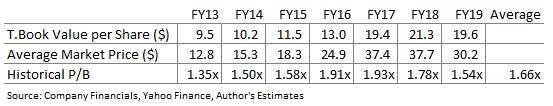

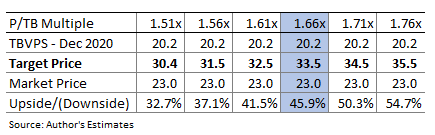

Along with the modest dividend yield, PPBI is offering a good opportunity for capital appreciation in the next seven to eight months. I'm using the average price to tangible book ratio, P/TB, to value PPBI. As shown in the following table, the stock has traded at an average P/TB multiple of 1.66 in the past.

Multiplying this average P/TB ratio with the forecast tangible book value per share of $20.2 gives a target price of $33.5 for December 2020. This price target implies a significant upside of 46% from PPBI's May 27 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

As noted above, the unusually high probability of an earnings surprise this year has increased the risks to valuation. Therefore, despite the high price upside, I’m adopting a neutral rating on PPBI.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.