Stocks To Buy In A Post-Pandemic World

by Dividend DiplomatsSummary

- The pandemic proved that not only is technology critical, but they can be a lifeline for a business.

- Insurance has performed very well, enough for most major insurance carriers to give back premiums to their customers.

- Banks are sitting on more deposits than ever and continue to fuel the economy as the money center.

Businesses are opening up here in Ohio, starting around May 21st. We are talking restaurants, retail, barber shops and other smaller stores/shops. Is the pandemic over? No, but what does this mean? Now that life and business are having their heart beat a little faster, here are stocks to buy or consider in a post-pandemic world.

Stocks to buy or consider

As an investor, the markets behaving this abnormal does not help in your financial decision. That's where we come in, to help bring clarity and reduce the grey from the decision process.

When considering what stocks to buy, we need to get back to basics. One must think of dividend stocks as boring. If you are into sexy/exciting companies like Amazon (NASDAQ:AMZN) Tesla (NASDAQ:TSLA) and others - then you probably would not be on this site! We are in the slow and steady race, but depending on how much you can save and invest truly can control your outcome. I'm running fast, just an FYI.

Therefore, I am going to go through industries that I believe are prime for the coronavirus, but also will be talking about the why. Further, we are big on dividend aristocrats here, which you will see many below. The companies in that category have weathered many more storms than this one.

Enough of me already, time to see the industries and stocks you can consider, based on the 3 simple metrics we use from the Dividend Diplomats Stock Screener.

Technology

The technology industry has prevailed during the pandemic. However, the businesses listed below were relevant before and will be more relevant after, as companies were forced to transition their business. The financial institution I work for went completely remote, for a bit of time, which required communication lines, network security and teleconference capabilities. The pandemic proved that not only is technology critical, but they can be a lifeline for a business. See the stocks providing those lifelines each and every day:

Cisco (NASDAQ:CSCO): Think about every company that is working remote. Chances are Cisco has been a part of that. It's no question they are on the list of stocks to buy, given Cisco has a strong dividend yield of over 3.20%, while trading at $45. Cisco's price to earnings ratio is around 15, far below the S&P 500 and not too alarmingly low. Payout ratio is relatively safe in the 40% range and they've already increased their dividend this year. Cisco is not a dividend aristocrat yet, but given their strength through the pandemic, they are surely on their way.

International Business Machines (NYSE:IBM): Yes, this new dividend aristocrat is on my list of stocks to buy or consider in a post-pandemic world. IBM has a stronghold in the cloud infrastructure, open source network programming with Red Hat acquisition and they are also a global leader in patents. They increased their dividend earlier this year, marking 25 straight years. They have gone from a high of near $160 down to the $120-125 range, while sporting a dividend yield of well over 5.30%. That destroys most competitors, as well as the S&P 500. The payout ratio is in the 50-55% range, with a price to earnings of 10-11.

Microsoft (NASDAQ:MSFT): As you can see, we went from telecommunications/teleconferencing/security, to cloud storage and software architecture and now to a combination of it all. Microsoft is a beast and I had to add them to the stocks to buy or at least consider. The downside is their yield, where Microsoft only boasts ~1.15%, higher than most high-yield savings accounts, but the kicker is their dividend growth rate. Microsoft has consistently increased their dividend by 10% over the last few years. Now, with a payout ratio of ~35%, they definitely can keep that up on a go-forward basis if they so desire. Their growth rate will outpace the average, for sure.

Insurance

Insurance has performed very well, enough for most major insurance carriers to give back premiums to their customers. I know my wife and I received a whopping $10 back for ours (still not sure how that one was calculated). With that being said, there are significant dividend companies in the insurance arena that have long-term dividend growth and are now at yield levels that are worth looking at, such as:

Aflac (NYSE:AFL): The duck baby! I feel like I have owned Aflac for almost 10 years. If you haven't read my dividend purchase activity posts, I have been acquiring even more shares throughout this pandemic and this dividend aristocrat deserves a spot on the stocks to buy in a post-pandemic world.

Travelers (NYSE:TRV): My wife has been picking up shares in this insurance beast. Since coming down over $50+ from their 52-week high, TRV is trading at $100.10 and yields 3.40%. Their payout ratio also is a safe one, at 38% and that's based on 2020 earnings, not 2021.

Cincinnati Financial (NASDAQ:CINF): Bert has been acquiring shares in CINF. Hard to argue why he has. Trading at $57.32 with a dividend of $2.40, the yield is now at 4.2%, which is double the S&P 500 yield. Further, they are a dividend aristocrat with a current payout ratio of ~65-67%. I don't anticipate high dividend growth in 2021, but could resume back to better growth in 2022.

Chubb (NYSE:CB): Now trading at ~$118, Chubb is down from the mid-$160s in the earlier part of the year. Chub is also a dividend aristocrat, which almost automatically puts them as one of the stocks to buy in the post-pandemic world. Chubb's payout ratio is in the low 30%, based on earnings in 2020 and drops even further into the upper 20%, based on forward earnings in 2021. Lastly, they just announced a 4% increase, not too shabby. A fairly safe and growing dividend here.

Banking

Banking has led the funding spree for the Small Business Administration (SBA) and their Paycheck Protection Program (PPP) loans. Further, banks are receiving mass deposits from the Treasury with the Economic Impact Payments (EIP). You know - those $1,200+ checks that the US population was receiving. The loans had to come from somewhere and the deposits had to go somewhere. Therefore, banks are sitting on more deposits than ever and continue to fuel the economy as the money center. Banks, who were beaten down, are showing significant signs of undervaluation, such as:

JPMorgan Chase (NYSE:JPM): JPMorgan is trading at ~$89 with a yield of now over 4%, with that $3.60 dividend. Given the pandemic, earnings will be difficult in 2020; However, I believe their dividend is fairly safe. In addition, analysts are expecting $8.74 in earnings for 2021, providing a payout ratio around 41%.

KeyCorp (NYSE:KEY): Key is now trading at $10.74 and pays a dividend of $0.74 per year. Therefore, that yield has swelled to almost 7%! Now, similarly, analysts expect earnings in 2021 to go back to $1.38 for a payout ratio of 54%. Higher yield, no doubt, but I don't anticipate steep dividend growth by any means.

People's United (NASDAQ:PBCT): The dividend aristocrat that both Bert and I have been acquiring. Currently trading at $10.86 with a dividend of $0.72 on the year, they are in the same boat as the other two banks mentioned above. Their 2021 earnings are projected to be back up, in the $1.12 range, bringing the payout ratio to 64%, the highest of the 3. Further, this is the smallest of the three banks. PBCT currently yields 6.62%.

Stocks to buy Summary points

As a dividend investor, I believe we are set up better than others. For the most part, dividends have continually been paid. That is not to see I had my share of dividend cuts that I experienced, but the sting was minimal. You want boring, fundamentally sound and easy-to- understand companies on your portfolio during uncertain times.

That is what this list is. The stocks mentioned above should deserve consideration to be on your list of stocks to buy now and going forward. They are all built on businesses that generate significant amount of steady cash flows.

Additional examples could include - want to back up your photos and videos to the cloud, now that you blog and vlog at home? Do you need a secure operating system that is protected against threats and viruses, as well as has the telecommunications infrastructure to video conference securely? Technology doesn't have to be exciting and the three companies of Cisco, IBM and Microsoft are names that offer services built for now and the future.

Relating to insurance, I don't see cars, homes, apartments, health, etc. going anywhere. These are the categories that relate to insurance. Insurance companies performed so well - they were sending checks back, due to reduced claims and expenses on their end. Further, most have built significant moats with their payout ratio.

Then there is banking. Markets need financial institutions for liquidity and the banking arena is the heart of the Small Business Administration (SBA) programs. From easy ATM access, applications to move money from person to person and place to place, banks have the infrastructure to stay. Banks have been around for hundreds of years and there's no question, they will be around after this, which is why they deserve a spot on your list of stocks to buy.

Lastly, the stocks to buy, listed above, appear to have undervalued characteristics in this uncertain market, which would be the only reason why I am talking about them!

Stocks to buy conclusion

If you are unsure where to go, hopefully this article showcased industries and stocks to consider during this unprecedented time. There are many other companies out there, but I wanted to showcase stocks that met the Dividend Diplomat Stock Screener metrics and show potential signs of being undervalued.

If you need help on how we screen for undervalued dividend stocks, look no further and see our Dividend Diplomat Stock Screener in action.

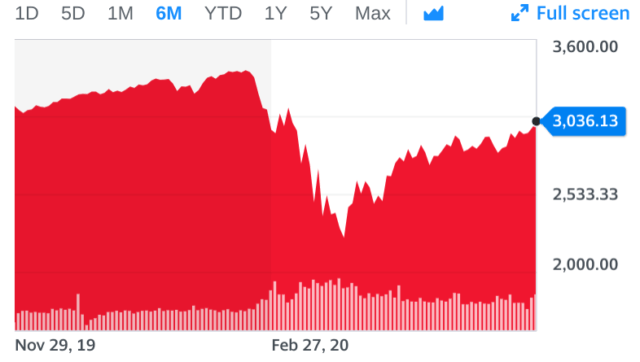

Lastly, stay strong out there. The stock market has always come back from difficult times like these and if this chart below doesn't give you any encouragement, hopefully the dividends that companies pay you will!

Based on your review of the article, if there are any questions you have, leave a comment below. We look forward to assisting as best as we can!

- Lanny

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.