Generating Alpha Using CEFs

by ADS AnalyticsSummary

- With volatility subsiding across financial markets CEF investors may be turning to other ways to generate returns over and above their beta exposure.

- We discuss four ways to generate alpha in CEFs: term funds, relative value switches, co-investing with activists and rotating between ETFs and CEFs.

- In the current environment, we find term fund and relative value opportunities most appealing.

- We highlight a number of opportunities in FIV and PFN over PCN.

The volatility in the CEF market has been enormous over the last few weeks, so many CEF investors have done well just by managing to hang on to their holdings and picking up a few bargains in the process. Now that market volatility has largely subsided, income investors can finally take a deep breath and think about longer-term sources of return. In this article, we review four types of additional sources of return above and beyond the beta of their existing portfolio holdings.

Our main takeaway is that in the current environment, we see most alpha potential in relative value opportunities and term funds. We highlight the First Trust Senior Floating Rate 2022 Target Term Fund (FIV) as an attractive pick in term funds as well as the PIMCO Income Strategy Fund II (PFN) as the relative value pick over the Corporate & Income Strategy Fund (PCN).

1. Term Funds

We covered term funds in more detail here. In relation to their more numerous perpetual funds, term and target term CEFs have a number of pros and cons, so they often suit different investment styles.

On the con side, term funds present a few additional risks. First is the possibility that the fund extends or cancels its termination date, as has happened a number of times. This may lead to a widening in the discount and price weakness. Secondly, term funds that go ahead and terminate are likely to deleverage and reduce risk into the termination, which will dampen earnings. And thirdly, funds in the process of termination may need to sell down some or all of their portfolio in the secondary market taking on the prevailing bid/offer spread. This risk is real but it is often overblown, as we have seen funds holding very illiquid assets terminate without taking on any undue cost that is observable in the NAV.

In addition to the risks, term funds provide certain benefits. In particular, the term fund structure of the fund provides two kinds of risk management. First, the fund's discount should be constrained by the termination date, which provides an anchor of zero. In practice, this means that the fund's price should outperform perpetual funds during drawdowns, all else equal. In an earlier article, we showed how the drawdowns of term funds were much more restrained in March. Secondly, term funds typically hold assets with lower duration, which makes them more resilient during drawdowns.

The most important benefit of term funds in the context of this article is the fact that they can provide a return tailwind if they are trading at a discount. For example, a term fund two years away from termination trading at a 4% discount will provide a 2% per annum return boost net of price moves as a result of its discount compression towards zero on the day of termination.

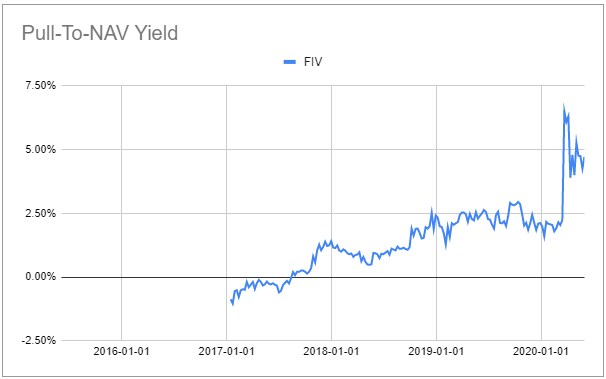

We recently introduced a new term CEF metric on the service which gets to the heart of alpha-generation in CEFs. This is the historic pull-to-NAV yield, which is an analogue of a pull-to-par concept for bonds. It is basically the current fund discount divided by the number of years to its termination, and is a measure of the additional yield an investor in the fund enjoys through the discount moving towards zero on the termination date. It's not a perfect analogue to pull-to-par, since the term date can sometimes be extended or even cancelled. However, used appropriately, it provides a very good estimate of additional performance.

Source: Systematic Income Investor CEF Tool

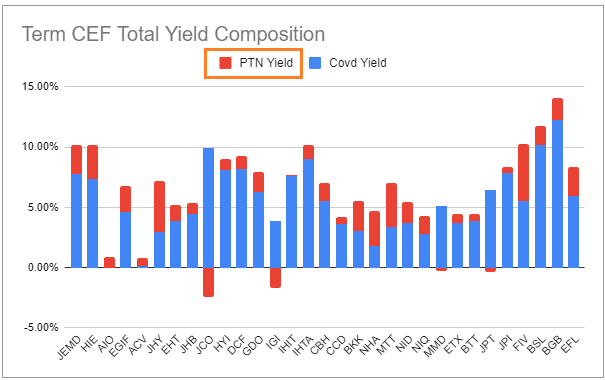

We calculate this metric across all term CEFs. The highest pull-to-NAV yield does not mean the fund automatically ends up on our Focus List, however. Instead, we evaluate this metric in relation to the quality of the underlying portfolio.

Source: Systematic Income Investor CEF Tool

We currently feature 5 term CEFs on our Focus List, more than perpetual CEFs. This is for two main reasons. First, it reflects our cautious stance in the current market after the huge run-up we have seen across various asset classes. And secondly, it is because we still find the level of pull-to-NAV yield very attractive.

The fund with the highest pull-to-NAV yield on the Focus List is FIV. It closed Tuesday at a 7.9% discount and a 3% current yield with a 4.73% pull-to-NAV yield. Part of the reason FIV has maintained a wide discount for a term fund is because of its low current yield, which hides the fact that its earnings yield is actually well above 5%. The fund's leverage is around 27%, so it is still kicking off a healthy amount of income. It is also a higher-quality choice in the Loan sector, with nearly 50% of the portfolio allocated to the BBB/BB rating buckets vs. just 29% sector average. All in all, for the underlying risk, the fund's all-in yield (earnings yield + pull-to-NAV yield) of over 10% is very attractive.

2. Relative Value

We discussed our approach to relative value in CEFs in more depth here. In brief, the reason why relative value or rotation opportunities work so well in the CEF space is that many CEFs, particularly those managed by the same fund company, run very similar portfolios. However, for technical reasons, the discounts of these funds can oscillate widely relative to each other.

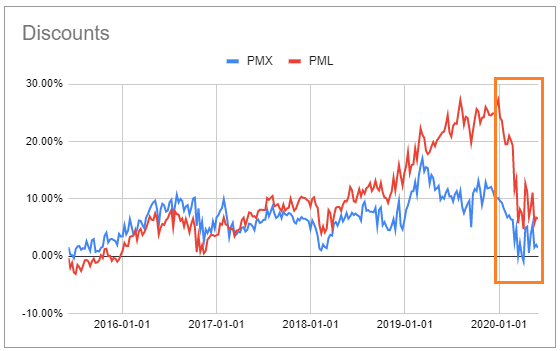

One of the more obvious pairs that we have highlighted in the early part of the year was the pair of the PIMCO Municipal Income Fund III (PMX) and the PIMCO Municipal Income Fund II (PML). The discount spread between these two funds approached 20%, which didn't make sense to us based on the underlying characteristics of the two funds. Since then, we have seen a steady narrowing of the spread to what is a more reasonable level.

Source: Systematic Income Investor CEF Tool

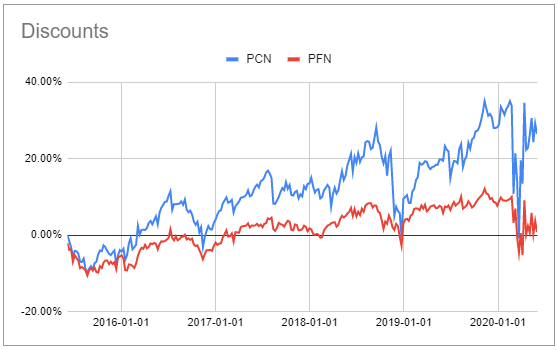

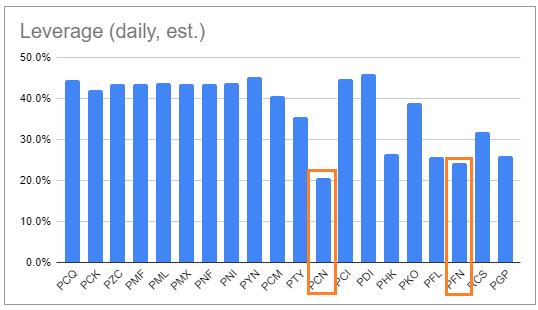

Another PIMCO pair we are keeping an eye on is PCN and PFN.

Source: Systematic Income Investor CEF Tool

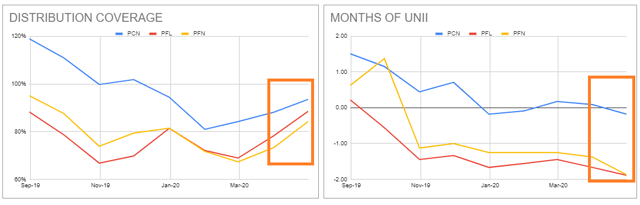

Recently we have seen sharper deleveraging in PCN than in PFN, so that PFN now carries significantly higher leverage.

Source: Systematic Income Investor CEF Tool

This means that the distribution coverage and UNII gap between the two funds should start to close, which appears to be already happening, based on April figures. This should be a prelude to discount compression between the two funds and the outperformance of PFN over PCN.

Source: Systematic Income Investor CEF Tool

3. Activist Pressure

We discussed CEF activists in more detail in this article. In short, activist investors try to influence CEF boards through efforts like electing board members and proxy battles to carry out various shareholder-friendly activities such as share buybacks, fund liquidation, tender offers and others. This is all done with the express purpose of fund price appreciation, typically through discount tightening.

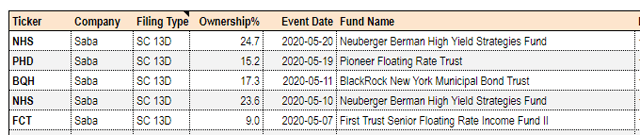

Activist funds initiate their battles by acquiring a sizable portion of the fund in order to exercise a meaningful vote. Because sizable fund holders need to disclose their positions, investors can follow the activities of activist funds through various SEC filings.

Saba is probably the most active, so to speak, of the activists. Below is a list of their 13D/G filings in May.

Source: Systematic Income Investor CEF Tool

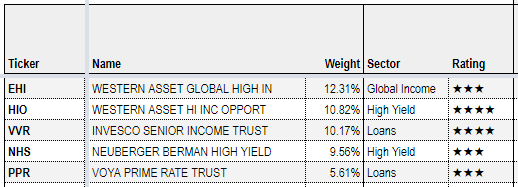

Keeping an eye on Saba can also be done through the holdings of their Closed-End Funds ETF (CEFS). Their top two holdings are related to their well-publicized battle with Western Asset / Legg Mason.

Source: Systematic Income Investor CEF Tool

Investors can piggyback on activist positions to ride out the battle. However, just because an activist is involved in a CEF does not necessarily make it a slam dunk for the simple reason that the activist may not succeed or they may bail out of the fund if they have already gained a decent return rather than stick it out to the bitter end.

The way we like to use activist positions is to marry them with funds where we already have conviction. At the moment, there are no obvious choices which we like. For instance, the largest position in CEFs is the Western Asset Global High Income Fund (EHI). The fund closed Friday at a 5.2% discount, which was at the 99th percentile. Secondly, the fund holds a third of its portfolio in single-B and CCC-rated securities, which are not exactly risk-free. Some of the largest positions are in Russian-ruble denominated Russian government bonds, Indonesian USD-denominated bonds, Petrobras bonds and others. The 5% of upside for this type of exposure is not an obvious risk/reward. Furthermore, the 5% upside is really the ceiling of the alpha opportunity, since we really need to probability-weigh it, as it is not guaranteed that Saba will succeed.

4. ETF / CEF Rotation

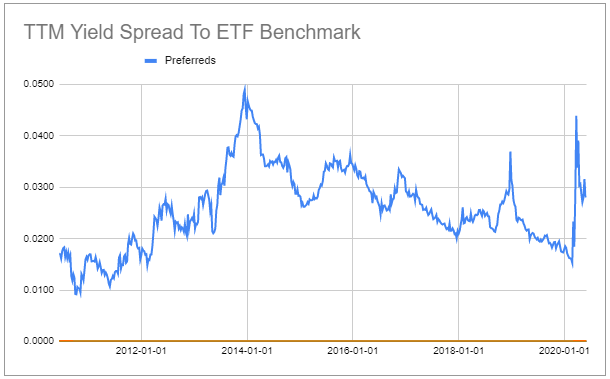

Finally, investors can rotate between CEFs and ETFs of the same sector based on yield differential and CEF discount valuation.

As an example, coming into the recent drawdown, CEF sectors offered historically low levels of additional yield over and above sector ETF benchmarks. This was due to the combination of high leverage costs as a result of higher short-term rates and also tight discounts.

Source: Systematic Income Investor CEF Tool

This offered a good reason for CEF investors to rotate into ETFs, as the opportunity cost of not being in CEFs was very low. Since then, the yield differential has moved higher, driven by both decreasing leverage costs and lower asset prices. Over the coming months, particularly if the economic recovery continues, we expect further tightening in the yield differential between CEFs and ETFs, offering further opportunity for investors to start reallocating back to ETFs.

Conclusion

With financial market volatility back to reasonable levels, CEF investors may be thinking about other opportunities besides the beta provided by their portfolios. We discuss four types of ways CEF investors can add alpha to their portfolios. In the current environment, we see most alpha potential in relative value opportunities and term funds.

Check out Systematic Income and explore the best of the fund, preferred and baby bond markets with our powerful interactive investor tools.

Identify the most attractive CEFs and track the entire market with our evidence-based bespoke metrics. Pick up the best preferred stocks and baby bonds that fit your criteria.

Get investment ideas and sector views from our Strategic Allocation Framework and Income Focus List.

Check us out on a no-risk basis - sign up for a 2-week free trial!

Disclosure: I am/we are long FIV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.