Boost explains why eWallet to bank account transfers have been discontinued

by Alexander WongBoost had recently performed a major upgrade which offers users a larger eWallet size of up to RM4,999. However, its previous feature which allows users to cash out their eWallet credit to bank accounts has been discontinued since 18th of May.

Understandably, some users were disappointed about the change and Boost has shared with us an official statement on the reasons behind its decision.

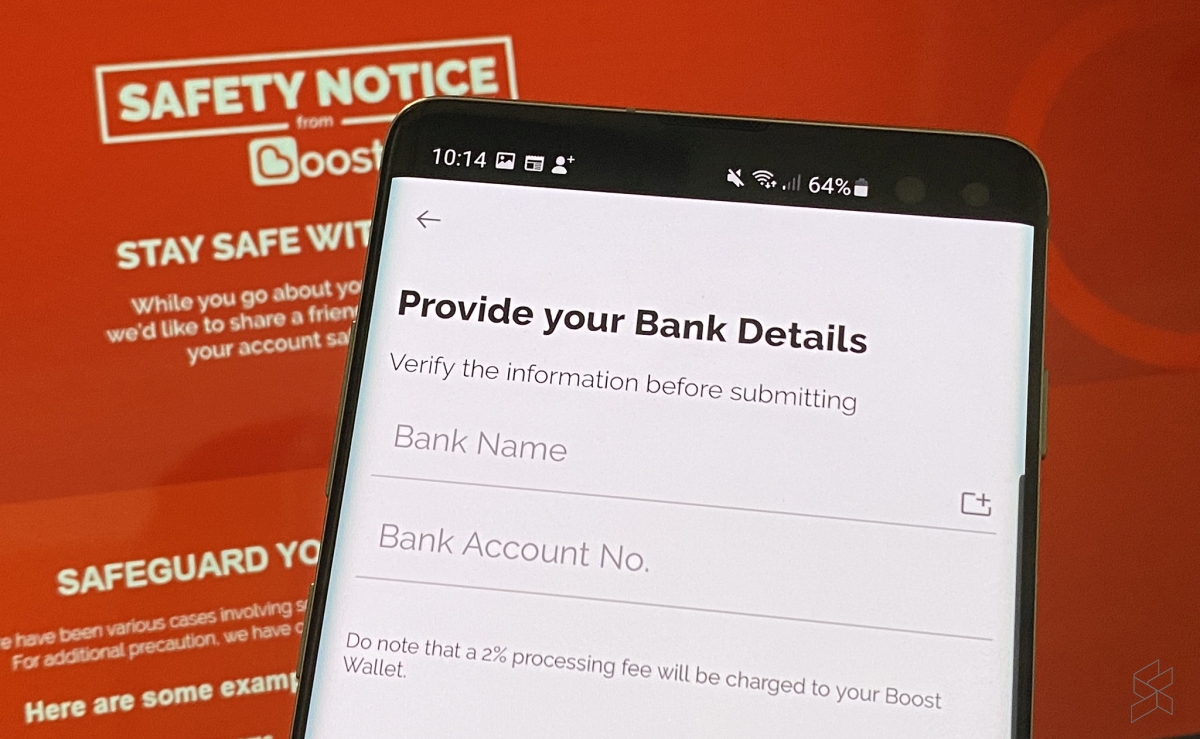

Essentially, the key justification for disabling cash out is user safety and they anticipate a possible rise in fraud and scam cases. Although Boost has its own safety measures in place, the latest update will prevent scammers from transferring users’ money to an external bank account in the event users are tricked into sharing their account details and One Time Password (OTP).

However, it is worth pointing out that Premium Wallet users are still allowed to transfer funds to another Boost eWallet user, but not having the option to cash out to bank account should be a major deterrent.

Below is Boost’s statement in full:

With the Movement Control Order (MCO) and now ongoing Conditional Movement Control Order (CMCO), many users have adopted online shopping to avoid going out into large crowds. While this is a safer way to transact, Boost is pre-empting the possible rise in fraud and scam cases.

User safety is Boost’s main priority and to protect users, both the new Basic and Premium wallets do not allow the transfer of e-wallet balances into bank accounts. This is a safety precaution built into the wallet to protect users from fraudsters and scammers who prey on e-wallet users in the past. With this new security measure in place, even if a scammer manages to trick users into revealing their account details, they would not be able to transfer out and steal their victim’s money.

You’ve probably heard about Boost scams where users would receive messages or ads claiming that they’ve won RM8,888. Unfortunately, there are victims that lose money through these phishing tactics and you can check how it’s done in the video below:

Boost has issued several notices and reminders about attempts to steal your personal information. Apart from sending links to fake boost websites through SMS, WhatsApp and email, some scammers even call up customers pretending to be Boost representative.

As a rule of thumb, no provider including banks and eWallets will ask for your password, pin number and the One-Time-Password (OTP). Do not click on any links that are sent from people you don’t know and always refer to the official websites or social channels for the latest updates.

If someone asks for sensitive information that only you should know, it is a clear sign that it is a scam. The OTP is a crucial safeguard against scammers and if you share that with someone else, it is your own negligence. It’s like passing your house keys to a total stranger.

To find out how to keep your account safe, you can refer to Boost’s safety notice here.