The Time For The Soybean Bull Market Has Not Come Yet

by Oleh KombaievSummary

- The current soybean futures price is at the minimum of its five-year range.

- The first USDA forecast allows us to hope that the U.S. soybean ending stocks will decline this season for the first time in many years.

- Funds sell and this puts pressure on the market.

Instrument

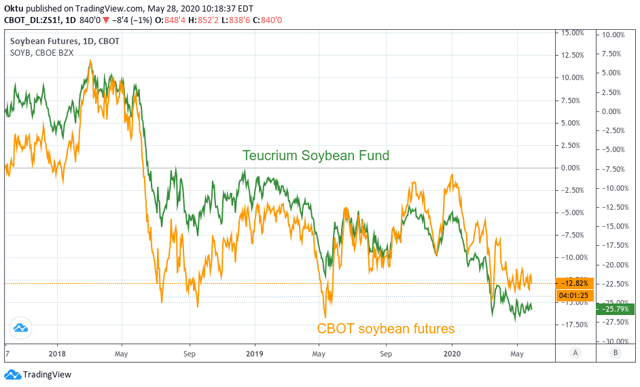

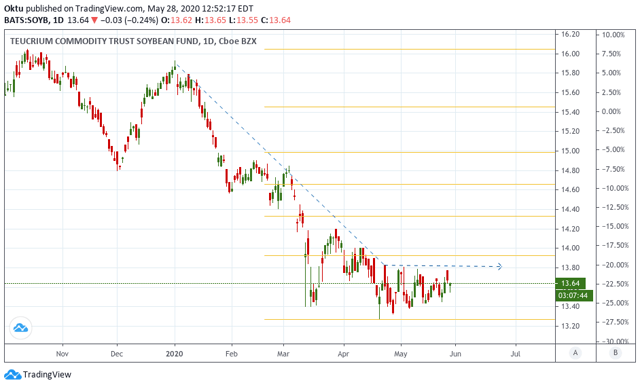

The Teucrium Soybean Fund (NYSEARCA:SOYB) provides investors unleveraged direct exposure to soybeans without the need for a futures account. Therefore, the decision to invest in this fund should be made after analyzing the soybean market.

Seasonality

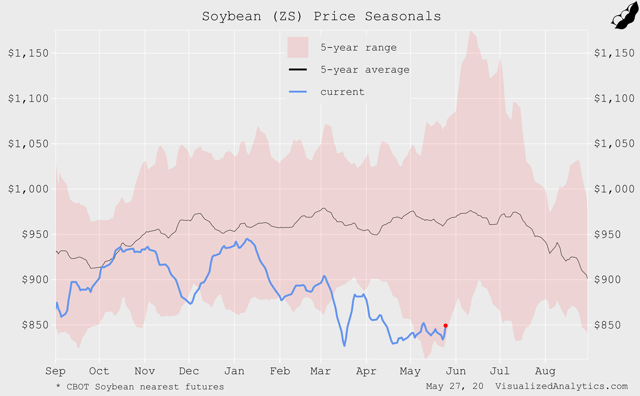

The current soybean futures price is at the minimum of its five-year range. Whatever you say, but technically, soy is now very cheap.

Soybean-Corn Spread

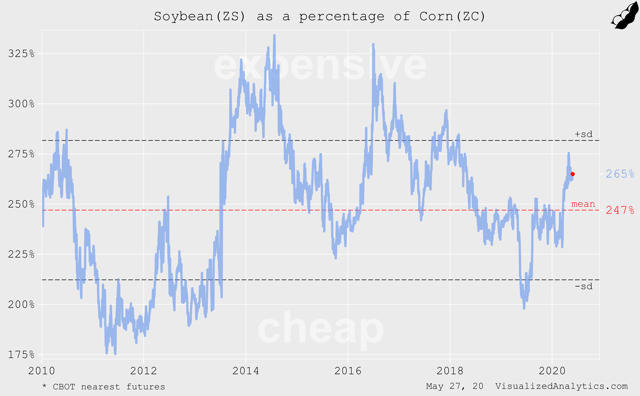

The price of soybean is currently more or less balanced relative to the price of corn:

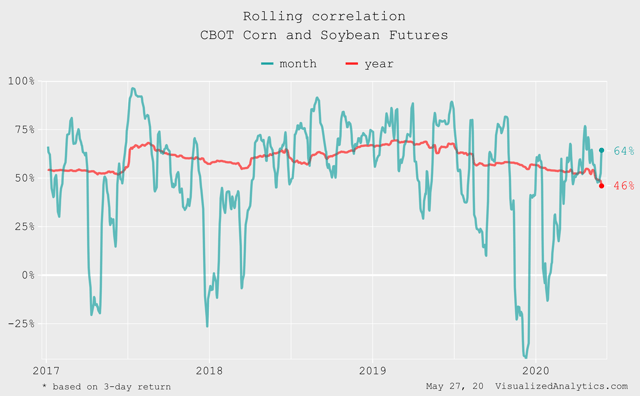

By the way, now there is a strong correlation between soy and corn:

In my opinion, the corn market is no longer bearish. Partially, this sensation is transmitted to the soybean market.

Supply and Demand

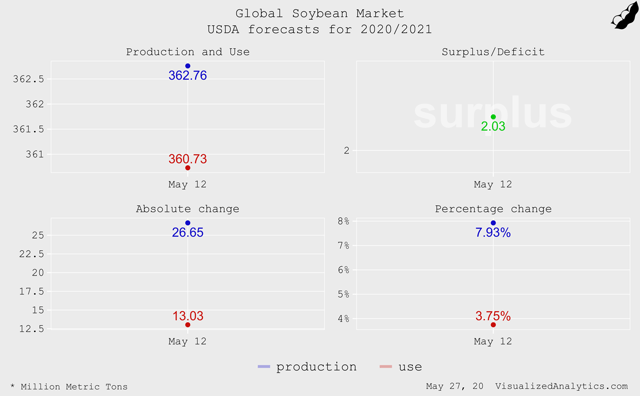

Overall, the first USDA forecast for 2020/21 was moderately bullish for the soybean market.

The global soybean ending stocks in the new season slightly decreased by 1.88 million tons to the level of 98.39 million tons:

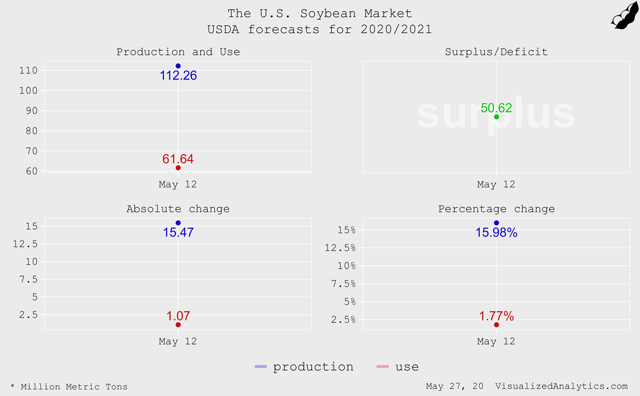

The U.S. soybean production in 20/21 will amount to 112.26 million tons (+15.98%) and the consumption will reach 61.64 million tons (+1.77%). But, the export forecast was increased to 55.79 million tons (+22.37%).

With higher global soybean import demand for 2020/21 led by expected gains for China, U.S. export share is expected to rise to 34 percent from the 2019/20 record low of 30 percent... USDA comment

As a result, the forecast of the U.S. ending stocks was decreased by 4.73 million tons to the level of 11.03 million tons.

The first USDA forecast allows us to hope that the U.S. soybean ending stocks will decline this season for the first time in many years.

Fundamental Price

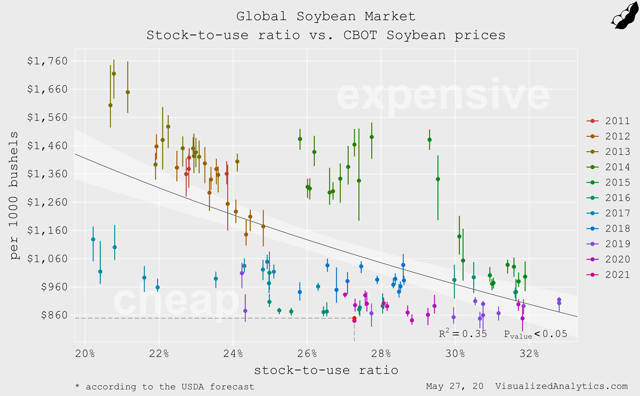

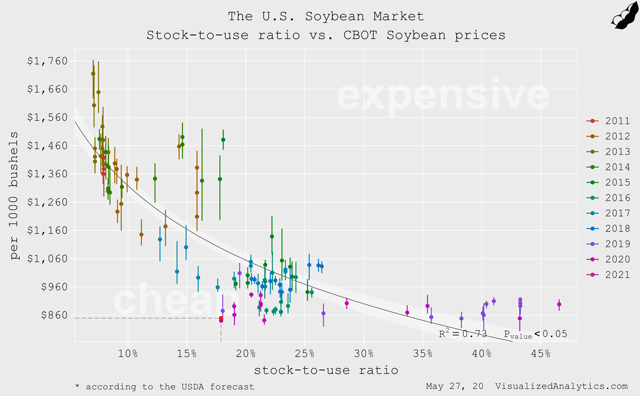

In the soybean market, as a commodity market, the price is formed on the basis of the balance between supply and demand. One of the key markers of this balance is the stock-to-use ratio. Therefore, in the long run, there is the relationship between the values of the stock-to-use ratio and the average price of the soybean futures.

Considering the stock-to-use ratio of the global soybean market, one can say that the price of CBOT soybean futures is undervalued:

The same conclusion holds true for the U.S. soybean market. In the next model, the price should increase by 20% in order to achieve the balanced state.

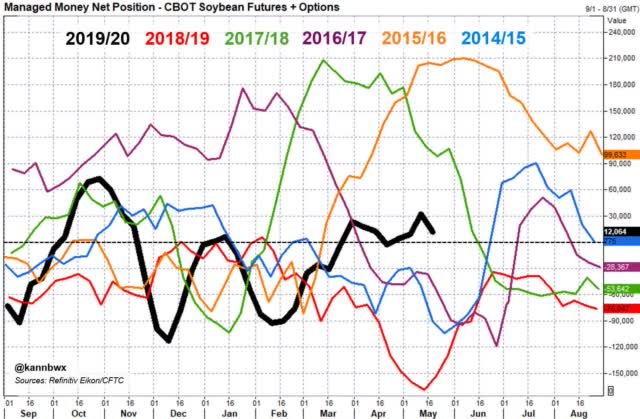

Funds

Over the last week, the money managers’ net long position in soybean fell by 20,401 (-63%) contracts, amounting to 12,064 contracts. Funds sell and this puts pressure on the market. This cannot be ignored.

Bottom line

As shown, fundamentally, the soybean market is undervalued. But the growing tension between the USA and China is preventing the soybean market from returning to normal. There is concern that the so-called first part of the US-China trade deal will be canceled. The actions of the funds confirm the seriousness of the situation.

I think we need to wait. The time for the soybean bull market has probably not come yet.

Under such conditions, in my opinion, the SOYB ETF will demonstrate a sideways dynamic in the near term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.