Manufacturers' New Orders Posted Widespread Declines In April

by American Institute of Economic ResearchSummary

- New orders for durable goods plunged 17.2 percent in April following a 16.6 percent tumble in March.

- New orders for nondefense capital goods excluding aircraft, a proxy for business investment, fell 5.8 percent in April following a drop of 1.1 percent in March.

- Extraordinarily weak economic reports are likely to continue over the next several months, but as government restrictions are eased, signs of healing are likely to emerge.

By Robert Hughes

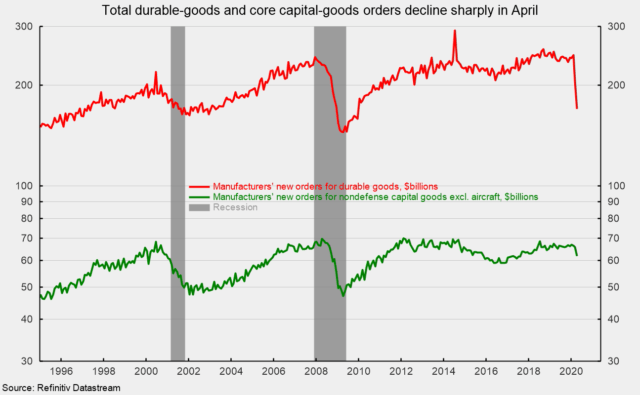

New orders for durable goods plunged 17.2 percent in April following a 16.6 percent tumble in March. If transportation equipment is excluded, new orders for durable goods decreased 7.4 percent in April following a 1.7 percent fall in March. Durable-goods orders had been holding above the $200 billion level since March 2011 before posting sharp declines in March and April (see first chart).

New orders for nondefense capital goods excluding aircraft, a proxy for business investment, fell 5.8 percent in April following a drop of 1.1 percent in March. This key category had been trending flat since mid-2018, hovering in the $65 to $70 billion range. The $61.9 billion pace for April is the slowest since August 2017 (see first chart).

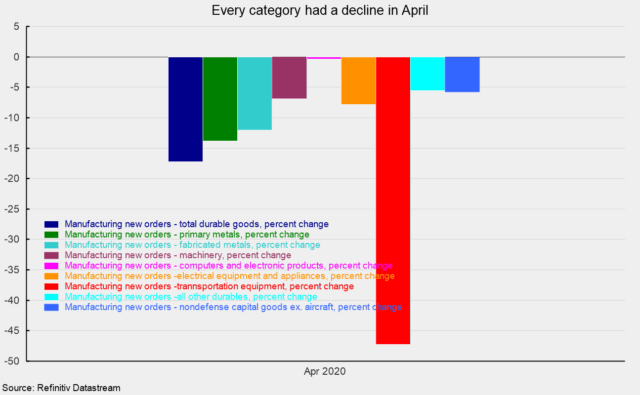

The results for the categories of durable goods shown in the report were all on the negative side in the latest month. Among the individual categories, primary metals fell 13.8 percent, fabricated metal products declined 12.0 percent, machinery orders were off 6.8 percent, computers and electronic products decreased 0.3 percent, electrical equipment and appliances dropped 7.8 percent, transportation equipment orders sank 47.3 percent, and the catch-all "other durables" category was off 5.6 percent (see second chart).

Within the transportation category, motor vehicles were down 52.8 percent while defense aircraft orders fell 32.7 percent. Nondefense aircraft orders were negative for a second month, totaling -$8.5 billion in April following a -$16.0 billion in March. Negative new orders represent cancellation of previously placed orders.

The report on durable-goods orders reflects the broadening impact of shutdown policies implemented in reaction to the outbreak of COVID-19. Despite massive government spending and extraordinary monetary policy efforts, the longest economic expansion in U.S. history has ended abruptly. Extraordinarily weak economic reports are likely to continue over the next several months, but as government restrictions are eased, signs of healing are likely to emerge.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.