When are the Eurozone Preliminary CPIs and how could they affect EUR/USD?

by Dhwani MehtaEurozone Preliminary CPIs overview

Eurostat will publish the first estimate of Eurozone inflation figures for May at 0900 GMT this Friday.

The headline CPI is anticipated to come in softer at 0.2% YoY while the core inflation is seen lower at 0.8% YoY during the reported month.

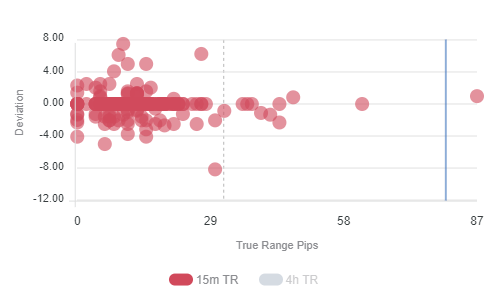

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 5 and 30 pips in deviations up to 4 to -4, although in some cases, if notable enough, a deviation can fuel movements of up to 45-50 pips.

How could affect EUR/USD?

Yohay Elam, FXStreet's own Senior Analyst, offers important technical levels ahead of the key release: “Support awaits at 1.1090, which was a peak in the winter, and it is followed by 1.1050, also a battle line. Further down, the former peak of 1.1010 now turns into support. It is followed by 1.0975, a swing high, and then by 1.0940 and 1.0895.”

“Some resistance is at 1.1111, which is 0.90 on USD/EUR, followed by the late-March peak of 1.1150. Further above, 1.12 and 1.240 are in play,” Yohay adds.

Key notes

Breaking: EUR/USD breaks above 1.1100, first time since end-March

EUR/USD: Busted through the 200-day ma scope for the 1.1240 December high – Commerzbank

Eurozone Inflation Preview: Only a dual dip could bring EUR/USD down

About Eurozone Preliminary CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).