Weekly Sentiment Indicators Improving

by Bespoke Investment GroupSummary

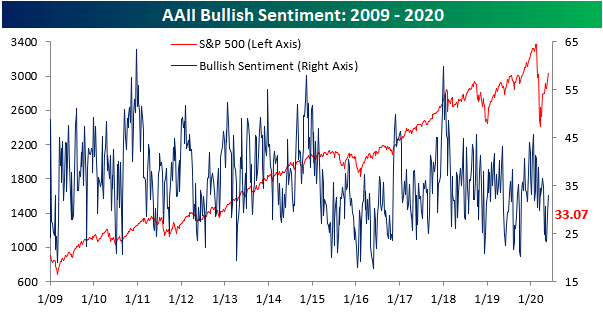

- 33.07% of respondents in AAII's weekly sentiment survey reported as bullish this week, up from 29% last week.

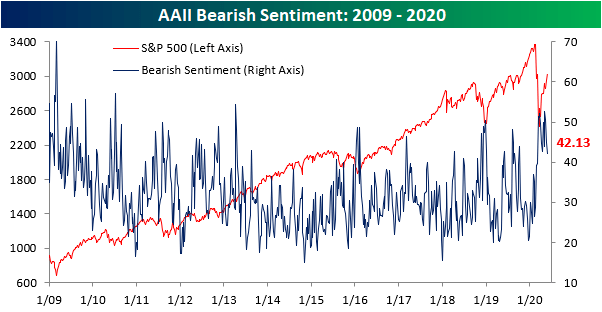

- After the 1.17-percentage point decline to 42.13% this week, the survey is reading the lowest level of bearish sentiment since mid-April.

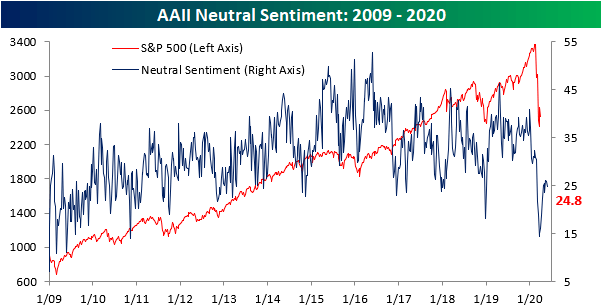

- Neutral sentiment fell for a second week in a row, currently at 24.8%.

Investors and newsletter writers are finally seeming to be convinced by the rally, as the S&P 500 has retaken its 200-DMA over the past week. 33.07% of respondents in AAII's weekly sentiment survey reported as bullish this week. That is up from 29% last week and the highest level of bullish sentiment since April 16th, when it reached 34.86%.

As for bearish sentiment, after the 1.17-percentage point decline to 42.13% this week, AAII's survey is reading the lowest level of bearish sentiment since mid-April. This week was the third consecutive week with bearish sentiment declining, but despite that, it is still fairly elevated. In fact, this week marked the twelfth consecutive week in which bearish sentiment was at least one standard deviation above its historical average (30.48%). That is the longest such streak since a 14-week long streak in 2008.

Finally, neutral sentiment in the AAII survey fell for a second week in a row. Currently at 24.8%, it remains at a much lower level than has been the norm for the past several years (over the past decade, it has averaged a reading of 33.76%) but also well off of its late-March low of 14.5%.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.