Commentary: Embattled China knows its national priority is the economy

by Bert HofmanNotwithstanding controversy over a Hong Kong security law and brewing tensions with the US, proceedings at the National People’s Congress and Chinese People’s Political Consultative Conferences clearly signal China’s focus on the economy, says East Asian Institute’s Bert Hofman.

SINGAPORE: China faces a raft of challenges, including rising tensions with the US, a backlash to the national security law and more.

Yet developments last week suggest the country has not lost sight of its chief national priority: Keeping the economy going.

After a more-than-two months delay due to the COVID-19 epidemic, China held its highly anticipated advisory Chinese People's Political Consultative Conference (CPPCC) and the National People’s Congress (NPC), the highest formal political organ of the People’s Republic of China.

These meetings were held in exceptional circumstances this year, as the country struggles to recover from the outbreak, and most of the rest of the world is still fighting the virus.

Just keeping 5,000 delegates gathered in the monumental Great Hall of the People at Tiananmen Square healthy and safe is a herculean task.

The NPC session kicked off with a moment of silence to remember the victims of COVID-19 in an important display of public mourning.

LISTEN: Why lifting lockdowns and easing restrictions may be the biggest COVID-19 test facing countries

READ: Commentary: Malaysia succeeded in suppressing COVID-19 but here comes the harder part

But the main topic discussed was undoubtedly economic policy.

This was reflected in the key reports presented at the sessions: The Government’s Work Report by Premier Li Keqiang, the Planning Speech by the Minister-in-charge of the National Development and Reform Commission He Lifeng, and the Budget Speech by Finance Minister Liu Kun.

NO GROWTH TARGETS

Remarkably, for the first time since 1994 when it started publishing annual growth targets, the Chinese government did not set an explicit growth target for 2020.

This was a wise choice, after the historically low 6.8 per cent year-on-year decline in GDP in the first quarter, and given the high level of uncertainty regarding the trajectory of the pandemic.

Many had argued a target could press local governments to action.

This year is also the crucial last lap of China’s decade-long goal of doubling its GDP in the 2010s to achieve the vision of arriving as a “moderately prosperous society”.

Yet the Chinese government wisely opted out, probably calculating that coronavirus containment measures made this unachievable. Holding on to an overly ambitious target would have shot macroeconomic policies into overdrive.

READ: Commentary: How Wuhan mobilised to survive an over-70 day COVID-19 lockdown - and bounced back

READ: Commentary: China billionaires a force to be reckoned with in global COVID-19 fight - and more

Implicitly, though, there still is a growth assumption hidden in the reports presented. As Wang Tao of UBS has pointed out, if one looks carefully at budget numbers and the inflation target of 3.5 per cent, the government assumes real GDP growth to be in the order of 1.8 per cent.

This is a feasible target, notwithstanding large uncertainties, and the challenge that China would have to outstrip the IMF’s projection of 1.3 per cent, which is close to the recent consensus forecast of investment banks of 1.35 per cent.

But a 2 per cent growth may be a stretch, when it requires reverting to 6 per cent growth in the second half of the year, pending second quarter estimates.

A MODEST STIMULUS

The stimulus implied by the government’s speech, though larger than announced earlier in the year, still seems modest compared to what China staged after the global financial crisis.

One caveat is China’s fiscal accounts are complex, and estimating an overall consolidated deficit number is challenging, but this looks to be in the order of 10.5 per cent of GDP.

In terms of stimulus, the deficit would be some 5 percentage points more than last year’s deficit, and considerably smaller than the global financial crisis stimulus at 12 per cent of GDP over two years.

A 10 per cent deficit is also less than projected for the US (15.5 per cent of GDP) and some EU economies at this stage.

Then again, China has emerged from the epidemic with less damage than most economies, so a smaller stimulus may well be called for.

READ: Commentary: Life in China after COVID-19 lockdown gives normal new meaning

READ: Commentary: Even China is sticking to a semi-formal lockdown

Much of the economic stimulus may come from the monetary side. Though Premier Li promised to pursue “prudent policy in a more flexible way” the emphasis is on flexible. Total social financing, a measure of all credit in the economy, is to grow at least as much as last year, which, in an economy with less growth, means looser monetary policy.

If it turns out that the economy needs more of a boost, China can always add another later in the year, something Premier Li implied in his speech.

THE YEAR CHINA AIMS TO REDUCE POVERTY AND KEEP UNEMPLOYMENT LOW

For China, this is not the year of growth, but of poverty reduction. Economic growth was mentioned 16 times in Premier Li’s speech, but poverty came up some 23 times. Stability (10) and security (six) were frequently mentioned too.

Concretely, China aims to keep urban unemployment below 6 per cent and create 9 million new jobs.

However, with growth in the order of 2 per cent, the target for new jobs may be a stretch. If it took 6 per cent growth to create 13.5 million jobs, 2 per cent growth would create something in the order of 4.5 million jobs.

China also faces an uphill challenge in battling unemployment. Many migrants have lost their jobs during the sharp downturn in the first quarter, with some 50 to 100 million looking to return to their old job or find new ones.

China’s maintained goal of eliminate extreme poverty this year will not be easy. Even before COVID-19, some 10 million people were already living in extreme poverty.

READ: Commentary: Restarting the economy in a COVID-19 world sure is hard. China would know

READ: Commentary: Can countries sue China for COVID-19? Should they?

There are plans to expand social welfare payments and rural pensions, which is a good move. These payments have been minimal and are the programmes that would sustain China’s poverty reduction in the medium term.

The policy also has the added benefit of promoting consumption. Recipients, poor as they are, are likely to spend aid.

The central government has dedicated a special social welfare programme spending transfer to local governments, but the challenge is to target and reach those in need.

NEW INFRASTRUCTURE INVESTMENTS

Infrastructure spending will still play a role in the stimulus, but is far less prominent in China’s plans compared to the global financial crisis stimulus, when China’s expansion of its highways, railway and cities led growth and drove up commodity prices around the world.

This time, “new” infrastructure will take centre-stage including investments in 5G networks, charging stations for electrical cars, cloud computing and the like, with a good part of the 3.75 trillion yuan (US$523 billion) in special local government bonds set aside for this purpose.

With COVID-19 wreaking havoc, the decisions to advance investments in this field will speed China ahead of the pack in industries identified as part of its Made in China 2025 plans.

By the end of the year, China aims to have 600,000 base stations for 5G, the backbone of the digital economy of the future.

NOT LETTING UP ON STRUCTURAL REFORMS

Finally, the government reconfirmed its commitment to structural reforms. Premier Li called for “energising market entities through reform and strengthening new drivers of growth” and listed a slew of structural reforms.

Noteworthy is the promised continued opening up of the economy and a trimming of the list of industries foreign enterprises cannot invest in.

While there has been past resistance, structural reforms perhaps stand a better chance when the going is tough. As they say: “Never waste a crisis.”

READ: Commentary: The new wave of Chinese tech champions you never heard of but should know

READ: Commentary: Alibaba makes a whopping US$28 billion bet on its next breakthrough act

THE HONG KONG SURPRISE

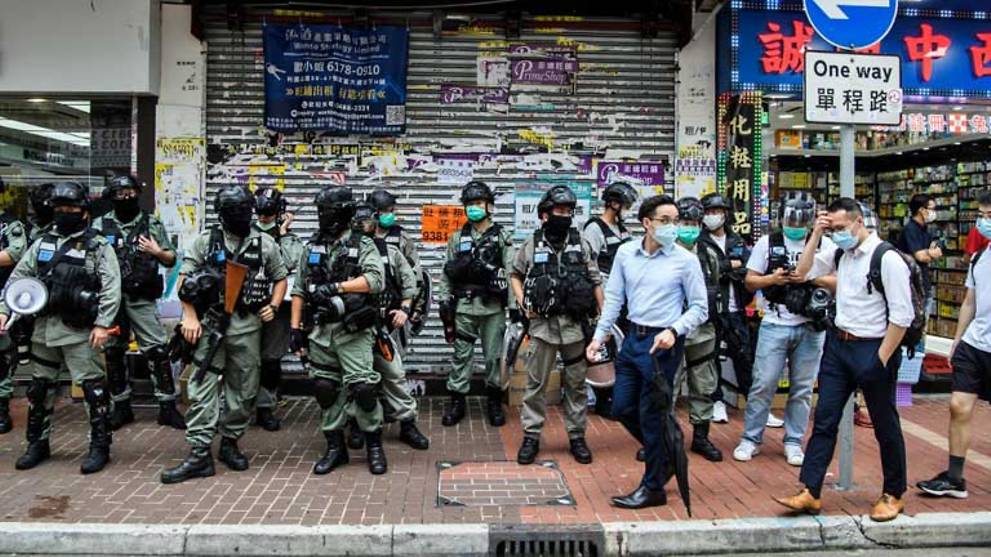

While China’s economic policy decisions were significant, it was the surprise proposal for a Hong Kong security law that grabbed headlines.

The controversial proposal also lobbed off some 7 per cent off Hong Kong’s stock market in the trading days after, as investors saw the bill as a threat to Hong Kong’s freedoms.

The news triggered street protests and concerns over Hong Kong’s autonomy under the “One Country Two Systems” formula.

United States politicians were quick to react to suggest the US could respond in several ways, including a withdrawal of Hong Kong’s status under the 1992 Hong Kong Policy Act, which gives the island special status in trade separate from that of the mainland.

This may be a bluff as doing so would also damage extensive US interests in the city, but the threat alone has cast a shadow over the city.

Already, Hong Kong’s economy has come under heavy fire arising from year-long street protests and coronavirus, with an 8.9 per cent first quarter contraction, the largest decline in four decades.

READ: Commentary: China's tensions could boost Hong Kong's stock exchange

READ: Commentary: Hong Kong will keep its chin up this COVID-19 outbreak and enjoy the small things

The NPC this week passed the bill, authorising the Standing Committee of the NPC to draft and pass the law later this year.

THE SINO-AMERICAN FIREWORKS

Unsurprisingly, brewing tensions with the US caused fireworks at the Two Sessions. Although Premier Li Keqiang assured China’s commitment to the trade deal, Foreign Minister Wang Yi accused the US of harbouring a Cold War mentality.

There has been a noticeable deterioration in US-China relations in recent weeks as the US administration stepped up anti-China rhetoric on the coronavirus origin and has tried to pin blame for the pandemic on China, including stoking accusations of the World Health Organisation being in China’s pocket.

Despite the Phase 1 trade agreement, the US has continued to tighten sanctions on Chinese companies, adding 33 organisations to its export blacklist for reasons of human rights violation and national security last week.

READ: Commentary: What's really behind the China coronavirus cover-up theory

Domestic sentiments have been whipped up, as calls for the US government to subsidise American companies to move out of China have grown.

Though some of this sabre-rattling is part of the Trump election campaign, it is increasingly likely that the US and China will accelerate their decoupling in the wake of COVID-19.

This is not just problematic for China and the US, but also for world trade and is likely to delay the global economic recovery after the pandemic.

But for now, China’s focus remains keeping its economy on an even keel, as it navigates its way through these troubled waters.

LISTEN: How Singapore businesses and workers can thrive in a post-pandemic new normal

BOOKMARK THIS: Our comprehensive coverage of the coronavirus outbreak and its developments

Download our app or subscribe to our Telegram channel for the latest updates on the COVID-19 outbreak: https://cna.asia/telegram

Bert Hofman is Director of the East Asian Institute at NUS.