TripAdvisor: Travel Rebound Play

by Stone Fox CapitalSummary

- TripAdvisor has permanently stripped out $65 million in operating expenses.

- Travel is starting to rebound as the CDC confirms COVID-19 pulled forward deaths of terminally ill patients.

- The stock only trades at 6.5x '19 EBITDA levels with potential upside now.

While the airlines are a great way to play a rebound in global travel, another opportunity is TripAdvisor (TRIP). The company was a cash-flow machine before the virus outbreak as the largest travel platform in the world with 463 million monthly users. The coronavirus crisis caused a near elimination of vacation travel, but the company is now poised for the rebound in travel and isn't as reliant on air travel that is still down nearly 90% from 2019 levels. The stock has already rebounded off the lows, but TripAdvisor might have potential upside as the bottom line improves coming out of the shutdown with a more efficient operation going forward.

Coming Back Stronger

On the Q1 earnings call, TripAdvisor made some interesting comments about coming back from the virus stronger than in the past. The company laid off 900 employees, or nearly 25% of the workforce, with no intention of rehiring those employees when business rebounds. Another 850 employees were furloughed with the intent of recalling those employees probably sooner rather than later.

Revenues were down 90% at one point in March, but business should be rebounding now. Air travel is already rebounding from a low below 5% of 2019 levels. In addition, most consumers are likely to drive for a vacation this summer which benefits TripAdvisor either way.

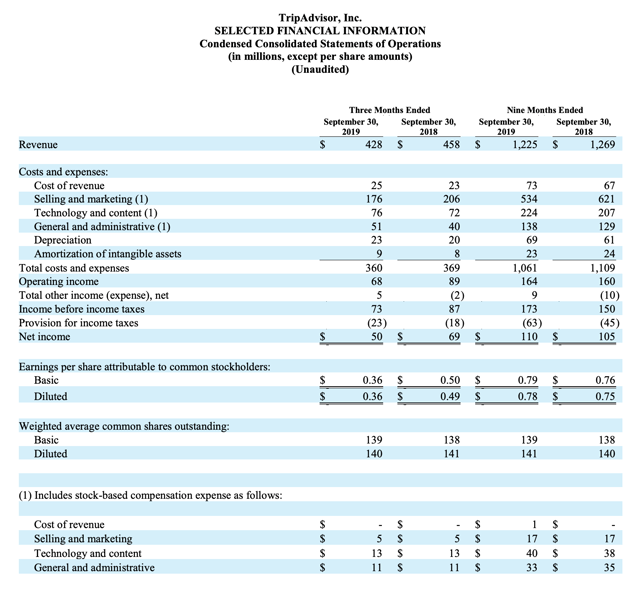

TripAdvisor forecasts a $65 million reduction in Q3 fixed operating costs while variable costs like performance marketing expenses and cost of goods sold will dip with revenues. Last Q3, the travel platform had $428 million in revenues and around $300 million in cash costs.

Source: TripAdvisor Q3'19 earnings release

TripAdvisor reported operating income of $68 million in Q3'19, but once adding back amortization costs of $9 million and stock-based compensation expenses of $29 million, the company generated $106 million in adjusted operating income. TripAdvisor had $129 million in adjusted EBITDA when adding back depreciation charges.

The $65 million reduction in fixed costs eliminates 20% of total costs from last year. The big question is whether TripAdvisor can return to the same revenue levels with a nearly 25% reduction in workers for a company previously generating adjusted EBITDA margins of 30%.

The upside to the stock could be substantial with this much fixed costs removed from the operations.

Travel Will Rebound

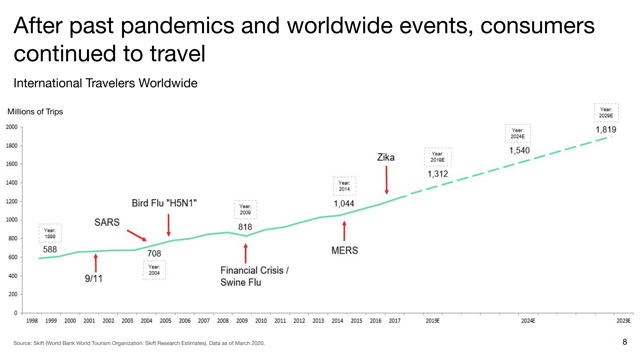

Based on recent momentum with the virus and economic reopening of most states, revenues should rebound faster than expected. The company provided this handy chart of how travel trends have always headed higher despite plenty of past virus concerns.

Source: TripAdvisor Q1'20 presentation

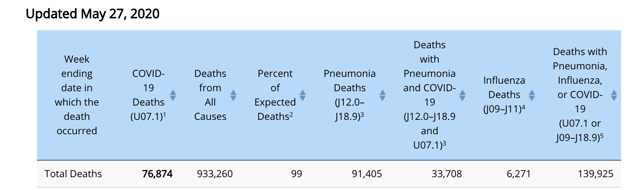

The latest data from the CDC is starting to confirm the COVID-19 deaths were only pulling forward deaths for terminally ill patients while the shutdown economy caused a reduction in non-flu like deaths. Through the week of May 23, the CDC shows that deaths for the year at 933K were actually lower than expected level at only 99%.

Source: CDC

A few weeks of excess deaths don't adjust the whole picture significantly. The case for travelers to stay home just can't be made when the virus isn't causing an abnormal level of deaths in the U.S. despite claims of 100K deaths from COVID-19.

For TripAdvisor, the company ended March with $798 million in cash after taking down a $700 million revolver. The travel platform estimated the cash would provide the liquidity for up to 2 years of sustained travel weakness.

The stock recently held strong support near $15. Anybody buying here at $23 missed the lows, but TripAdvisor appears set to make a run at previous highs with the reduced cost structure.

Takeaway

The key investor takeaway is that TripAdvisor is poised to continue rallying. The company has the potential of coming back more profitable despite previously generating large EBITDA margins. The stock is a definite buy on weakness following any failure to break the downtrend near $25.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Sign up today to see the stocks bought by my Out Fox model during this market crash.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.