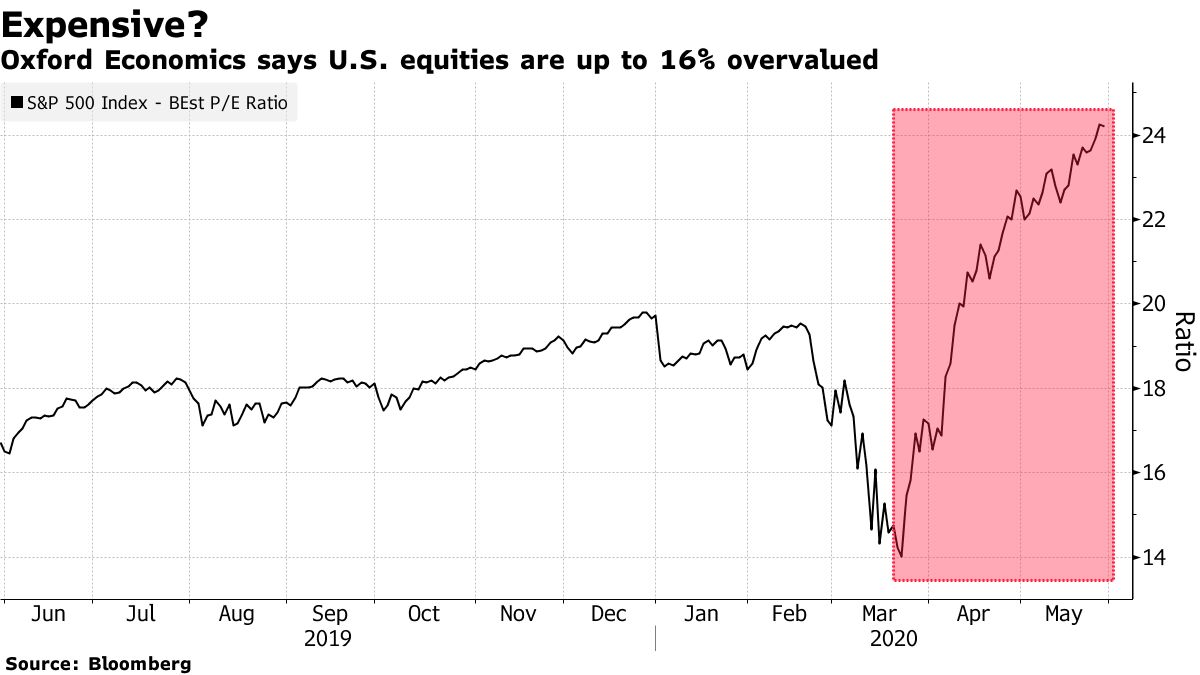

U.S. Stocks Expensive Any Way You Cut It, Says Oxford Economics

by Adam HaighStocks in the U.S. are expensive on a range of valuation multiples and could come under pressure as geopolitical tensions escalate, according to Oxford Economics.

American shares are as much as 16% overvalued at present levels, and a short position on the S&P 500 Index looks increasingly favorable, said strategist Daniel Grosvenor. Low bond yields aren’t sufficient to sustain equity valuations after the surge in shares from the March lows, he added.

“The threat of renewed tariffs adds clear downside risks to already-depressed global trade, and this could derail the eventual earnings recovery,” Grosvenor wrote in a report. “The market is vulnerable to a correction.”

Despite a slew of warnings about valuations and the pace of the rebound following the huge sell-off earlier this year, as well as the racheting-up of hostilities between the U.S. and China in the past couple of weeks, investors are pushing stock prices up through some key technical levels. The S&P 500 rose to nearly 3,069 intraday on Thursday, its highest level since March 5, and now sits above its 50-, 100- and 200-day moving averages.

“The S&P 500 is expensive versus history on almost all the measures we consider,” Grosvenor said. His measure of valuing companies by discounting the value of their future cashflows would still be 6% overvalued even with an assumption of a much higher terminal growth rate of 4%, he wrote.