Pandemic accelerates desire to pass down wealth

Fear over potential tax rises leads to a rise in people gifting assets to family members

by Lucy Warwick-ChingThe coronavirus lockdown has focused minds on how wealth will be passed to the next generation.

Advisers report that increasing numbers of clients are contacting them to discuss the best ways of passing down cash and other assets to their children and grandchildren.

“There’s nothing like a global pandemic to remind people of their own mortality,” says Chris Groves, partner in the private client and tax team at law firm Withers. “People have been rushing to get their financial affairs in order and put plans in place to pass down wealth to the next generation over lockdown.”

Although many people will have had their estate planning strategy in place for some time, Mr Groves said the unprecedented effects of the pandemic meant priorities and financial situations had changed for many families. “People are reassessing their plans,” he adds.

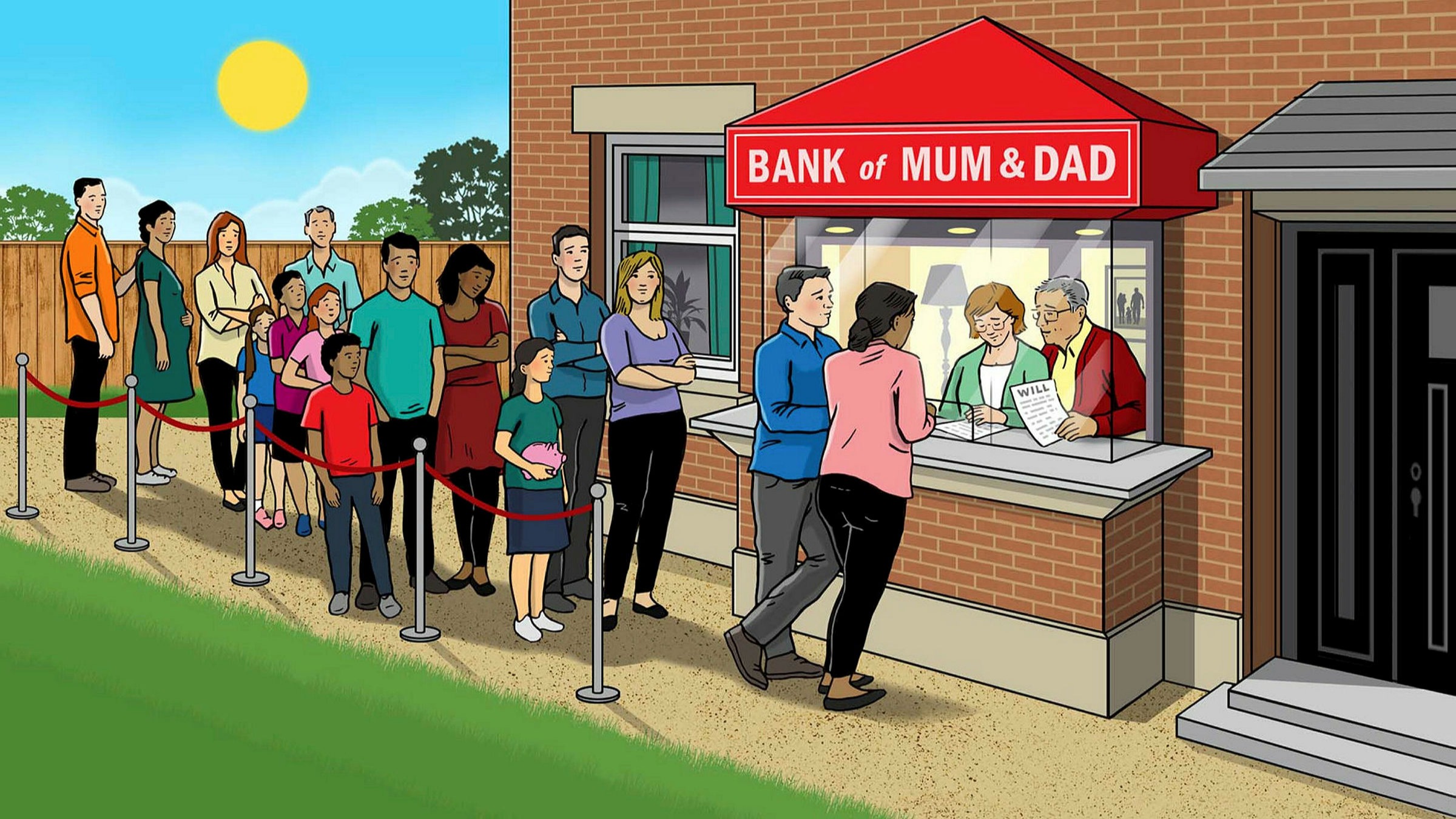

Younger generations, who stand to be hit hardest by the crisis, may need to call on the “Bank of Mum and Dad” for financial support — although parents will need to evaluate how any cash calls could impact their own retirement plans in the wake of market movements.

However, families are also revisiting their plans through fear of future tax rises the UK government could bring in to cover the cost of the pandemic measures.

With an estimated £3.2tn ($4tn) of intergenerational wealth transfers due to take place in the UK and North America over the next 20 years, advisers say that even those who had not considered gifting assets before are discussing ways of passing on their wealth in the most tax-efficient way ahead of any potential rule changes.

FT Money looks at the kinds of practical considerations wealthy families are discussing with their advisers and financial planners.

An early inheritance

Advisers say plenty of parents and grandparents are seeking to pass assets to their heirs now to “lock in” current tax reliefs and rates while they still can.

“Even before the pandemic, we always thought the chancellor’s second Budget in November was going to be more challenging for taxpayers than his first in March, and that must be all the more the case now,” says Julia Cox, partner at Charles Russell Speechlys.

Many people who were going to make gifts anyway are just bringing those gifts forward and making them now while the seven-year rule is still aroundNimesh Shah, Blick Rothenberg

“Regardless of the current Covid-19 crisis, many were concerned about the reduction in certain tax reliefs and an increase in present tax rates anyway, which one can only imagine that the government support packages will make all the more likely.”

Others say the coronavirus has concentrated the minds of clients who were previously pondering whether or not to make substantial gifts. Under current inheritance tax (IHT) rules, unlimited sums can be given away tax free under the “seven-year rule”.

“The message is: don’t delay,” says Judith Millar, a partner in the private wealth department at BDB Pitmans. “If they survive the gift by seven years, its value falls out of their account completely and no IHT is payable under current rules and there is tapering relief after the first three years.”

Another reason to act sooner rather than later, says Nimesh Shah, partner at tax advisory firm Blick Rothenberg, is the likelihood that IHT could be reformed and the seven-year gift rule could be abolished.

“Many people who were going to make gifts anyway are just bringing those gifts forward and making them now while the seven-year rule is still around,” he says.

Tax-efficient transfers

Plenty of families are looking at ways of passing down assets, as well as cash. From the point of view of capital gains tax (CGT), advisers say now is a good time to gift assets because the economic impact of Covid-19 could mean that assets like shares have fallen in value and therefore attract less CGT.

Alastair Collett, private wealth partner at BDB Pitmans, says now is the time to conduct a detailed portfolio review with your investment manager to identify stocks and shares that can be handed on.

Although assets can be passed between spouses without triggering a CGT bill, this is not the case if you are gifting them to a child or grandchild. However, couples could manage the transfer so they both make full use of their annual capital gains allowance — currently £12,300 per person.

“Where there is CGT to pay, the rate for many clients is relatively low at 20 per cent for non-property assets,” Mr Collett says. However, he warns that this level of relief has previously “been thought to be within the chancellor’s sights” and could be altered at a future Budget.

Advisers say a further benefit of making any transfers now is that even if the shares subsequently rise in value, any IHT bill will be based on the share price at the point they were gifted.

Dividing family money

Another question that frequently vexes families is how to divide assets fairly, say advisers.

The financial power balance within many families has changed as a result of economic turmoil — but siblings and grandchildren who expect a future legacy are often hugely sensitive if plans change and one of them gets their inheritance early.

One adviser to a couple with two adult children has been discussing their desire to gift a substantial cash sum to their son, who runs his own business, and is struggling financially. However, this has caused tensions with their daughter, who has a full-time job and whose finances have not been affected by the pandemic. These kinds of decisions need to be managed extremely sensitively to avoid a family rift.

Helen Jones, a partner in private client services at BDO, says demands for an early inheritance are not the only pressures parents are facing.

“Since Covid-19, parents may have experienced their children returning home during lockdown, struggling to pay rent, or facing issues with their businesses,” she says. “Parents in a position to help their children may have found themselves making loans or providing other assistance to ensure their children’s businesses continue to trade in this most challenging landscape.”

Others are advising families to focus on the younger generations who will be hit particularly hard by the economic downturn resulting from the pandemic.

Paul Falvey, tax partner at BDO, says: “We live in a time when four generation families are increasingly commonplace, and are likely to see that many first and second generations will be more protected from the economic impact of Covid-19 as they often already own property or have adequate pension provision. However, third and fourth generations tend not to have such security.”

The gift that keeps on giving

The easiest way to help children or other family members, say advisers, is via regular gifts. This is particularly efficient from an inheritance tax point of view as IHT is not charged on gifts made from an individual’s “excess” income — loosely defined as income not otherwise required to maintain their usual standard of living.

Ian Dyall, head of estate planning at Tilney, recommends that parents simply pay expenses on behalf of the adult child, for example school fees for the grandchildren. “This is simple — it can be stopped once the crisis is over,” he says. “The money being gifted is not at risk if the child becomes bankrupt or divorces.”

Recommended

Inheritance

Wealthy seek inheritance tax rebates

He makes the point that these gifts will immediately be exempt for the purposes of the donor’s IHT liability if they are regular, and paid from income which is excess to the donor’s requirements. If they are not out of excess income, then the donor will need to survive the gift by seven years to reduce their IHT liability.

“We are seeing this used where the prime motivation is helping the children rather than IHT mitigation,” says Mr Dyall.

One-off gifts

Advisers report an increase in people giving away cash gifts to help family members. Under the current gifting rules, is possible for individuals to give away assets or cash up to a total of £3,000 in a given tax year without it being added to the value of their estate for IHT purposes when they die.

Unlimited gifts of up to £250 are also allowed to as many people as you like, and parents can gift up to £5,000 to their children as a wedding present and grandparents £2,500.

Gifts worth more than the £3,000 will be subject to IHT if you die within seven years of handing over the money. These gifts are called potentially exempt transfers (PET) because if you die within seven years, your beneficiaries will have to pay tax on a sliding scale, depending on how long you lived.

Ms Cox says: “The sooner those gifts are made, the more likely the seven years are to go by. There is no limit on the amount of outright gifts anyone can make to an individual in this way, so the more the merrier, but the parent will not control these gifts once made.”

That, she says, would need to be considered in the case of a child getting divorced in the future, for example.

Increasingly, advisers say they are seeing a rise in the number of clients repaying children’s debts. Mr Dyall says: “That may be a better use of outright gifts, particularly where the interest on the debt is high, such as credit cards and unsecured loans. It is also less likely to damage benefits. If the debt is a mortgage then there are other considerations, such as redemption penalties on the mortgage and the property may still be at risk in cases of bankruptcy.”

Using family trusts

Another way to pass money down the generations is through a trust. A fairly limited amount of cash — at most £325,000 per individual, so £650,000 for a couple — can be put into a trust without triggering any immediate inheritance tax charge. Advisers say this could provide a valuable source of funding for the education of a couple of grandchildren, particularly if the pandemic is going to have a serious impact on parental finances.

Trusts are useful where the financial needs of various beneficiaries are not yet clear, which is helpful in such an uncertain and changing landscape. In effect, this creates an “emergency fund” that different children or grandchildren can benefit from if and when needed.

“The reduction in investment values also helps with funding trusts,” says Mr Dyall. “If you gift more than the nil rate band to a discretionary trust over any seven-year period, the excess is liable to IHT at 20 per cent. The reduction in the value of investments means that the donor can get more into the trust today than they could six months ago.”

However advisers warn that the future taxation of trusts is something that has been talked about for some time and could be reformed.

Mr Collett of BDB Pitmans says: “The government’s stated approach in their consultation paper is to ensure that trusts do not offer either a tax advantage or disadvantage, so clients need to be able to identify clear non-tax objectives before entering in any trust arrangements.”

Family investment companies

As an alternative to a family trust, people with large estates could consider setting up a family investment company — a limited company which can be used to hold a broad range of assets including property, cash and investments. This approach allows the family to control assets while accumulating income in a tax-efficient manner. It also enables family succession planning and provides an effective tool for wealth planning too, say advisers.

Family investment companies can have different share classes so that, for example, the parents are the trustees and make the decisions on the assets and the children are beneficiaries. You will generally not pay tax on the income as long as you reinvest the dividends. There are, however, personal income tax charges to consider when extracting funds.

Ms Jones at BDO says: “Starting an investment company is a more modern alternative to trusts: they give parents a chance to involve the next generation in co-managing assets.”

Don’t give away too much

Despite compelling arguments for passing on your wealth now, advisers warn that some parents who would like pass on assets may feel more constrained than they had previously anticipated.

For example, the value of their pension funds could have been hit by market volatility, or their income may have been reduced by the sharp drop in dividend yields. This will impact their ability to provide for others.

“The market downturn has meant that parents are reassessing what they may need for themselves,” says Ms Cox. “One of the first rules of IHT efficient intergenerational giving is that you can only give away what you can afford to live without forever.”

She warns that the problem is that if you make a gift and then take some benefit back from that — for example, an income from the asset — then that is a so-called “gift with a reservation of benefit”. For IHT purposes, this will be treated as if you had never made the gift, and carries certain other tax penalties. “In short, it’s to be avoided as a ‘bad’ tax place to be,” she adds.

One of the good things to have come out of the pandemic, say advisers, is that people’s minds have focused on the importance of family, the value of personal relationships and the desire to take care of each other.

Shona Baijal, managing director at UBS Global Wealth Management, makes the point that as families spend more time together, perhaps this is also creating a better backdrop for some of life’s more fundamental questions to be discussed.

“People have been forced to face the stark reality of their own potential mortality,” says Ms Baijal. “Many thoughts and discussions that may have been previously delayed regarding intergenerational wealth transfer are therefore now more likely to be tackled.”

Where there’s a will, there’s a way

Almost one-third of people without a will have considered making one as the pandemic prompts families to get their finances in order, according to research by law firm BLM.

Of those with an existing will, 14 per cent said they were now more inclined to consider updating it.

However, only 9 per cent of respondents had taken steps to prepare or update their final wishes — perhaps due to the difficulties of doing so under lockdown.

“The pandemic is nudging will preparation further up the ‘life admin’ list,” says James Beresford, head of wills and estate planning at BLM.

It is estimated that more than half of UK adults do not have a valid will, which can present considerable difficulties for surviving family members.

“If you were thinking of preparing or updating a will pre-coronavirus, the crisis may have given you the time and the head space to sort it,” says Mr Beresford. “As the reality of lockdown and the impact of coronavirus has settled in, many of us are now having difficult and honest conversations with family and loved ones.”

Recommended

Inheritance

Making a will: 10 things you should know

Current laws stipulate that in England a will needs to be in writing and to be signed in the physical presence of two adults who are not beneficiaries or executors of the will.

“A lot of people have not written wills — this is often something that people think they will do later but invariably don’t,” says Neil Jones, tax and wealth specialist at Canada Life. “This current crisis has focused minds and increased the demand.”

He points out that the requirements for independent witnesses are causing difficulties, although these rules are intended to demonstrate that the will writer was of sound mind and not being coerced.

“Obtaining signatures is not as easy now we are under isolation and there have been reports of wills being signed over car bonnets to help expedite [matters],” says Mr Jones.

The Law Society and the Ministry of Justice are currently discussing ways to relax the regulations for the signing of wills.