Brighthouse Financial Inc: A 6.75% Preferred Stock IPO From This Life Insurer

by Arbitrage TraderSummary

- Brighthouse's new preferred stock, BHFAO, is currently trading above its par value.

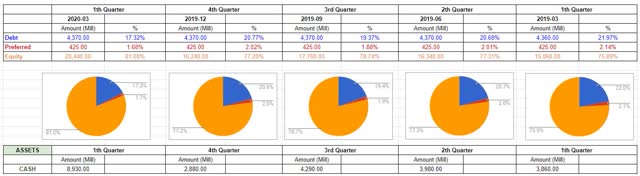

- The common stock does not pay dividend, but the company holds almost $9 billion in cash.

- BHFAO is the highest-yielding security both in the company and in the sector.

Introduction

The issuance of new preferred stocks and baby bonds is always welcome for all fixed-income investors. Especially when these are large and liquid issues with a good rating from any of the Big Three. The increased variety, the opportunity for anyone to diversify their portfolio, or if you are a day trader just a higher probability for an arbitrage opportunity are only positive things in the little world of the fixed-income securities. In this article, we want to pay our attention to a new Preferred Stock issued by Brighthouse Financial Inc. (BHF).

The New Issue

Before we submerge into our brief analysis, here is a link to the 424B5 Filing by Brighthouse Financial - the prospectus. (Source: SEC.gov)

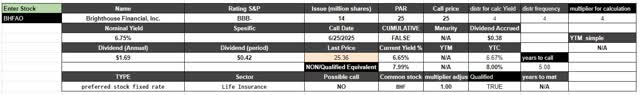

For a total of 14 million shares issued, the total gross proceeds to the company are $350 million. You can find some relevant information about the new preferred stock in the table below:

Source: Author's spreadsheet

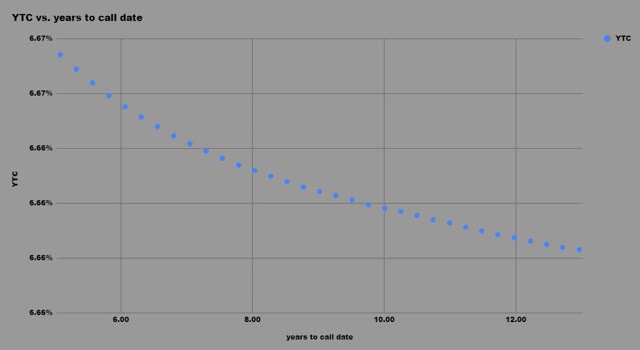

Brighthouse Financial 6.75% Depositary Shares Series B Non-Cumulative Perpetual Preferred Stock (NASDAQ: BHFAO) pay a qualified fixed dividend at a rate of 6.75% and has a par value of $25. The new preferred stock is expected to be rated a "BBB-" from Standard & Poor's and is callable as of 06/25/2025. Currently, the new issue trades above its par value at a price of $25.36, translating into a 6.65% Current Yield and a 6.67% Yield-to-Call. This means that the non-qualified equivalent would be 7.99% Current Yield and 8.00% YTC.

Here is the product's Yield-to-Call curve:

Source: Author's spreadsheet

The Company

Brighthouse Financial, Inc. is a provider of life insurance and annuity products in the United States. The Company offers a range of products and services, which include variable, fixed, index-linked and income annuities, as well as variable, universal, term and whole life products. These products and services are marketed through various third party retail distribution channels in the United States. Fixed income annuities provide a guaranteed monthly income for a specified period of years and/or for the life of the annuitant. The Company operating segments include Annuities, Life and Run-off.

Source: Reuters.com

On August 7, 2017, MetLife, Inc. (NYSE: MET) announced it had completed the spin-off of Brighthouse Financial, Inc., creating two independent, publicly traded companies.

Below you can see a price chart of the common stock, BHF:

Source: TradingView

We currently have no plans to declare or pay cash dividends on our common stock. We currently intend to use our future distributable earnings, if any, to pay debt obligations, to fund our growth, to develop our business, for working capital needs, to carry out any share or debt repurchases that we may undertake, as well as for general corporate purposes. Therefore, you are not likely to receive any dividends on your common stock in the near-term, and the success of an investment in shares of our common stock will depend upon any future appreciation in their value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which the shares currently trade. Any future declaration and payment of dividends or other distributions or returns of capital will be at the discretion of our Board of Directors and will depend on many factors, including our financial condition, earnings, cash needs, regulatory constraints, capital requirements (including capital requirements of our subsidiaries), and any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends or make other distributions or returns on our common stock, or as to the amount of any such dividends, distributions or returns of capital.

Source: 10-K Filing for the fiscal year 2019 by Brighthouse Financial

In addition, BHF has a market capitalization of around $2.98 billion.

Capital Structure

Below you can see a snapshot of Brighthouse Financial Inc.'s capital structure as of its last quarterly report in March 2020. You can also see how the capital structure has evolved historically.

Source: Morningstar | Company's Balance Sheet

As of Q1 2020, BHF had a total debt of $4.37 billion ranking senior to the newly issued preferred stock. The new Series B preferred shares rank junior to all outstanding debt and equal to the other issued preferred shares by the company, Series A Preferred Stock, that totals $425 million.

The Ratios Which We Should Care About

Our purpose today is not to make an investment decision regarding the common stock of BHF but to find out if its new preferred stock has the needed qualities to be part of our portfolio. Here is the moment where I want to remind you of two important aspects of the preferred stocks compared to the common stocks:

- Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

- Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

Based on our research and experience, these are the most important metrics we use when comparing preferred stocks:

- Market Cap/(Long-term debt + Preferreds): This is our main criterion when determining credit risk. The bigger the ratio, the safer the preferred. Based on the latest annual report and taking into consideration the latest preferred issue, we have a ratio of 2,980/(4,370 + 775) = 0.57, meaning the company's equity is insufficient to cover the debt and the preferred stocks.

- Earnings/(Debt and Preferred Payments): This is also quite an easy-to-understand approach. One can use EBITDA instead of earnings, but we prefer to have our buffer in what is left to the common stockholder. The higher this ratio, the better. The ratio with the TTM financial results is 4,930/(190 + 52) = 20.37, which indicates an extreme buffer for the preferred stocks and the debt payments, so the preferred stockholders and bondholders can be calm about the payments. Moreover, despite the fact that the company doesn't pay any dividends for its common, it holds almost $9 billion in cash.

The Brighthouse Financial Family

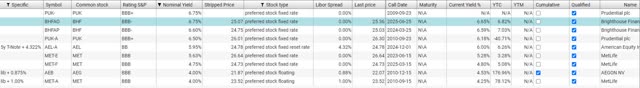

BHF has two more outstanding fixed-income securities: one preferred stock and a baby bond:

- Brighthouse Financial 6.60% Dep Shares Series A Non-Cumul Perp Preferred Stock (BHFAP)

- Brighthouse Financial 6.25% Junior Subordinated Debentures due 9/15/2058 (BHFAL)

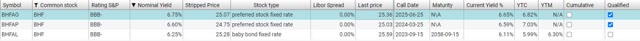

Source: Author's database

The other preferred stock, BHFAP, also bears a "BBB-" Standard & Poor's rating and is callable as of 03/25/2024. Like the newly issued BHFAO, BHFAP is paying a qualified dividend but at a rate of 6.60%. Currently, it is trading close to its par value at a price of $25.03 and has a 6.59% Current Yield and 7.03% Yield-to-Call.

The company's baby bond, BHFAL, has the same credit rating as the preferred stocks, "BBB-", has a nominal yield of 6.20%, and as may be expected, as a debt security, its interest is not eligible for the preferential tax rate. The bond is callable as of 09/15/2023, and it is maturing on 09/15/2058. With its current market price of $25.59, BHFAL has a 5.99% Yield-to-Call and a 6.30% Yield-to-Maturity.

With a Yield-to-Worst of 6.65%, equal to its Current Yield, the new IPO is currently the highest-yielding preferred stock in the company. However, its advantage is not that significant, as the other preferred stock has a Yield-to-Worst only 0.06% lower. For more conservative investors, in terms of returns, I would say the baby bond does not lag behind from its "preferred brothers" with its 5.99% YTW, while it is standing above in the BHF's capital structure. However, what should also be taken into account is the qualified dividend of the preferred stocks versus the not-qualified interest paid by the bond.

In addition, in the following chart, you can see a comparison between BHF's issues and the fixed-income securities benchmark, the iShares Preferred and Income Securities ETF (PFF). There is a very close correlation between the three issues, which on the one hand is expected after both BHFAP and BHFAL take part in the ETF's holdings. Still, an outperformance of the baby bond over BHFAP and PFF is observed almost all the time.

Source: TradingView

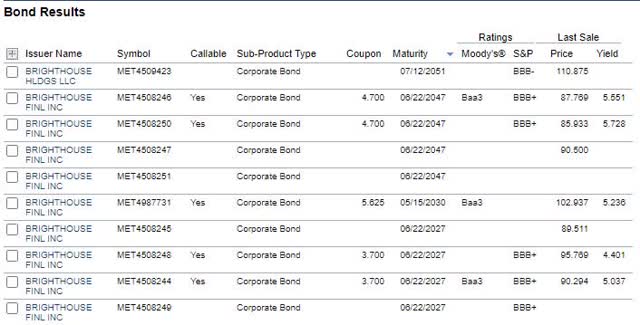

Furthermore, there are 10 corporate bonds issued by the company:

Source: FINRA

For my comparison, I chose a fixed-rate bond that has the closest maturity date to the call date of the newly issued preferred stock, the 2027 Corporate Bond, MET4508248. Some information about the bond could be found in the table below.

Source: FINRA | MET4508248

MET4508248, the FINRA ticker, is rated a "BBB+", is maturing on 06/22/2027 and has a Yield-to-Maturity of 4.124%. This should be compared to the 6.67% Yield-to-Call of BHFAO, but when making that comparison, do remember that its YTC is the maximum you could realize if you hold the preferred stock until 2025. This result in a yield margin of around 2.5% between the two securities, which, despite the higher rating, I would again give an advantage to the newly issued preferred stock by repeating the good financials, the longer maturity date of the bond and the qualified dividend income of the preferred stock.

Sector Comparison

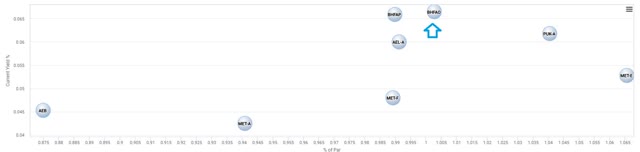

The chart below contains all preferred stocks in the "Life Insurance" sector (according to Finviz) regardless of the dividend rate they pay and have a par value of $25. Except for AEL-A, all of these preferred stocks are rated as investment grade by Standard & Poor's. It is important to take note that all of these preferred stocks are eligible for the preferential federal tax rate.

- By % of PAR and Current Yield

Source: Author's spreadsheet

Except for PUK-A and MET-E, the Current Yield of all issues is actually their Yield-to-Worst. For PUK-A and MET-E, their YTW is also their YTC. Thus, it turns out that MET-E has 2.00% lower YTW, and as for PUK-A, it even carries a call risk. With its Yield-to-Worst of 6.65%, equal to its Current yield, the newly issued BHFAO is the highest-yielding security in the sector, leaving behind BHFAP with a 6.59% Current yield.

- Take a look at the full list:

Source: Author's spreadsheet

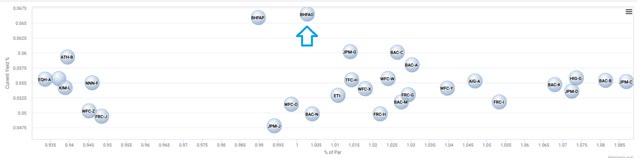

All BBB- Preferred Stocks

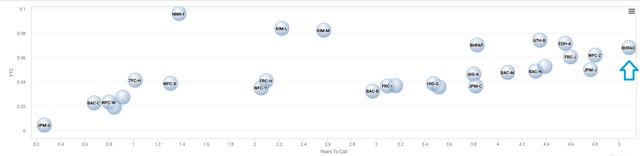

The last chart contains all preferred stocks that pay a fixed dividend rate, have a par value of $25, a positive YTC and a "BBB-" Standard & Poor's rating.

- By % of PAR and Current yield

Source: Author's database

- By Years-to-Call and Yield-to-Call

For this chart, I'll exclude all callable issues to have a much clearer look over the group:

Source: Author's database

Redemption Following a Rating Agency Event or Regulatory Capital Event

We may elect to redeem the Series B preferred stock: in whole, but not in part, at any time prior to June 25, 2025, within 90 days of the occurrence of a “regulatory capital event” (as defined in “Description of the Series B Preferred Stock—Optional Redemption”), at a redemption price equal to $25,000 per share of Series B preferred stock (equivalent to $25.00 per depositary share), plus an amount equal to any dividends per share that have accrued but not been declared and paid for the then-current dividend period to, but excluding, such date of redemption; or in whole, but not in part, at any time prior to June 25, 2025, within 90 days of the occurrence of a “rating agency event” (as defined in “Description of the Series B Preferred Stock—Optional Redemption”), at a redemption price equal to $25,500 per share of Series B preferred stock (equivalent to $25.50 per depositary share), plus an amount equal to any dividends per share that have accrued but not been declared and paid for the then-current dividend period to, but excluding, such date of redemption. Source: 424B5 Filing by Brighouse Financial Inc.

Use of Proceeds

We estimate that the net proceeds to us from this offering will be approximately $339 million (or approximately $390 million if the underwriters exercise in full their option to purchase additional depositary shares), after deducting the underwriting discount and before paying estimated offering expenses payable by us. We intend to use the net proceeds from this offering to repay approximately $339 million of borrowings under our unsecured term loan facility promptly after the closing of this offering (and an additional approximately $51 million of borrowings thereunder if the underwriters exercise in full their option to purchase additional depositary shares). As of May 18, 2020, there was approximately $504 million outstanding under our unsecured term loan facility after giving effect to the repayment of borrowings with the proceeds of the sale of the Notes.

Source: 424B5 Filing by Brighouse Financial Inc.

Addition to the iShares Preferred and Income Securities ETF

With the current market capitalization of the new issue of around $350 million, BHFAO is a potential addition to the ICE Exchange-Listed Preferred & Hybrid Securities Index during some of the next rebalancings. If so, it will also be included in the holdings of the main benchmark, the iShares Preferred and Income Securities ETF, which is the fund that seeks to track the investment results of this index and which is important to us due to its influence on the behavior of all fixed-income securities.

Conclusion

The company seems high leveraged after its equity is only a little more than half of its debt, but the debt payments and preferred dividends coverage compensate the low equity/debt ratio. Moreover, BHF currently holds almost $9 billion in cash. As for the new IPO, it is trading slightly above its par value, at a 1.5% premium, and has a Yield-to-Worst of 6.65% equal to its Current Yield. This places the new IPO as the highest-yielding security in the company by having 0.06% higher return than BHFAP, and it is also yielding 0.66% more than the company's baby bond, BHFAL. In terms of the sector and the other "BBB-" fixed-rate preferred stocks, Brighthouse's new IPO, BHFAO, seems to be the best issue compared to its peer group.

Trade With Beta

Coverage of Initial Public Offerings is only one segment of our marketplace. For early access to such research and other more in-depth investment ideas, I invite you to join us at 'Trade With Beta.'

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.