How investors learnt to love the rally in stocks

‘Fear of missing out’ dominates in sweeping ascent as doubters turn into believers

by Richard HendersonThe bumper run in the US stock market is beginning to turn its doubters into believers, adding fresh thrust to a rally that has wrongfooted veteran investors, lured in retail traders, and defied the dire economic outlook caused by the global pandemic.

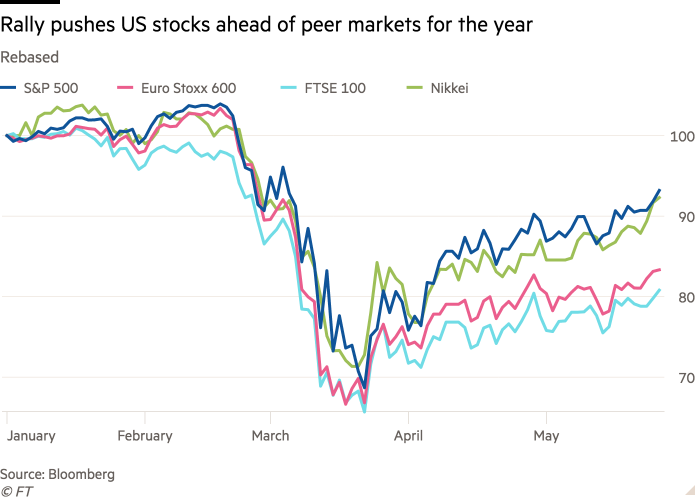

The S&P 500 index of US blue-chip stocks is up more than a third from its low two months ago, in the depths of the virus sell-off. On Wednesday, the benchmark closed above 3,000 points for the first time since early March, bringing the index to just 10 per cent below the record high reached in February.

The rally has built a legion of sceptics who worry the market is being driven entirely by Federal Reserve stimulus and that bullish investors are too confident a vaccine will emerge to rekindle corporate profits. But now, even detractors are reluctantly joining the buying.

“There’s an element of fear of missing out — FOMO — as investors start to look at the momentum,” said Emily Roland, co-chief investment strategist for John Hancock Investment Management in Boston. She likened the recent buying by the new believers to crossing a busy highway. “They are looking for an opening, they know it’s possible to get hurt, but they are just going for it.”

Gains are not confined to the US. Led by the S&P 500, the Euro Stoxx 600 and FTSE 100, the UK benchmark, are both up by around a quarter, while the Nikkei index of Japanese stocks has gained more than 30 per cent since the rally began on March 23.

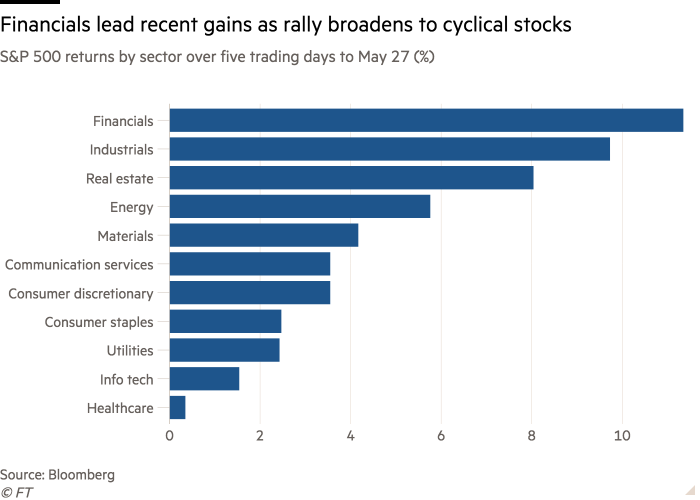

Rallies are also beginning to expand beyond the mega-cap tech stocks that have emerged as a haven for investors through the turbulence this year — a signal that a broader range of buyers is joining the stampede.

My 10-year-old son asked me if he can open an ETrade account so he could buy Tesla stockEmily Roland, John Hancock Investment Management

Cyclical stocks and small-caps have enjoyed bumper gains over the past week as investors show new support for economically sensitive companies.

On Tuesday bank stocks had their best day since early April, suggesting the rally can endure, said Mike Mullaney, director of global markets research for fund manager Boston Partners. “You can’t leave the financial sector in the dust and expect the rally will last — the banks are the backbone of the economy,” he said.

Rob Almeida, global investment strategist for MFS Investment Management in Boston, has maintained a bearish view through the rally, but said missing out on the gains has been painful. MFS has joined the rally cautiously, expanding its holdings of tech groups it believes will prosper through and beyond the Covid-19 crisis, like payments groups and athletic apparel companies, as stuck-at-home professionals swap suits for sweatpants.

“What you’ve seen in the last few weeks is a tremendous amount of assumptions,” Mr Almeida said. “I think the market is ahead of itself.”

The forward price/earnings multiple for the S&P 500 — a popular valuation measure — is now above 23, its highest since the early 2000s, according to Capital IQ.

A vaccine for the coronavirus may yet be several years away and top scientists have warned that the colder months in the US and Europe may bring about fresh outbreaks that lead to more shutdowns, hampering a recovery.

Yet so far, the sustained buying has proven doubters wrong. Two weeks ago, Stanley Druckenmiller, the hedge fund manager who helped George Soros break the Bank of England, said the reward for buying equities was “as bad as I've seen”. David Tepper, founder of Appaloosa Management, a US hedge fund, echoed this view a day later. Since then, US stocks have gained around 7 per cent.

Critics have also warned that retail investors, lacking the hard-nosed analysis of Wall Street professionals, are backing the rally — potentially dangerously bidding up battered stocks.

Users of Robinhood, the stock trading app, have more than doubled their positions in companies in the Russell 3000 index of the biggest US listed groups since the rally began, according to Morgan Stanley calculations. The 10 most popular stocks held by Robinhood users include American Airlines and Carnival, the cruise operator — two coronavirus-hit companies whose fortunes may not turn for some time.

Online trading and a “buy-the-dip” mentality have helped attract a new breed of retail investor, said Ms Roland of John Hancock.

“My 10-year-old son asked me if he can open an ETrade account so he could buy Tesla stock,” she said. He had learned about fractional shares, which give investors the ability to buy a slice of a stock and would allow him to purchase a portion of the carmaker’s shares that currently trade at $820. “He only has $150 — it was his first communion money.”

Steven DeSanctis, an equity analyst for Jefferies, said daily trading in small biotech stocks has climbed in recent weeks, often exceeding companies’ outstanding share count. He puts this down to active day-trading, reminiscent of retail investors’ frothy buying of internet stocks during the dotcom boom.

“There’s a little of that euphoria in the market, which makes me nervous. You know how it ends — badly,” Mr DeSanctis said.

Those priming for another big sell-off may have to wait. US policymakers have indicated they are ready to expand the record amounts of fiscal and monetary support and all states are either relaxing their shutdowns or have reopened.

“I don’t think the market can get knocked down by much these days,” said Ms Roland. “What we’ve seen is absolutely devastating — but markets seem entirely immune to it.”