Dumpster Diving: (Potbelly Corp. Edition)

by Courage & Conviction InvestingSummary

- Before COVID-19, Potbelly was showing tangible signs of a business turnaround.

- If you look at Q4 2019 results, the company had its best comps in three years at down 0.1%.

- Although, in-store traffic has been an issue, Potbelly's catering, and online business (as it has partnered with the major food delivery companies) have done well.

As my regular readers might have worked out, I recently started a new series called 'dumpster diving,' where I share interesting trading ideas. The loose criteria are something trading at less than 90% of its all-time high, that is under the radar, and that is super cheap from a valuation standpoint (often replacement cost or some form of book value).

Moreover, as a few of my longtime readers might recall, back in late 2016 and early 2017, I was writing a lot about a then favorite nano-cap company of mine called Famous Dave's (the company later changed its name to BBQ Holdings, Inc. (BBQ)).

Now what I absolutely love about Seeking Alpha is that, at least in nano-cap or even in small-cap land, management teams tend to read and pay attention to your articles, as there is rarely sell-side coverage or interest. Enclosed below (and I made this an author's pick so you can read it) is an article that I am particularly proud of.

Arguably, I wrote the blueprint for Famous Dave's then C Suite to follow, as if I was a highly paid consultant from Bain Capital or Boston Consulting Group. Not only did I write the playbook, I flew out to Minnesota and met with the management team. Incidentally, if you read that piece and then looked at management's subsequent actions, either it listened to me or I correctly diagnosed the situation and it had the same action plan.

Source: SA Courage & Conviction archives

Incidentally, I haven't owned a restaurant stock with the exception of brief and profitable trading in Dine Brands Global, Inc. (DIN), as I think IHOP is an amazing business.

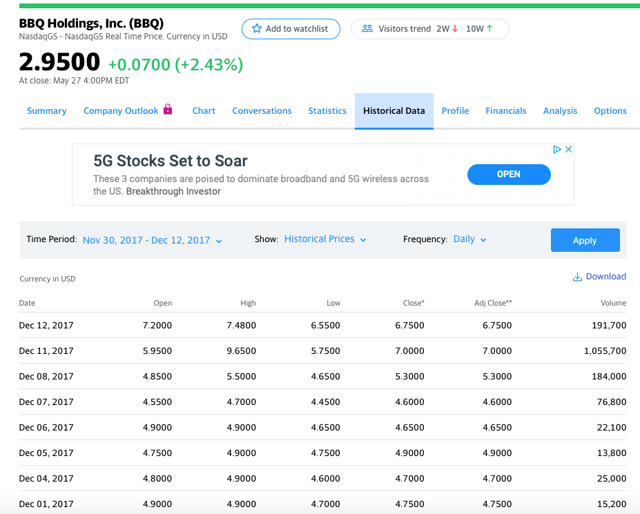

And by the way, readers made a lot of money on Famous Dave's, as the stock moved from the mid-$3s (March 2017) to a brief intra-day pop over $9 on December 11, 2017. Management's clever rights offering might have helped spark an awesome short squeeze.

Source: Yahoo Finance

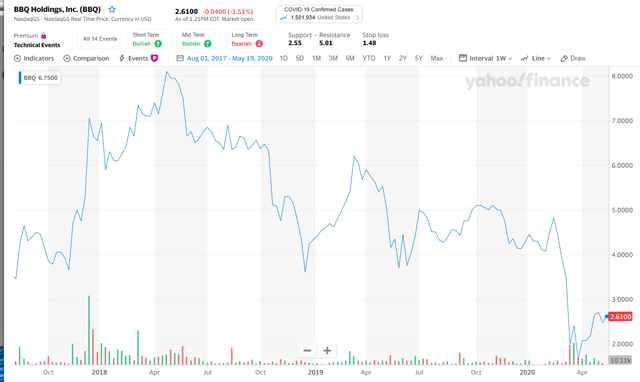

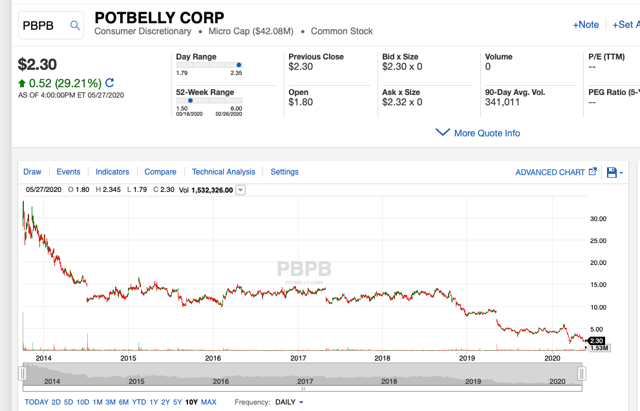

Here is a look at the stock chart.

Source: Yahoo Finance

So speaking of restaurants, today, I write to discuss a business in the fast-casual restaurant space: Potbelly Corporation (PBPB).

My point is that I don't often play in the restaurant space, but if something is cheap and qualitatively decent, as a value investor, I get involved.

My thought process is why be hemmed in, boxed in, or stuck in the same boring sandbox? Who wants to solely focus on one specific sector, pretending that sector is always compelling and a buy. Seriously, I have no idea how anyone could just write about just Shipping, or REITs, or Chemicals, Banks, etc. That would be so boring to me and more importantly, more often than not, that sector might not be particularly cheap or attractive.

As an investor, the world is my oyster, so I am free to roam and go where the opportunities present themselves. Yes, at times, this involves throwing caution to the wind and traversing rugged terrain for value. However, these adventures are rich, and the journey makes you a better investor.

The Thesis In a Nutshell

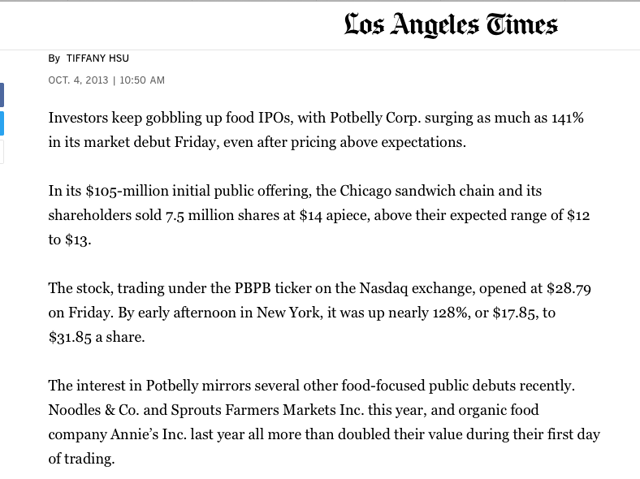

Potbelly was a hot IPO back in October 2013. The company sold 7.5 million shares at $14 per share. The stock more than doubled in its IPO debut.

Source: L.A. Times

PBPB has been an ugly stock chart ever since, as its champagne days were brief. Selectively, I love ugly stock charts as it can mean lots of bad news and negative sentiment are priced in. Of course, this is an art form, as many ugly charts never come back in vogue, whereas ugly sweaters find some love again, especially during the holiday party circuit (think work parties, family parties, etc.).

Source: Fidelity

The thesis is simple

Potbelly's top line has been stagnant for a while now.

However, similar to Chico's FAS (CHS), Potbelly was inflecting positively before the COVID-19 pandemic.

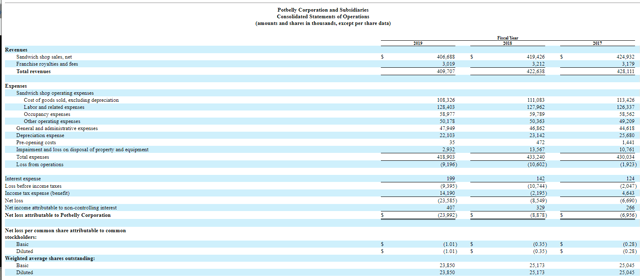

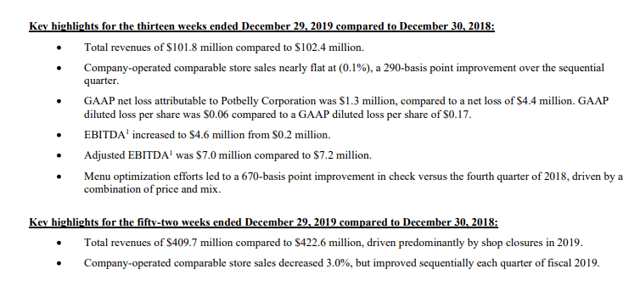

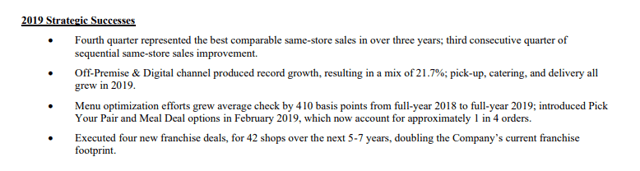

In Q4 2019, the company posted its best comps (down 0.1%) in three years. And its FY 2019 comps improved sequentially.

Source: Potbelly Q4 FY 2019 Press Release

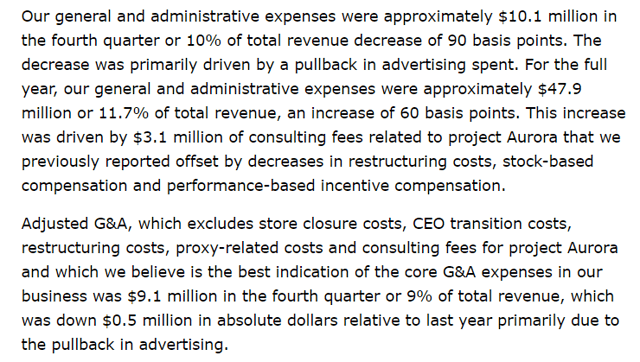

For broader context, if you read the company's quarterly conference calls you learn that the company has struggled with driving in-store traffic. The company brought in a fancy consult team for 'Project Aurora.'

The consultants worked out that Potbelly got into a persistent rut by being overly promotional as a means to drive traffic and this consulting firm determined it was time to change the conversation (see below).

Exhibit A - Change the message away from promotions

We call this effort project Aurora. Whilst it includes several new initiatives, it is largely a compliment to an extension of our existing strategy. We firmly believe that it will help us accelerate the pace of our turnaround. We have acted with urgency and already begun deploying some of the Aurora's elements across our shop base in the fourth quarter. For example, we changed our promotional message away from discounting towards talking more about a warm toasted sandwiches and focusing on getting critic for our high quality ingredients like our bacon and the freshly sliced avocado.

Exhibit B - This $3.1 million consulting expense was one-time and won't repeat in FY 2020, so this is a SG&A tailwind this year

Source: Potbelly Q4 2019 conference call

In Q4 2019, evidence of this change in strategy showed up, as average check grew by 410 bps for the full year, from FY 2019 to FY 2018.

Q1 FY 2020

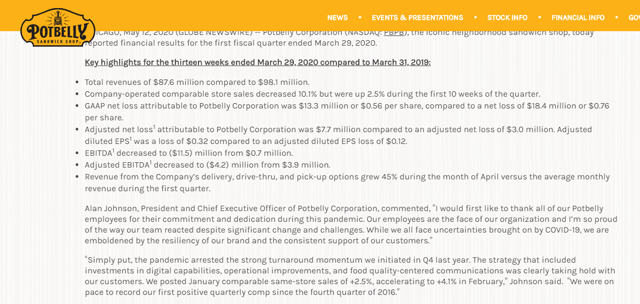

If we turn to Q1 2020, there were 'green shoots', as the company was on pace to post its first quarterly comps since Q4 2016!

Source: Potbelly Q1 2020 press release

The company's investments in digital are paying off.

Our business is different now with digitally-enabled off-premise channel predominant. The investments we made last year to improve our digital capability are proving crucial in this environment and will position us well during the recovery. Customers can digitally order profitability through our app and website as well as through our delivery partners, DoorDash, Grubhub and Uber Eats. Digital was a strong growth area for us before COVID-19 crisis, and that growth is amplified now. Digital sales across all delivery and pickup channels increased from 10.5% of shop revenue in January, February in 2019 to 14.8% in the same period in 2020. Since the second week of April of this year, digital revenue is now 51.6% of shop sales.

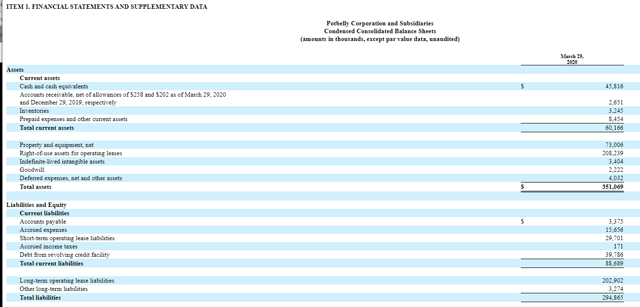

Turning to Potbelly's Q1 2020 balance sheet, the company had $45.8 million of cash and $39.8 million drawn on its revolver.

As of May 15, 2020, Potbelly's revolver expires on July 31, 2022, and maximum capacity is $40 million.

Valuation

With 23.7 million shares outstanding x $2.30 per share, we are looking at a market capitalization of $54.5 million and $6 million of net cash, so an enterprise value of $48.5 million.

Potbelly generated $25.5 million of Adjusted EBITDA in FY 2019.

So we are paying less than 2X FY 2019 EV/Adjusted EBITDA.

Franchises and Store Count

As of March 29, 2020, Potbelly had 427 company-owned units and 46 franchises.

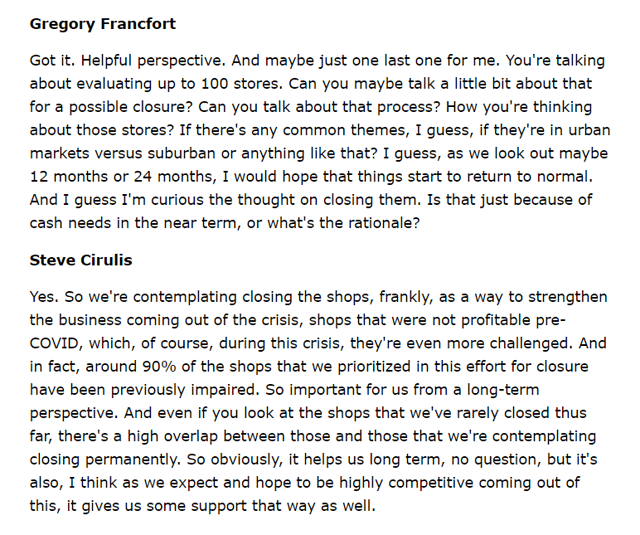

On its Q1 2020 conference call, Potbelly indicated it was evaluating closing upwards of 100, most of which were already impaired.

Think about how nearly 25% of the store fleet has been dragging down Adjusted EBITDA.

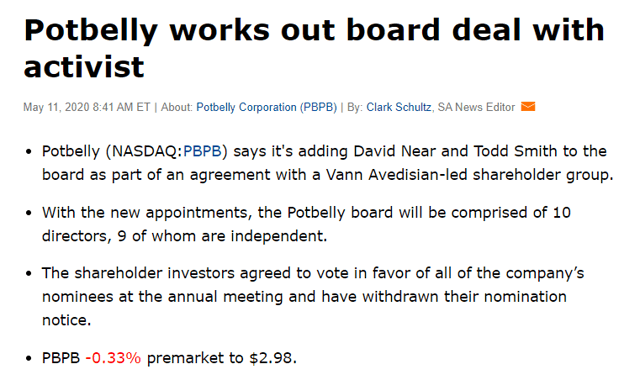

New Board Members

On May 11, 2020, Potbelly appointed two new board members.

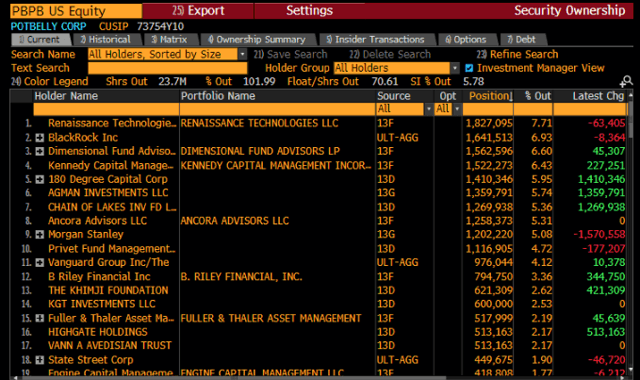

March 31, 2020, Holders

Source: Bloomberg

Conclusion

Simply stated, the market has thrown the baby out with the bathwater. The company has $6 million of net cash, a brand name, a large chain of stores already built out (think of the cumulative capex required and replacement cost), and reported its best comps in three years in Q4 2019. The company has made savvy investments in delivery, catering, and online that have helped combat the decline of in-store traffic. On a normalized basis, this business could easily return to making $20 million +. So at an enterprise value of $48.5 million, the stock is way too cheap.

For context, look at how some much larger publicly traded companies have rebounded smartly. And yes, I get it that Dine, Brinker (NYSE:EAT), and Jack in the Box (NASDAQ:JACK) are the parent companies that own the valuable franchise rights.

That said, Potbelly continues to languish.

- Jack in the Box Inc. up 309% off its 52-week low

- Dine Brand Group, Inc. up 272% off its 52-week low

- Brinker International, Inc. up 302% off its 52-week low

- Darden Restaurants, Inc. (DRI) up 212% off its 52-week low

At some point, other value investors might notice too.

Second Wind Capital is a catalyst driven/ trading oriented service with an underpinning tied to value and out of favor sectors. The hold period can range from a few days to up to six months (sometimes longer if my conviction level for a particular thesis is elevated and fundamentally and tangibly intact). Risk management perimeters will be set based on position sizing and/or stop losses. No one bats a thousand, so if you can get it right 51% of the time and you manage your risk, you will generate outsized returns. Join now with a 2 week free trial and follow my real-time porfolio.

Disclosure: I am/we are long PBPB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.