Amazon Faces A Brand New World

by ValuentumSummary

- The top end of our fair value estimate range for Amazon stands at $2,465 per share.

- In this article, we cover our revenue, EBITDA, net operating cash flow, and free cash flow growth forecasts for Amazon through the start of the mid-2020s.

- We strongly appreciate Amazon's net cash balance.

- We expect the company will continue to prosper in a post-COVID-19 world.

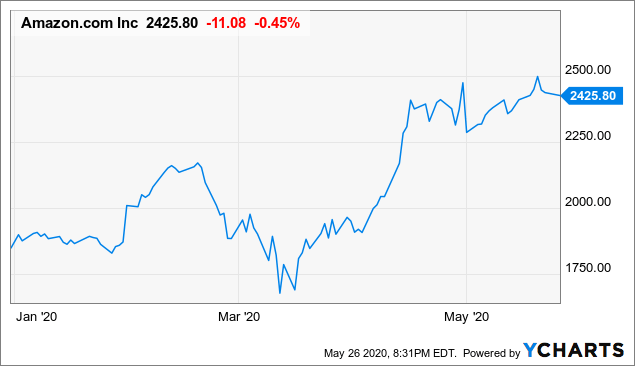

Data by YCharts

Image Shown: Shares of Amazon continued to climb higher after its first-quarter 2020 earnings report was published on April 30.

By Callum Turcan

We are following up on our last article covering Amazon (AMZN) on Seeking Alpha that was published back on April 2, 2020 (link here). Please note that in that piece, we highlighted that shares of AMZN under our most optimistic bull-case scenario carried a fair value estimate of $2,465 per share (derived through our discounted free cash flow analysis). In the course of roughly two months, Amazon has seen its stock price surge upwards towards the high end of our fair value estimate range, which isn’t surprising to us given the e-commerce and cloud-computing giant’s stellar performance during the first quarter of 2020.

Top-Line and Operating Income Growth

On April 30, Amazon reported that its first-quarter GAAP revenues grew by over 26% year over year hitting just under $75.5 billion, though rising operating expenses held down its margins. Amazon’s GAAP operating income declined by 10% year over year, shifting down to $4.0 billion last quarter. Furthermore, Amazon pledged to invest heavily in protecting its recently enlarged workforce from the ongoing coronavirus (‘COVID-19’) pandemic, which could see its operating income turn negative this quarter. That being said, shares of AMZN moved sharply higher over the course of the preceding month as investors focused on what mattered most, Amazon’s improving long-term growth outlook.

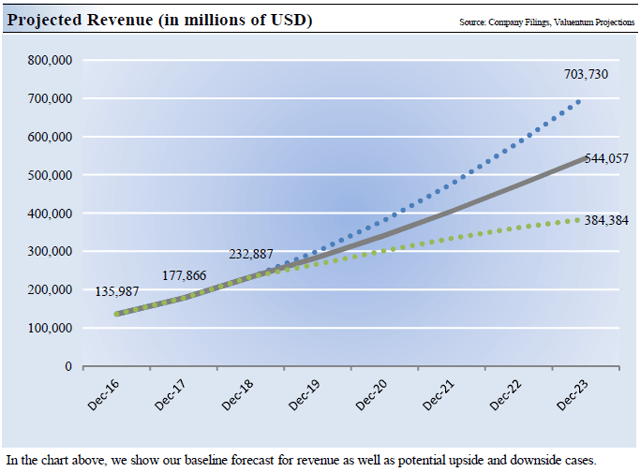

In the upcoming graphic down below, we highlight our forecasts for Amazon’s top-line growth trajectory over the coming years, sourced from our enterprise cash flow models covering the company. There are several major forces underpinning this trajectory, including Amazon’s rapidly growing digital advertising business (leveraging the popularity of its e-commerce business to move into new opportunities, in this case, a very lucrative one), its rapidly growing cloud-computing business Amazon Web Services (‘AWS’) - which like its digital advertising business started out by leveraging the size of its e-commerce operations - and its juggernaut-like e-commerce platform. Please note that in the upcoming graphic down below, the green dots highlight our bear-case scenario, the grey line highlights our base-case scenario, and the blue dots highlight our bull-case scenario as laid out in our enterprise cash flow models.

Image Shown: We are very optimistic that Amazon’s revenues will continue growing at a meaningful clip going forward. Image Source: Valuentum

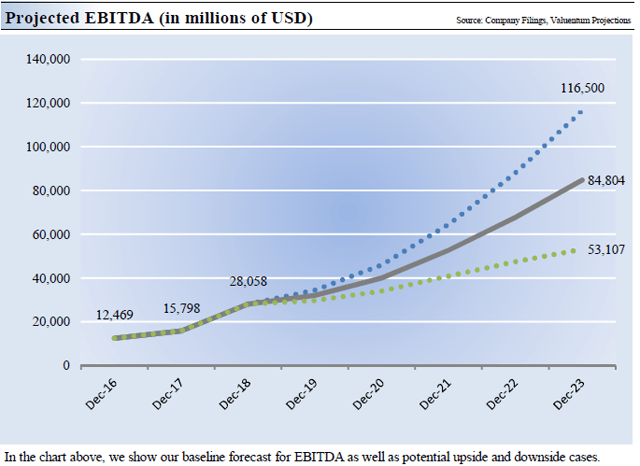

While Amazon’s operating income will come under pressure in the near term due to rising operating expenses, in the medium to long term, stronger revenue growth should result in very meaningful cash flow growth. In the upcoming graphic down below, we highlight Amazon’s forecasted EBITDA growth trajectory under our bear case (green dots), base case (grey line), and bull case (blue dots) scenarios. This trajectory is underpinned by Amazon’s strong forecasted top-line growth, by the firm shifting into higher margin businesses (i.e. digital advertising), and by achieving ever-greater economies of scale.

Image Shown: We forecast that Amazon will generate meaningful EBITDA growth over the coming years, even though its operating expenses will be elevated, relatively speaking, over the next couple of quarters to deal with the ongoing COVID-19 pandemic. Image Source: Valuentum

Cash Flow and Balance Sheet Analysis

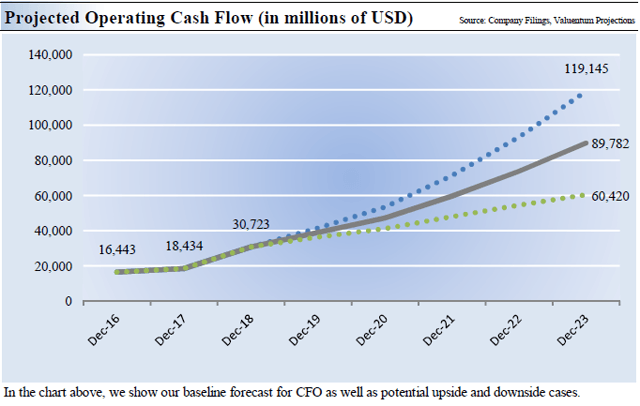

Ultimately, the goal is to drive meaningful net operating cash flow growth to enable rising free cash flows over time. Free cash flows are the true source of value for equities, in our view, and please check out our book Value Trap to learn more on the subject. In the upcoming graphic down below, we highlight our forecasts for Amazon’s net operating cash flows over the coming years under our bear case (green dots), base case (grey line), and bull case (blue dots) scenarios.

Image Shown: Amazon’s net operating cash flows are set to rise manyfold from 2016 levels by the start of the mid-2020s. Image Source: Valuentum

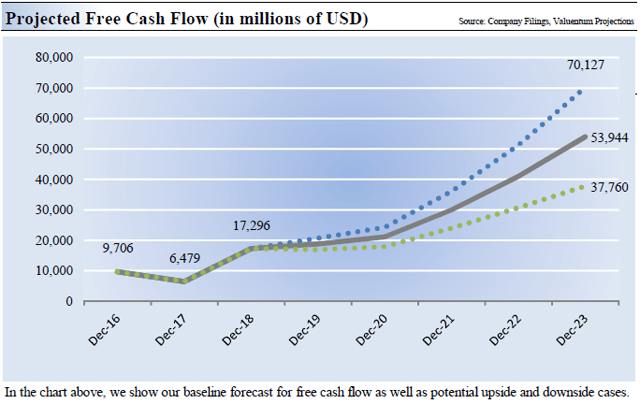

We define free cash flows as net operating cash flows less capital expenditures. Considering Amazon is making massive investments in its logistics, warehousing, data center, and other operations, its capital expenditure budgets have historically been quite meaningful and we expect that to remain the case going forward. Even so, strong forecasted net operating cash flow growth will more than cover those necessary investments and then some. In the upcoming graphic down below, we highlight Amazon’s forecasted free cash flow growth under our bear case (green dots), base case (grey line), and bull-case scenarios (blue dots) over the coming years.

Image Shown: Keeping Amazon’s hefty capital expenditure expectations in mind, we still expect sizable net operating cash flow growth will drive impressive free cash flow growth through the start of the mid-2020s and beyond. Image Source: Valuentum

Another thing we really like about Amazon is its net cash pile. At the end of March 2020, Amazon had $27.2 billion in cash and cash equivalents on hand plus $22.1 billion in short-term marketable securities on the books versus $23.4 billion in long-term debt (and no short-term debt). Having a net cash position during these harrowing times better enables a firm to ride out the storm and provides a nice liquidity position should opportunities arise (such as surging demand for grocery home delivery services, which is a high growth area within Amazon’s e-commerce business).

Key Management Commentary

Here’s what Amazon’s management team had to say on the issue of the firm’s growing consumer staples sales and what Amazon is doing to invest in its workers' safety during the firm’s latest quarterly conference call:

Beginning in early March, we experienced a major surge in customer demand. Particularly for household staples and other essential products, across categories such as health, and personal care, groceries and even home office supplies. At the same time we saw lower demand for discretionary items such as apparel, shoes, and wireless products. This large demand spike created major challenges in our operations network… We increased grocery delivery capacity by more than 60%, and expanded in store pickup at Whole Foods stores from 80 stores to more than 150 stores. And other Amazon teams shifted their focus to directly helping customers and the overall effort to fight the COVID virus… How is all this impacting our business? While customer demand remains high the incremental revenue we are seeing on many of the lower ASP [appears to refer to average selling price] essential products is basically coming at cost. We've invested more than $600 million in COVID related costs in Q1, and expect these costs could grow to $4 billion or more in Q2. These include productivity headwinds in our facilities as we provide for social distancing and allow for the ramp up of new employees. Investments in personal protective equipment for employees, enhanced cleaning of our facilities, our wages for our hourly teams and hundreds of millions of dollars to develop COVID-19 testing capabilities. In Q1, we also had another $400 million of costs related to increased reserves for doubtful accounts. On the flip side, we did see a drop in travel, entertainment and meeting costs, as well as lower marketing as a way to dampen our demand for non-essential items. While we can't have great certainty about what the next few quarters will look like, I'm humbled by the efforts of my fellow Amazonians in delivering essential goods and services to so many people.

Due to Amazon expecting to invest roughly $4.0 billion towards worker safety and related endeavors (billed as “costs related to COVID-19”) this quarter, the firm is guiding for its operating loss/profit to range from an operating loss of $1.5 billion to an operating profit of $1.5 billion on forecasted sales of $75.0 billion-81.0 billion in the second quarter of 2020. We appreciate the planned investments and think that short-term headwinds aside, Amazon will be viewed more positively after committing to seriously helping out its frontline workers, particularly during these harrowing times. Amazon had already temporarily boosted frontline worker pay to reward its employees during the early stages of the pandemic.

There are potential operational benefits here in terms of better workforce retention rates and a more positive brand image in the eyes of consumers, especially after Amazon was harshly criticized in the past for its initial handling of the pandemic (specifically as it relates to its warehouse operations). Please note that Amazon aggressively scaled up the size of its workforce to meet surging e-commerce demand in recent months, which came with some operational hiccups. Additionally, we like Amazon’s forecast for strong sales growth to continue in the short term, as its revenue forecast indicates management is guiding for 18-28% year-over-year top-line growth this quarter.

Concluding Thoughts

We continue to be impressed with Amazon’s growth trajectory and see the firm’s push into the grocery home delivery market and digital advertising space as augmenting that upside. Amazon’s strong technical performance of late is a reflection of its strong fundamental and operational performance, and there’s some room for shares of AMZN to climb higher still from current levels as of this writing.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.