Why Molina Healthcare Stock Is Up 3x Despite Declining Revenue

by Trefis Team

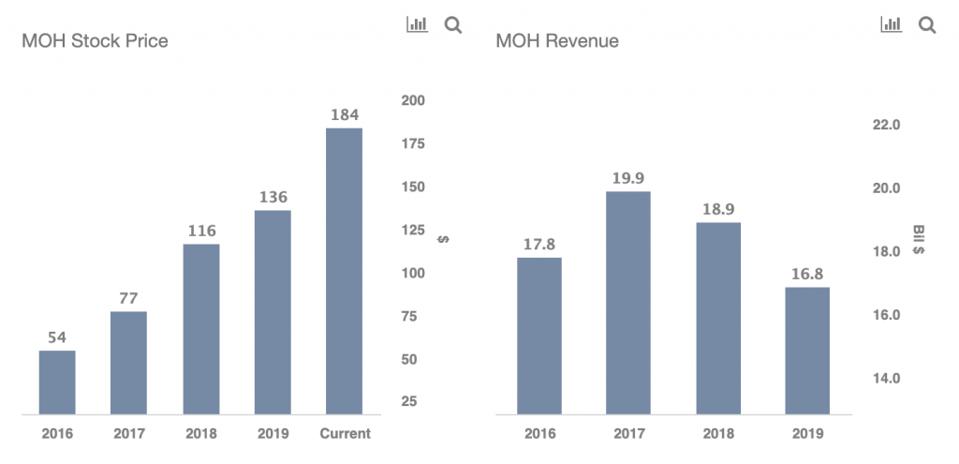

Molina Healthcare’s stock (NYSE: MOH) has gained a whopping 240% since early 2017. But how did the company pull off such impressive gains, as its revenues actually declined 5% over the same period? Well, there is a valid reason, of course. As it turns out, the net earnings margins (adjusted profits as a percent of revenues), expanded 10x from 0.4% to 4.4% between 2016 and 2019. In addition, the company’s P/S multiple has jumped by 190% over the same period. Our dashboard on Molina Healthcare Revenues And Stock Price Change Mismatch provides the key numbers behind our thinking, and we explain more below.

What Brought About A Change In Margins & Multiple?

The expansion in Molina’s net margins was brought about by lower medical costs as well as better operating cost management. The margins going from 0.4% to now 4.4% has meant that the adjusted earnings per share grew a stellar 9x from about $1.28 per share in 2016 to $11.57 a share in 2019. Though revenue declining 5.4% was a a slight drag.

While the bigger change came from margin expansion, the company’s P/S multiple, which grew from 0.2x to 0.5x, also helped. There are two broad factors driving the multiple expansion. Firstly, the higher unemployment rates in the wake of Covid-19 impact on the economy will boost enrollments for the government sponsored healthcare programs managed by Molina. Secondly, earnings growth is also likely to look up in the future, as the company plans to acquire Magellan’s Complete Care, Magellan’s managed care business, taking Molina’s base to 3.6 million members in government-sponsored healthcare programs.

Despite the large 240% stock price move, Molina still appears to be attractive compared to some of its peers, including Humana HUM and Centene CNC , something we detail in our analysis, After 35% Growth In 2020 What’s Next For Molina Healthcare’s Stock?, with the underlying numbers.

Care about health insurance stocks? Do you know that based on historical performance, CVS Health compared to UnitedHealth Group UNH looks more attractive. And why Health Insurance Stocks are poised for gains after Covid-19?

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams