The American Workplace Is Reopening. Are Employers Ready?

by Insights TeamBy Richard Sine

Ready or not, American workplaces are revving into action. Battered by the economic costs of the lockdown, governors are easing closure orders and allowing businesses to reopen. But what will the post-pandemic office look like? Forbes Insights, in collaboration with Zoom, surveyed over 400 senior executives in HR, IT, finance and facilities to better understand how leaders are planning for the return.

The bottom line: Big changes lie ahead in daily routines, office layouts and corporate policies. Some of these changes may last for months or even years. In fact, three-quarters of respondents agreed that workplaces will be “forever changed” by the pandemic. There is much for reopening businesses to do, but executives say they’re up for the task: More than half of executives say they’re at least midway through planning for the reopening, and they’re confident that leadership will collaborate to develop effective reopening plans.

Changing Spaces

Going by the survey results, tomorrow’s workplace will feel a bit like a biohazard containment area. A whopping 89% of executives said their organizations would “require employees to wear a mask and/or gloves during the workday.” Most said they would take other direct measures to reduce employee risk, including providing hand sanitizer or cleaning wipes, increasing office cleaning and providing personal protective equipment, or PPE. A smaller but significant majority of executives said they will check employees’ temperatures at the office or monitor worker health in other ways, such as questionnaires.

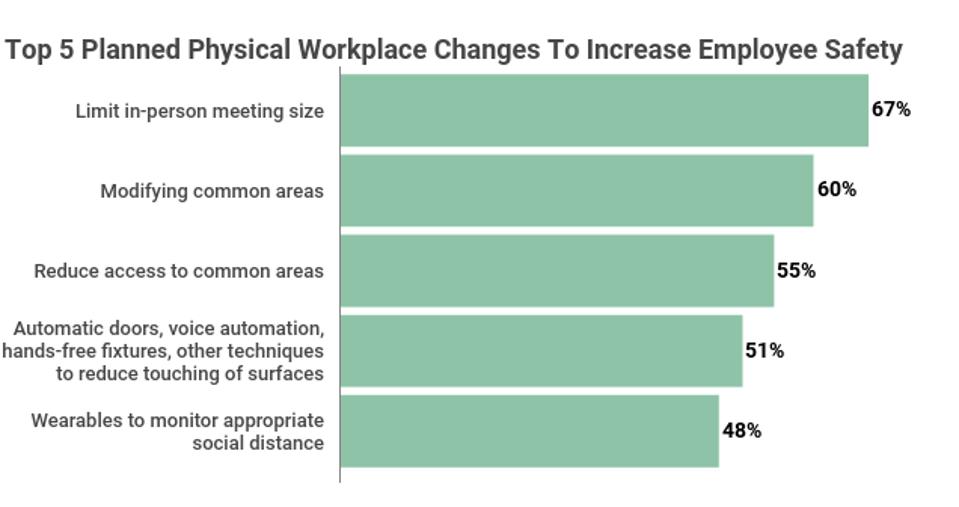

Employers will change our work patterns to minimize close-up interactions. More than two-thirds of executives said they will limit in-person meeting size. About half said they planned to stagger work shifts, work breaks, or office workdays.

The changes could have big impacts on office space decisions, and a knock-on effect on the commercial real estate market. More than half of finance and facilities executives said they were likely to need to delay office space purchase or rent out office space. The most emphatic response: Nearly three-quarters said they were likely to need to add office space to allow for social distancing. Still, that’s unlikely to offset the overall impact to commercial real estate in the near term.

Low-Touch Tech

Technology will undergird the post-pandemic transformation of the American workplace. Video conferencing is clearly here to stay: Asked which productivity tools they would rely on most in the new office environment, 78% singled out video conferencing.

Meanwhile, nearly half of executives said they planned to implement an emerging technology: wearables that monitor appropriate social distance. Wearables could also be used for location tracking and contact tracing. They’re also planning on technologies such as voice automation or automatic doors that can reduce the need to touch surfaces. Plus, almost half planned on using software or hardware to monitor employee productivity—a controversial option due to privacy concerns.

When they re-enter the office, IT executives said they would focus on identifying new IT solutions and implementing new architecture. Remote work is bringing new challenges when it comes to cybersecurity: More than half of IT executives said they would increase cybersecurity training or increase communication on cybersecurity policies and best practices.

New Policies

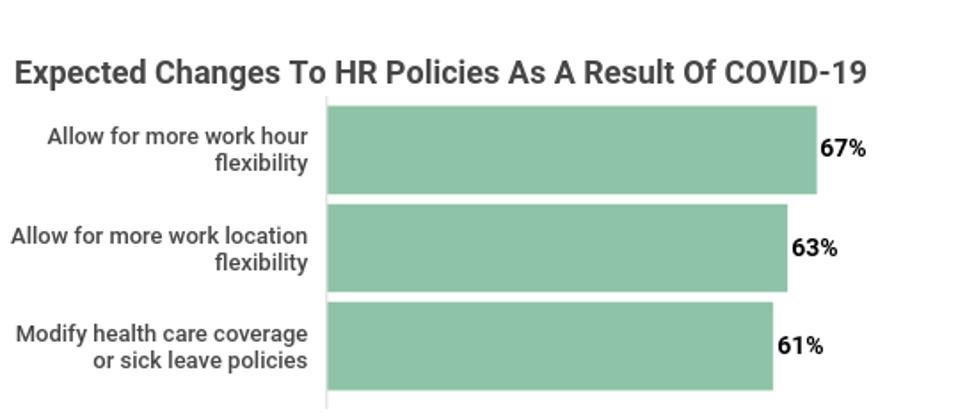

The pandemic is changing employer policies in ways that may outlast the pandemic—especially when it comes to added flexibility and sick leave. Many health experts say sick leave is important for reducing contagion because it encourages sick workers to stay home without worrying about losing income.

How long will all these workplace changes last? Asked to run through a list of changes—PPE, physical office changes, new IT tools or HR policies, business travel bans and virtual conferences— on average, 43% of executives expected changes to last more than 6 months or permanently.

Meanwhile, the pandemic is motivating a wholesale business transformation. Asked how they would modify their operating model upon reopening, 58% said they would adjust worker training, given a reduced or dispersed workforce. More than half said they would revisit their delivery model to ensure social distance. Other popular responses included revisiting their organizational structure and revamping the supply chain to increase resiliency.

Full Steam Ahead

Most executives expressed considerable confidence in their organization’s ability to handle the reopening.

Ninety percent of executives said they were confident that cross-functional collaboration is occurring to make the necessary workplace changes. And most said they were very confident that their organization is adequately prepared in areas including IT, customer service through digital service, culture changes, sanitization and PPE access.

Most respondents believed the funding was in place for their office re-entry and the majority of finance executives also said they had budgets in place for additional changes as the crisis evolves. Asked about the costliest changes, the largest numbers pointed to IT, new HR policies, and PPE or sanitization efforts. Not as many expected that physical office changes would be a big financial lift.

Overall, our respondents seem confident that they can and will reopen successfully. But in most areas of the country, the reopening has just begun, or hasn’t even started yet. Will the new measures be enough to lure in anxious workers, customers or clients? Will they be sufficient to keep spread rates low and prevent subsequent closures? Much uncertainty still lies ahead.