Qualcomm, Qorvo & Jabil: Apple Suppliers Have Been Left Behind From The Rally. Time To Buy?

by Trefis Team

Apple stock (NASDAQ: AAPL) is up about 5% year-to-date, despite the Coronavirus pandemic, driven by its strong balance sheet and fast-growing services business, which makes it a safe haven of sorts. However, most of Apple’s suppliers have not fared as well. Our indicative list of 6 key suppliers for the iPhone – which includes Qualcomm, Skyworks, Broadcom, Jabil, Texas Instruments, and Qorvo remains down by about 10% year-to-date on an equally weighted basis, slightly worse than the broader market.

There could be two broad reasons for this. Firstly, Apple’s iPhone sales could be mixed in the near-term, as there is little reason for people to buy or upgrade to costly smartphones at the moment, and this could weigh on near-term demand for components. Moreover, these vendors are likely to face disruption in their supply chains due to the pandemic, and it could take some time for things to get back to normal. To be sure, these trends are likely to only cause short-term impact, with things picking up in a few quarters. Does this present an opportunity for investors to pick up Apple suppliers at reasonable valuations? We think it does, and provide an overview of some of Apple’s key suppliers below. View our dashboard Trefis Theme: Apple iPhone Component Suppliers which compares some of the key financial and valuation metrics for Apple and its key suppliers.

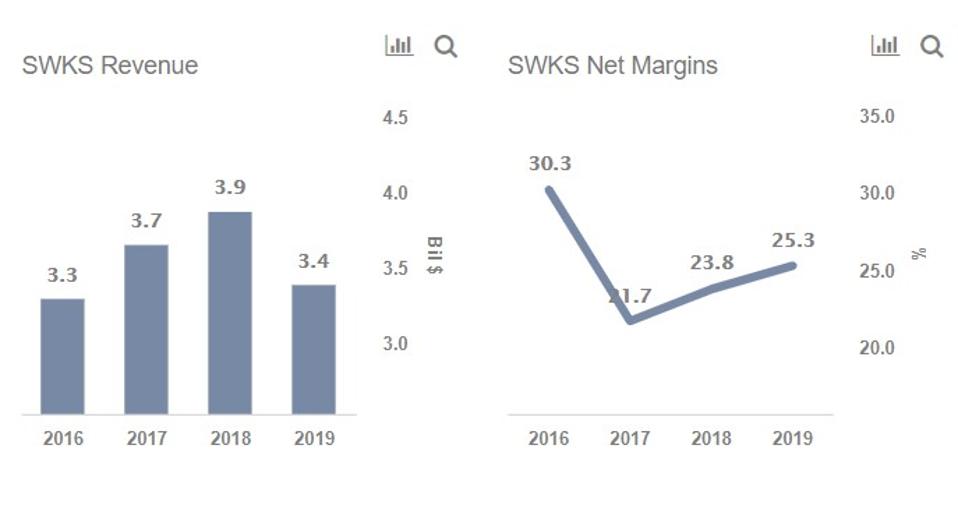

Skyworks (-2% YTD, $19.6 billion market cap) manufactures semiconductors for use in radio frequency and mobile communications systems. While the stock trades at about 24x trailing earnings, despite no revenue growth over the last three years, the outlook for the company could be strong. The upgrade to next-generation 5G networks should stoke demand for higher-end components, driving up the company revenue and earnings. Skyworks, which generates roughly half its revenues from Apple [1] , might stand to gain more than rivals as Apple is expected to go all-in on 5G technology, launching multiple 5G iPhones this year.

Qorvo (-9% YTD, $12 billion market cap), is a semiconductor player that supplies RF systems to Apple. The company trades at relatively high multiples of about 36x, despite tepid revenue growth in recent years. However, the long term picture remains strong, as the 5G cycle drives growth. Canalys estimates that 1.9 billion 5G smartphones will ship in the next five years, overtaking 4G in 2023. Qorvo also stands to gain from increased 5G base-station deployment, which could leverage its Gallium Nitride (GaN) based amplifiers and components. Qorvo generates roughly a third of its revenues from Apple.

Jabil (-25% YTD, $4.8 billion market cap) is a manufacturing firm that makes encasements for Apple’s iPhones and iPad. The smartphone behemoth is estimated to account for roughly a quarter of Jabil’s sales. Jabil stock is down by about 25% year-to-date, making it one of Apple’s worst-hit suppliers. This might make sense, as the company is quite dependent on iPhone volumes and may not stand to gain in terms of value-add over the 5G cycle, unlike other suppliers who could see higher pricing. However, the stock trades at a relatively lower multiple compared to Apple’s other suppliers, potentially making it a better value bet.

Qualcomm (-11% YTD, $88 billion market cap) - the wireless tech major sells application processors, modems, and licenses wireless technology to key handset manufacturers. Last year, the company settled a two-year-long legal dispute with Apple and looks set to become the sole modem vendor for the new 5G iPhones, unlike previous years when rival Intel ate into its share of Apple’s business. The company trades at about 22x trailing earnings, and this appears relatively fair, considering its leadership in the 5G space, with licensing revenues likely to see growth as the next-gen networks ramp-up globally. (related: Qualcomm Stock To Surge Past $90 Post COVID-19 Crisis?)

Did you know Google’s revenue growth rate was roughly 4x Apple’s over the last 3 years, although Apple’s stock price grew at 2x Google’s? Does this make Google a better investment than Apple? Find out in or comparative valuation Is Apple’s 2x Price Rise Vs. Google Justified?

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams