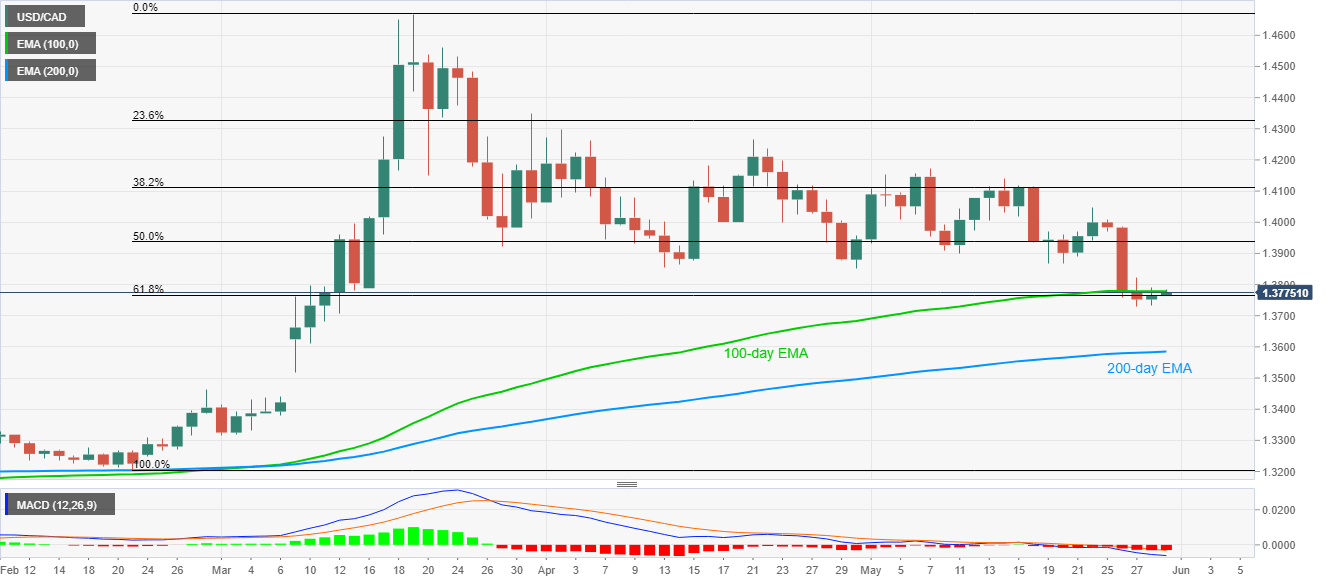

USD/CAD Price Analysis: Seesaws between 61.8% Fibonacci retracement, 100-day EMA

by Anil Panchal- USD/CAD steps back from 100-day EMA, still positive on a day above the weekly low of 1.3728.

- 200-day EMA offers additional support below 61.8% Fibonacci retracement.

- May 19 low, 50% Fibonacci retracement can challenge the buyers.

USD/CAD drops from the intraday high of 1.3785 to 1.3773 amid the initial hour of Tokyo trading on Friday. In doing so, the pair retreats from 100-day EMA but stays above 61.8% Fibonacci retracement level of February-March upside.

Even so, the bearish MACD and a failure to carry the bounce off 1.3728 favors the sellers.

As a result, odds of the pair’s drop to a 200-day EMA level of 1.3585 become brighter if it breaks the immediate supports surrounding 1.3765 and 1.3730.

On the contrary, an upside clearance of a 100-day EMA level of 1.3780 might not help the bulls regain the throne as May 19 low near 1.3865/70 and 50% Fibonacci retracement level of 1.3940 stand all as near-term key resistances.

USD/CAD daily chart

Trend: Bearish

Additional important levels

| Overview | |

|---|---|

| Today last price | 1.3774 |

| Today Daily Change | 11 pips |

| Today Daily Change % | 0.08% |

| Today daily open | 1.3763 |

| Trends | |

|---|---|

| Daily SMA20 | 1.3982 |

| Daily SMA50 | 1.405 |

| Daily SMA100 | 1.3712 |

| Daily SMA200 | 1.3456 |

| Levels | |

|---|---|

| Previous Daily High | 1.379 |

| Previous Daily Low | 1.3734 |

| Previous Weekly High | 1.4114 |

| Previous Weekly Low | 1.3867 |

| Previous Monthly High | 1.4299 |

| Previous Monthly Low | 1.385 |

| Daily Fibonacci 38.2% | 1.3769 |

| Daily Fibonacci 61.8% | 1.3755 |

| Daily Pivot Point S1 | 1.3735 |

| Daily Pivot Point S2 | 1.3707 |

| Daily Pivot Point S3 | 1.3679 |

| Daily Pivot Point R1 | 1.3791 |

| Daily Pivot Point R2 | 1.3818 |

| Daily Pivot Point R3 | 1.3846 |