AUD/JPY Price Analysis: Depressed above 71.00 after Japanese statistics

by Anil Panchal- AUD/JPY fails to extend the bounce off 71.17 much beyond 71.43.

- Japan’s Retail Sales, Tokyo CPI and Unemployment Rate flashed better than forecast results.

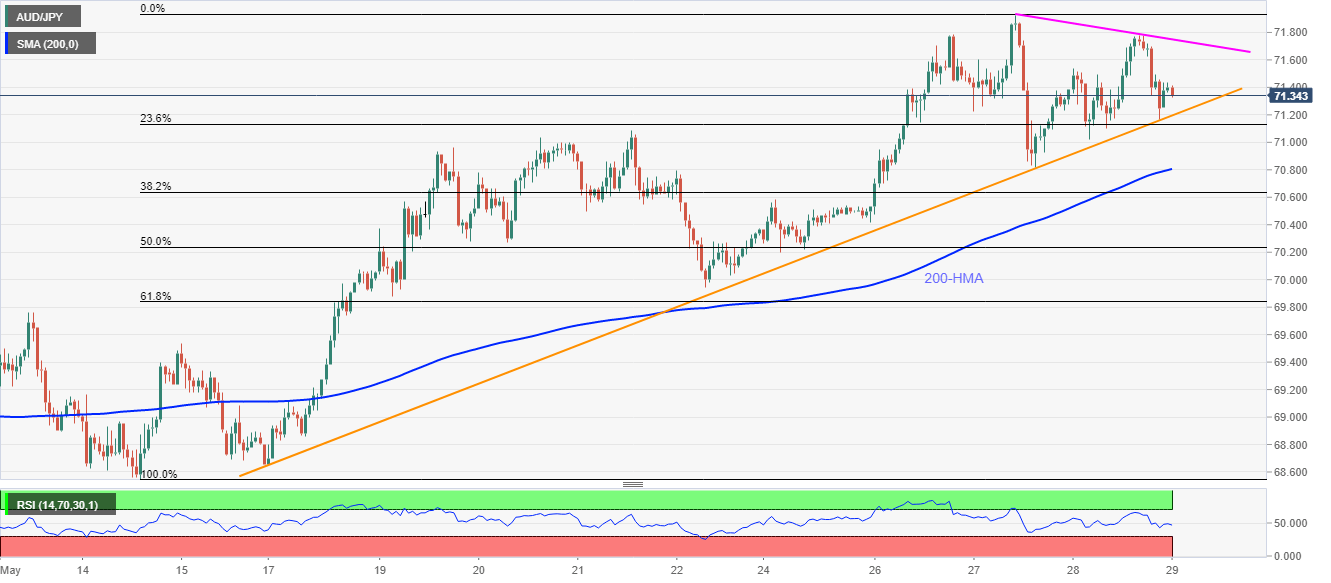

- 200-HMA adds to the downside support below a two-week-old rising trend line.

- Buyers will wait for a sustained break above the weekly resistance line.

AUD/JPY drops to 71.33 after the key economics from Japan recently weighed on the pair amid the initial Asian session on Friday.

Read: Tokyo area May Core CPI +0.2% YoY smashes estimates of ‐0.2%

Even so, the quote stays above an upward sloping trend line stretched from May 15, at 71.20 now, a break of which could drag the AUD/JPY prices towards a 200-HMA level of 70.80.

In a case where the bears dominate past-70.80, 70.00 and May 13 top near 69.75 could become their favorites.

Meanwhile, 71.55 my offer immediate resistance ahead of the weekly falling trend line, currently around 71.75.

Should there be a clear run-up beyond 71.75, 72.00 and January month low near 72.45 may return to the charts.

AUD/JPY hourly chart

Trend: Bullish

Additional important levels

| Overview | |

|---|---|

| Today last price | 71.4 |

| Today Daily Change | -0.04 |

| Today Daily Change % | -0.06% |

| Today daily open | 71.44 |

| Trends | |

|---|---|

| Daily SMA20 | 69.79 |

| Daily SMA50 | 68.39 |

| Daily SMA100 | 70.28 |

| Daily SMA200 | 72.14 |

| Levels | |

|---|---|

| Previous Daily High | 71.78 |

| Previous Daily Low | 71.02 |

| Previous Weekly High | 71.08 |

| Previous Weekly Low | 68.65 |

| Previous Monthly High | 70.17 |

| Previous Monthly Low | 64.4 |

| Daily Fibonacci 38.2% | 71.49 |

| Daily Fibonacci 61.8% | 71.31 |

| Daily Pivot Point S1 | 71.05 |

| Daily Pivot Point S2 | 70.65 |

| Daily Pivot Point S3 | 70.28 |

| Daily Pivot Point R1 | 71.81 |

| Daily Pivot Point R2 | 72.18 |

| Daily Pivot Point R3 | 72.57 |