March quarter GDP growth to show drastic fall; brace for worse in Q1FY21 print

A note by ICICI Bank stated the country's March quarter GDP growth may come to 1.5 percent year-on-year (YoY).

by Nishant KumarThe disruption caused by coronavirus pandemic may have dragged India's January-March quarter GDP number to a multi-year low level, say experts.

The country's January-March quarter GDP is to be released on May 29.

A report by CARE Ratings said the country's GDP growth is likely to be at 3.6 percent in January-March 2020 as economic activity came to a complete halt due to the countrywide lockdown imposed to contain the coronavirus outbreak.

"We expect GDP growth in Q4 to be 3.6 percent with the headline number coming down to 4.7 percent for the entire year," CARE Ratings said in a report.

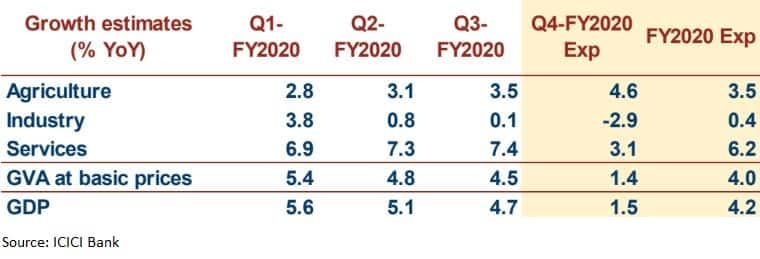

A note by ICICI Bank stated the country's March quarter GDP growth may come to 1.5 percent year-on-year (YoY).

"GDP growth is expected to print at about 1.5 percent YoY in Q4FY20 with a possible downside bias, dipping sharply from the 4.7 percent YoY seen in Q3, on account of the spread of the coronavirus," a note from ICICI Bank said.

"The sharp slowdown in growth over Q4FY20 will weigh on headline GDP growth for the just-concluded fiscal year. We expect GDP growth to print at nearly 4.2 percent YoY in FY20," the note further added.

Joseph Thomas, Head of Research - Emkay Wealth Management points out that the GDP growth in India has been close to the 4 percent level in the last two quarters of the last financial year, mainly on account of the economic sluggishness which the economy entered into earlier on in the last financial year.

Thomas highlighted that some measures were taken by the government and the RBI to redeem the situation, but they were sadly far from adequate for an economy that was precariously poised to slow down further for want of sufficient credit and aggregate demand.

On top of this, the pandemic dealt a severe body blow to the economy consequent to the national lockdown, and the widespread wage cuts and job losses both in the formal sector and the unorganized sector.

In Thomas' view a number of fiscal and monetary measures, initiated by the government and the RBI, focussed more on the supply-side, and much less on the demand side, as a means of propelling the sagging demand and falling employment levels.

As the lockdown started in the last week of March, Thomas believes the GDP number may not reflect the actual ground reality currently prevailing and the full impact of the lockdown on the main sectors of the economy.

"The rate of growth for the last quarter may still be in the lower single digit, while the numbers for the current quarter may reflect the actual distress in the economy," he said.

Jyoti Roy, DVP Equity Strategist, Angel Broking concurs to Thomas' views.

"While the Q4FY20 numbers will give us some glimpse into the slowdown in economic activity it will not offer a true picture given that the full brunt of the lockdown was felt from April 2020 onwards which is reflected in the auto sales and the PMI numbers for April. While most auto companies reported almost zero sales in April the services PMI collapsed to 5.4 while the manufacturing PMI fell to 27.4.from 51.8 in March," Roy said.

As per a Reuter's poll, India's economy is likely to have expanded at its slowest pace in at least eight years, partly as a result of the coronavirus clampdown.

The poll of 52 economists, taken May 20-25, indicated India's economy grew at 2.1% in the March quarter from a year ago, it is weakest since comparable records began in early 2012, and sharply slower than 4.7% in the prior three months, reported Reuters.

The GDP growth in FY20-21 is expected to remain in the negative category, with some pick up in the second half, Reserve Bank of India Governor Shaktikanta Das said on May 22.

On the other hand, former RBI governor Duvvuri Subbarao said that country's economy is likely to decline by 5 percent in the current fiscal but may expand by around 5 percent in the next financial year.

Rating firm Crisil on May 26 said the Indian economy may shrink by 5 percent in FY21, adding this recession could be the country's fourth since Independence and perhaps the worst to date.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.

Download a copy Get best insights into Options Trading. Webinar by Mr. Vishal B Malkan is Live. Watch Now!