Investors can participate in NIIT Tech share buyback through these 2 strategies

Given, the stock to perform well going ahead owing to increase in the order inflows & strong growth outlook, arbitrage benefit of 15-20 percent can be achieved easily in one month as on closing price (Rs 1,473).

by Moneycontrol ContributorManali Bhatia

NIIT Technologies has approved buyback of 19,56,290 fully paid up equity shares of face value Rs 10 each representing up to 3.13 percent of the total number of equity shares. The buyback is fixed at a price of Rs 1,725 per equity share for an aggregate amount of up to Rs 337.46 crore via tender offer. NIIT Technologies is buying back its shares at a premium of 17 percent to the current price of Rs 1,473.

The buyback offer opened on May 29 and will close on June 11. As record date has passed, only such shareholders will benefit who already had its shares as on March 12, the record date.

Has NIIT Tech priced its buyback (Rs 1,725 per share) reasonably?

Surely, the buyback price of Rs 1,725 per share is fair. Company's promoter being Hulst BV, an investment holding company registered in Netherlands, is a part of BPEA (Baring Private Equity Asia). Being an MNC, it commands good corporate governance and thereby by returning the excess cash they generate wealth for shareholders at the right time. Thus, this buyback price of Rs 1,725 is fair and justified.

NIIT Technologies share buyback issue opens; 10 key things to know

Should one tender shares in NIIT Technologies buyback offer?

As record date has already passed, therefore, retail investors (individuals holding up to 2 lakh equity share capital) who already hold shares as on March 12 may tender their shares in buyback. There are two ways to participate:

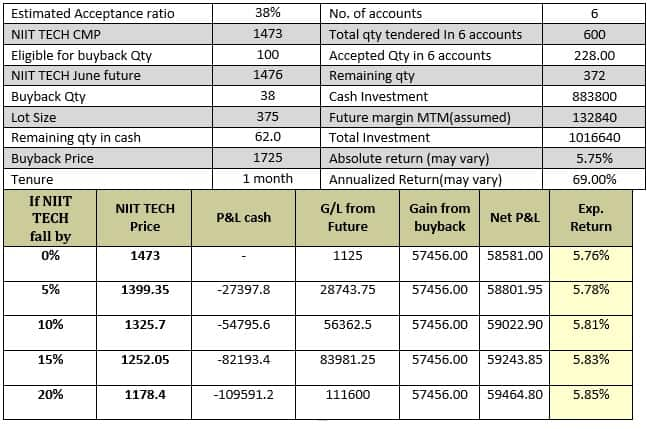

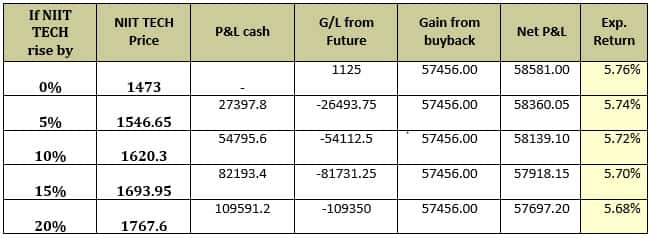

Case A: Hedging through future

If a shareholder already has 6 accounts with a minimum of 600 shares then hedging is possible. For example, a retail investor has 100 shares. Estimating the acceptance ratio at 38 percent, the remaining 62 percent shares would be hedged through future. Thus, such amount needs to be tendered in 6 accounts to match the future lot size of NIIT tech of 375 shares.

Thus, by hedging his shares, an absolute gain of 5-6 percent can be achieved in one month.

Case B: Gain through tender offer – direct market purchase

In this case, if a retail investor holds share upto Rs 2 lakh, then he may tender shares and the avail the arbitrage benefit. Already, buyback is at a premium of 17 percent to the current price of Rs 1,473. As we have estimated the Eligibility ratio to be around 20-25 percent, the estimated acceptance ratio could be around 35-40 percent (assumed higher by 60-70 percent from eligibility ratio). Hence, assuming 38 percent of his shares being accepted in the buyback, the remaining quantity can be purchased from the open market. Hence, a good arbitrage opportunity exists. Given, the stock to perform well going ahead owing to increase in the order inflows & strong growth outlook, arbitrage benefit of 15-20 percent can be achieved easily in one month as on closing price (Rs 1,473).

Why did NIIT Technologies prefer to go for buyback?

The buyback would help NIIT Technologies to:

1> Improve the return on equity by reduction in the equity base, thereby leading to long term increase in shareholders' value and

2> Help the company to distribute surplus cash to its eligible shareholders

What is NIIT Technologies' Outlook?

NIIT Technologies reported strongest ever quarter with good set of numbers meeting estimates. Along with that the positive management guidance for growing sequentially in Q2 FY21 bodes well for the company. Despite the COVID-19 situation, company has the largest order intake at $180 million for the 4th quarter and $468 million of firm business to be executable over next 12 months. Though, company expects to decline single digit sequentially in Q1 FY21, the overall outlook remains stable and attractive.

Moreover, eyeing on the company's promoter holding it is around 70.10 percent acquired by the Hulst BV, an investment holding company registered in Netherlands, a part of BPEA making NIIT Technologies more lucrative as it would command higher P/E ratio being MNC having good corporate governance.

The author is Senior Research Analyst at Rudra Shares and Stock Brokers.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.

Download a copy Get best insights into Options Trading. Webinar by Mr. Vishal B Malkan is Live. Watch Now!