Too early to celebrate value comeback

by David Llewellyn-SmithVia the excellent Damien Boey at Credit Suisse:

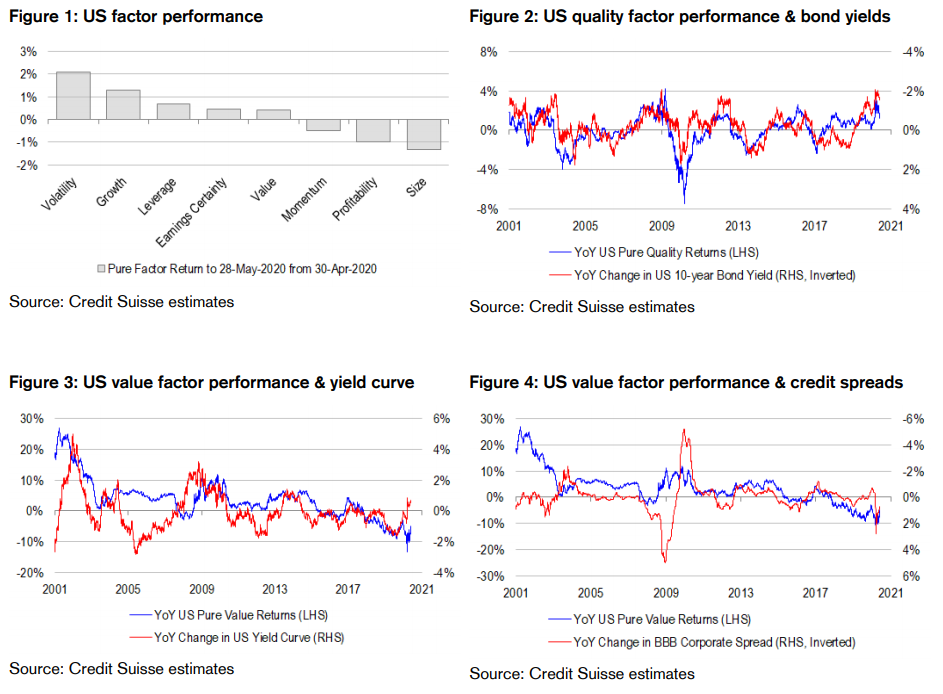

• Value bounces hard. Over the past few days, we have seen value factors outperform very sharply. Sectorally in Australia, high yielding banks have led the charge, while healthcare stocks have been the laggards. The bid for resources stocks has also unwound, strangely on concerns about US-China tensions on the one hand, but reduced demand for gold as a safe haven on the other. The overall story has been one of faith in the system returning as policy makers try to re-open their economies. The sharpness of factor and sector rotations has been impressive, rivalling the “great” value rotation we saw in late 2019.

• Value oversold? Historically, value factors have tended to outperform whenever the yield curve has steepened or whenever credit spreads have narrowed. And in recent weeks, we have seen the yield curve steepen, and credit spreads compress. However, value has underperformed (until the past few days), despite these developments. In the circumstances, a case has formed that value has become oversold, and due for a bounce.

• Bigger picture, momentum and value are not offering much diversification. As sharp as the rotation from the past few days has been, the bigger picture for May is that value has only slightly outperformed, while momentum has slightly underperformed. But although momentum and value are naturally opposites, the equally-weighted combination of the two factors has actually subtracted from alpha over the month. Indeed, in “pure” terms, the combination has been consistently subtracting alpha since 2018! Yet they have remained the building blocks of conventional quantitative funds. Our view is that factor rotation has become a worthwhile exercise, and that factors should be considered from both long and short angles.

• Still long quality, short momentum and short value. As impressive as the value bounce of the past few days has been, we are not yet believers in the argument that the fortunes of the factor are genuinely turning around. Value is an anchoring strategy based on the idea that fundamentals drive asset prices rather than the other way around. And in turn, this requires an environment without de-leveraging pressure, because in de-leveraging regimes, asset prices drive earnings, dividends and book values lower, unhinging the anchoring properties of the factor, and even making it work perversely. Recent yield curve steepening and credit spread compression support the view that de-leveraging pressure has abated. But note that while the Fed has won the battle against illiquidity, it has not yet won the war on insolvencies. And longer-term, current activities could prove quite unsustainable should inflation return in earnest, either raising the prospect of inflation hedges running rampant, or the spectre of premature tightening of financial conditions, and an unravelling of markets like we saw in March. Therefore, we are not yet convinced that de-leveraging has truly ended to support sustained value outperformance. That said, we recognize tactical bounces from time to time, and are protecting our model portfolio against these by being short momentum as well as value. We remain long on quality – not because we think that bond yields will fall a lot further, but because there are still downside risks to the economy and earnings to navigate, as evidenced by lingering real yield curve inversion. Also, we note that there is not of room for volatility gauges (eg the VIX) to move sustainably lower. To be sure, we could see an undershoot in the VIX near-term, supporting a compression of the equity risk premium relative to the risk free rate, and the valuations of high-beta cyclicals over low-beta defensives. But the VIX is currently very close to fair value, all things considered, meaning that the cyclicals-defensives rotation could lose a little steam in the coming quarters … Interestingly, had we not positioned our model portfolio to be short momentum and value as well as long quality, we would not have had much protection against the recent rotation, because quality factors have not made a lot of money of late – but shorting momentum and value factors has made up for some of the missing alpha generation!\

David Llewellyn-Smith

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geo-politics and economics portal.

He is also a former gold trader and economic commentator at The Sydney Morning Herald, The Age, the ABC and Business Spectator. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Latest posts by David Llewellyn-Smith (see all)

- Labor trumpets treason - May 28, 2020

- Aussie capex expectations sink - May 28, 2020

- Australian dollar starts to labour as stocks rocket on - May 28, 2020

There are 11 words left in this subscriber-only article.