Coronavirus Stock Market Bargains: Xerox Stock

by Alon ZieveSummary

- Xerox stock has lost $4.5B of value in the recent selloff.

- Forward-looking estimates indicate that only $2.7B of value loss was warranted.

- XRX has poor price momentum at the moment.

As a long standing fan of Seeking Alpha Author Ploutos, I was intrigued by his recent article that looked at the 50 worst performing stocks since the Coronavirus Stock Market lows. In particular, I looked for stocks in this list that had been hit in the short term by coronavirus but whose industry is likely to be unchanged in the long term. This list should include some deep value Coronavirus Stock Market bargains. Xerox (NYSE:XRX) jumped out as such a stock. XRX stock has been impacted by the closure of offices. My thesis is that in the long term, even if remote working becomes more prevalent, office equipment will always be needed by companies. Employees that work remotely will still need the same equipment. Dispersing the workforce may actually increase demand for office equipment.

Coronavirus Stock Market deep value bargains

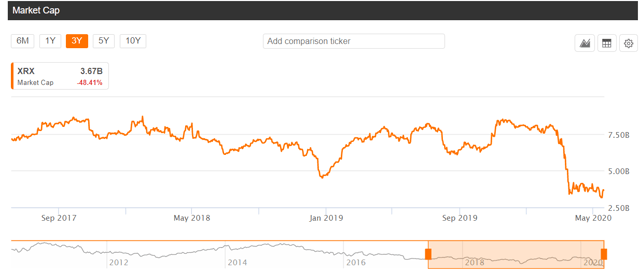

Xerox stock has lost 52% of its value since the beginning of the year. That loss of value happened almost exclusively during the Coronavirus Stock Market crash. Below, you can see how that looks in terms of market cap that was wiped out.

Source: Seeking Alpha

XRX lost $4.5B of market cap between Feb. 13, 2020, and the date of writing this article. Below, I analyze whether that value was justifiably wiped out, or whether Xerox stock is currently trading at bargain prices after the Coronavirus Stock Market sell-off.

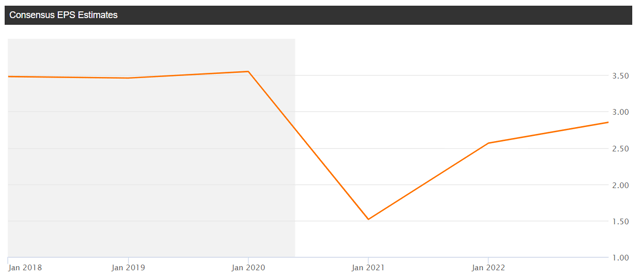

Xerox had an EBITDA of $1.5B in 2019. In Q1 2020, the EBITDA was $158M. Over the past 5 years, the EBITDA has consistently been around $1.5BM, averaging $1.46B. Q1 is an indication the XRX EBITDA is unlikely to fall below zero. This is confirmed by analyst EPS estimates.

Source: Seeking Alpha

Extrapolating the EPS estimates for 2020, EBITDA is expected to come in at around $0.5B. This translates to $1B of lost earnings this year. Looking forward to 2021 and 2022, analyst estimates are that earnings come in 20% lower than historical levels.

In a bad scenario, let's assume that XRX earnings are depressed by 20% forever. On top of that, let's assume that 2020 earnings come in at $0.5B instead of $1.2B at that 20% level, i.e. a further loss of $0.7B this year. This can be translated to valuation impact by deducting 20% of the pre-COVID-19 Enterprise Value and deducting a further $0.7B. This totals $2.7B, significantly less than the $4.5B of market cap that has been lost. This would indicate that Xerox stock is indeed trading at deep value and is a Coronavirus Stock Market bargain.

Perhaps, for this reason, Seeking Alpha's Quant Ratings have XRX at A+. Interesting to note that profitability is rated at A-. Momentum is at F due to recent performance, which significantly impacts its overall Quant Rating.

Other Seeking Alpha authors, such as Chris Lau, have also made the case for why Xerox is trading at bargain prices.

Xerox stock has been a consistent dividend stock

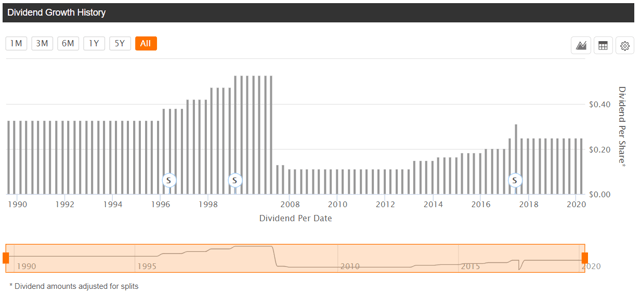

Xerox stock has been a consistent dividend payer, cutting its dividend only 3 times in the last 30 years. Each cut was during stock market crash, the most significant cut being in 2000.

Source: Seeking Alpha

XRX stock currently 5.8% on a forward looking basis and has a payout ratio of 66%.

Should I buy Xerox stock?

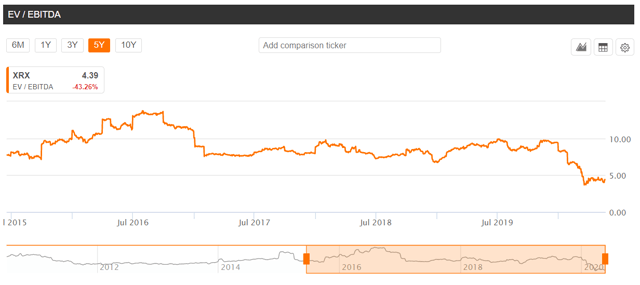

The analysis above indicates that Xerox stock is trading at bargain prices. The EV/EBITDA ratio is also at around 50% of where XRX has typically traded.

Source: Seeking Alpha

One key question as to whether Xerox is a buy is whether this is a good entry point. The Seeking Alpha Quant Rating puts an extremely high emphasis on momentum. When I ran a screen of the highest Quant-rated stocks, the factor rating that is consistently high is the momentum rating. The EPS revisions factor rating comes in second. The logic is that even if a stock is trading at deep value, if the market doesn't recognize that, it could take a very long time to realize that value. Momentum gives an indication of whether the market recognizes that value.

Impact of coronavirus on Xerox core business

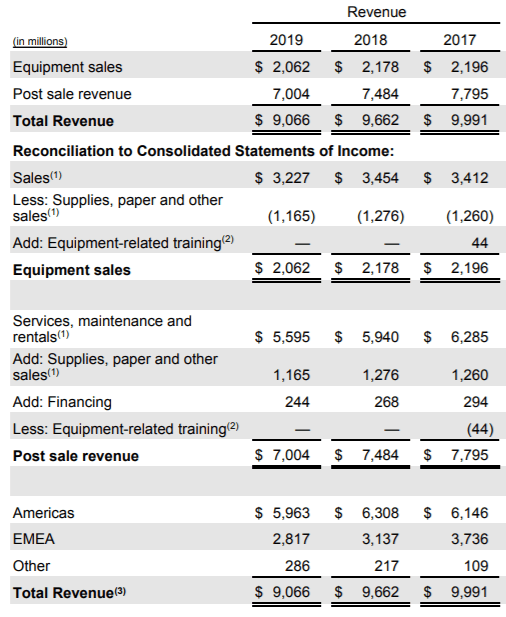

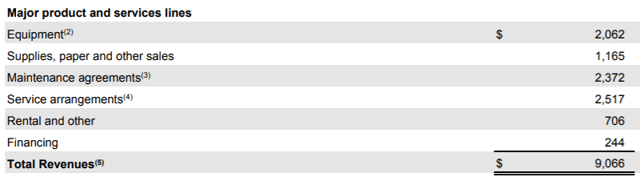

Xerox has an international footprint and a full lifecycle business model. In assessing the impact of COVID-19, it is necessary to understand the revenue streams.

Source: Xerox 10k

Geographically, two-thirds of the business is in the Americas, with one-third in EMEA (almost entirely Europe). More importantly, 77% of the revenue is from post-sale services, largely contract revenues for equipment, usage and maintenance. 36% of revenues are from non-contract sales - equipment, supplies and paper.

Source: Xerox 10k

In the Q1 10Q, Xerox discusses the impact of COVID-19.

Total revenue of $1.86 billion for first quarter 2020 declined 14.7% from first quarter 2019, including a 0.8-percentage point unfavorable impact from currency. The decrease in revenue reflected a decrease of 11.4% in Post sale revenue, including a 0.9-percentage point unfavorable impact from currency, and a decrease of 27.5% in Equipment sales revenue, including a 0.5-percentage point unfavorable impact from currency. As previously noted, the economic disruption caused by the global COVID-19 health crisis significantly impacted our first quarter 2020 revenues due to business closures during the month of March that impacted our customers' purchasing decisions, and caused delayed installations and lower printing volumes on our devices.

In the outlook for 2020, the 10Q further details the impact.

As a result of the uncertainty created by the global COVID-19 health crisis, we are withdrawing our previously disclosed outlooks for full year 2020 revenue, earnings, operating cash flow and capital allocation as disclosed in our 2019 Annual Report. At this time, we remain committed to paying our dividend on common shares and our policy of returning at least 50% of operating cash flows, after capital expenditures, to shareholders.

And finally,

The global COVID-19 health crisis significantly impacted our first quarter 2020 financial results due to business closures during the month of March that impacted our customers' purchasing decisions and caused delayed installations and lower printing volumes on our devices. The third month of any quarter is typically our strongest, when the largest proportion of equipment is sold and profit is recorded, therefore our first quarter 2020 was significantly impacted by the ramping up of office closures in March which limited our ability to deliver and install equipment. Further, as more businesses required employees to work from home the use of Xerox equipment declined, impacting our post sale revenue. While we continue to implement actions to mitigate the effect of this crisis on our business and operations, the uncertainty around the duration and economic impact of this crisis, makes it difficult for the company to predict the full impact on our business operations and financial performance. We have modeled the potential impacts on our business of several recovery scenarios. Our base model assumes the greatest impact to our revenues from business closures to be during the second quarter, with an inflection point late in that period, and a gradual recovery during the third quarter. For the fourth quarter, we expect to get closer to our planned levels for that period. The most significant near-term impact from the crisis is on our equipment and unbundled supplies sales which are transactional in nature. Sales are expected to decline significantly as businesses hold off or delay purchases during the closure period. However, we expect this portion of the business to rebound in the second half as businesses reopen. The impact on revenues from lower equipment and supply sales is somewhat mitigated by bundled services, which are more contractual in nature. Our bundled services contracts, on average, include a minimum fixed charge and a significant variable component linked to print volumes. The variable charges are impacted by our customers' employees not being in the office and using our equipment due to current lock-down restrictions, however, we expect the contractual relationship with our customers will enable us to ramp up quickly for them when businesses resume operations. We expect that as closures are lifted, we will see more normalized trends emerge over the course of 2020.

The biggest impact to revenues is on the transactional portion of equipment and supplies. This is limited to 36% of the revenue stream. In addition, it is likely that if remote work proliferates, then other Xerox equipment will be sold and deployed to enable work from home. The analyst estimates of a 20% long term revenue impact to the business represent a 56% impact to this business line. This seems extremely unlikely. Xerox itself speaks about a recovery by Q4 this year.

Xerox's declaration that they intend to continue paying the dividend is putting its money where its mouth is. If Xerox did not believe in a fast recovery, it would immediately suspend its dividend.

Xerox's revenue footprint, combined with its statement, indicates a fairly rapid return to business as usual. This, combined with the initial analysis that indicates an overreaction in the selloff, suggests that Xerox is a buy. It is very hard at the moment to get a read on whether the market will recognize the opportunity any time soon. For that reason, whilst I think Xerox stock is trading at very attractive valuations, I'm probably not going to buy yet. I am putting it on my watchlist, and when there are signs that the stock may start trading up, I will consider a buy. It is also definitely a stock I will consider buying if we have a second stock market crash.

If you liked this article, please follow me with the follow button at the top of this page.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in XRX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.