Yext: Avoid At These Levels

by Adam SternSummary

- Shares have rallied over 75% off its April lows, but the price today is unsustainable at these levels.

- Yext has been given worse reviews than its competitors, which worries me about the moat it can build around its products.

- With its lengthy path to profitability getting longer and with the future outlook being weaker, your capital can see better returns elsewhere.

Editor's note: Seeking Alpha is proud to welcome Adam Stern as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

Why should Yext be avoided?

The current market cap for Yext, Inc. (YEXT) is unjustified given its declining margins, heavy share dilution, bad reviews, and how it is valued compared to its peers. Shares have rallied considerably since its April lows, but at this share price, there is still a lot of things that need to improve significantly to justify the current valuation. At the least, operating margins must turn positive in the next 3-4 years, losses must stop increasing, and estimates have to stop getting lowered for Yext's NPV to get to its current share price.

Competition

There is no clear competition for Yext from a company that offers all the products it has, but they do face a lot of competition from companies that specialize in their products. They have many products that are not as highly rated as their competitors. I used G2, the leader in software reviewing sites, for my base on reviews and I found that it consistently rated below many of its competitors. All the Yext's major competitors rate higher than it in the areas it has products in, such as SEO, reviews, site search, and reputation.

| G2 Rating | |

|---|---|

| Yext | 4.2 |

| Competition for SEO | |

| SpyFu | 4.7 |

| Moz Pro | 4.50 |

| Reviews | |

| BirdEye | 4.93 |

| Site Search | |

| Algolia | 4.59 |

| Reputation | |

| BrightLocal | 4.50 |

Source: G2 Yext

I found it odd for Yext to offer products about managing reviews and building a good reputation online, while they cannot do that for themselves. Yext helps businesses gain a better online presence with their SEO optimization, but when you search "best SEO optimization companies", they are not found on the first five pages of Google. When researching on the many companies in the SEO optimization market, I can across two articles that were high on Google search results, DreamHost's "15 SEO Tools to Optimize Your Website for Success in 2020 and DAN's "Top SEO Companies in the USA", and Yext was not mentioned in either article. For Yext to base much of their company on helping businesses build a reputation and having a better online presence in search engines while not being able to do it for themselves concerns me about its ability to build a moat around its products.

Valuation

When investing in software companies, I try to invest in companies whose customers love the product, because it is hard for businesses to cut products that they love using in their workspace. I also look for software companies that have a moat, or are building a moat around their products because, as Warren Buffett said best, a moat creates the ability to "maintain competitive advantages over its competitors to protect its long-term profits and market share from competing firms." The problem I see for Yext in the future is that they will have little to no moat, and with the competition that is already here today; their overall margins will struggle to improve in a significant way.

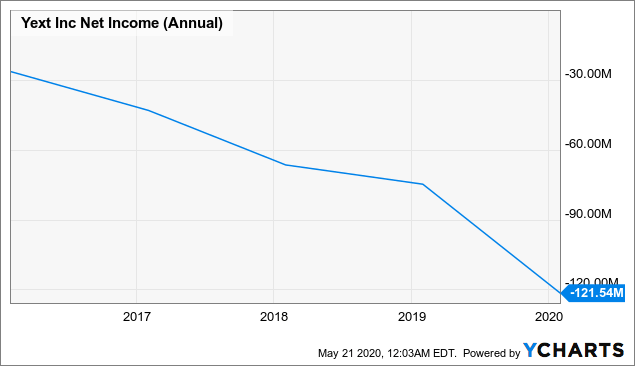

Yext, like many software companies, drives most of the cash they receive back into their business through sales & marketing and research & development to fuel future growth. Since they are using all the cash they receive to invest back into themselves, they have had losses in each of the past five years. Net income has now been accelerating negatively for five years too, which is concerning because it is showing that it cannot grow its revenue significantly without increasing its losses.

Data by YCharts

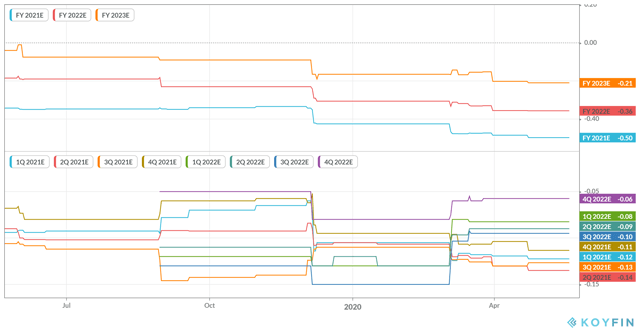

Increasing losses does not always concern me in a company, but increasing losses along with decreasing estimates gives me weariness. Yext's Non-GAAP EPS numbers have been cut in half over the past year and this constant decrease in estimates of EPS, along with EBITDA and revenue, has given me no real idea when earnings will start showing up. Since June of last year, estimates of Non-GAAP EPS have been on a decline. This decrease in estimates has been a result of poor sales execution and a weaker outlook and I worry how much estimates can improve in the future with a large number of their customers in the hospitality and food industry, which have been greatly hurt due to the coronavirus.

Source: Koyfin

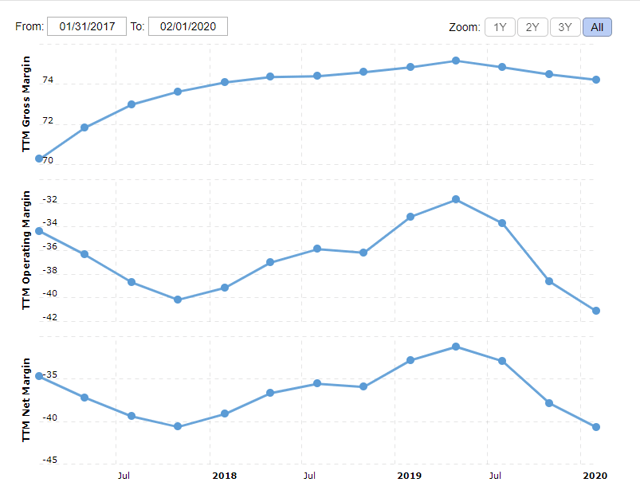

Over the past few quarters, Yext has had declining gross, operating, and profit margins. In most cases when a software business starts to scale, margins will improve if the business truly scales, and with Yext trying to scale up, it has had its margins decline and decline by a lot. In its Q4 Earnings Release, the company attributed its decrease in operating margins for this year with the increase in employee-related costs as well as the impact of new lease arrangements. In the next few quarters, it will be interesting to see how margins hold up during this pandemic and after it. If the company cannot improve its operating margin especially over the next 2 years, shares will suffer.

Source: Macrotrends

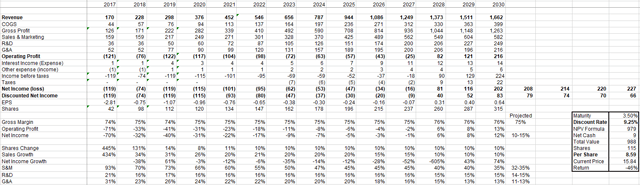

When creating an NPV model, I used their WACC of 9.25% and used estimates from Koyfin to help complete my model. My EPS is a bit different from the non-GAAP EPS estimates because I used GAAP in this model and stock-based compensation is included in GAAP. Since I am accounting for stock-based compensation, I used the share count off the most recent 10-K. According to my model and based on today's estimates, Yext is overvalued and that the current NPV is $8.59. With such a low NPV, I would stay away unless you believe that it will majorly outperform its estimates.

(Author's own spreadsheet using SEC filings and Koyfin estimates)

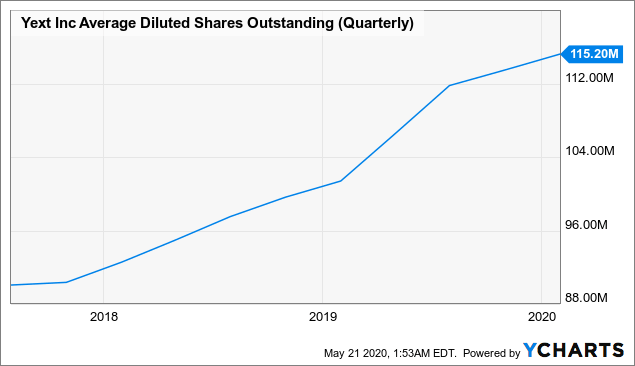

Heavy share dilution is also a risk when it comes to investing in Yext. Most of this share dilution comes from stock-based compensation. In 2019 alone, stock-based compensation was $68 million, increasing from 2018 of $44 million and 2017 of $22 million. Over the past 3 years, the share count has risen over 25% and with the current share price quite low, Yext will have to dilute more shares to keep their compensation plans attractive. When the company starts making profits, investor's shares will be heavily diluted by that time, which will mean current investors will get a smaller piece of the pie of the earnings.

Data by YCharts

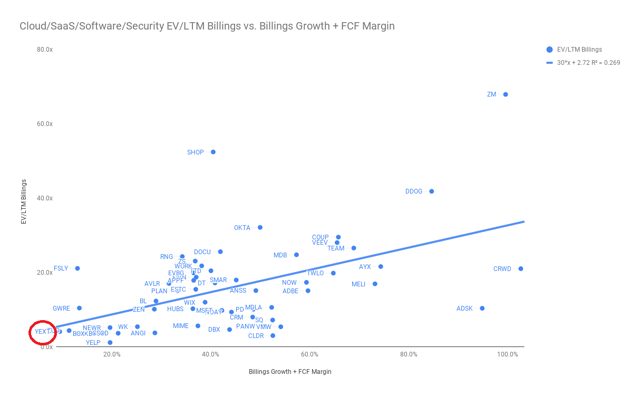

Compared to many other software names, Yext may seem cheap with a P/S of 5.5, but actuality it is not. The reason the market has given such a low valuation is that its margins and outlook are dim at the moment. Comparing the margins to other software companies, Yext's margins are quite low. Its gross margin is in-line with the software industry, but its operating margin of -37.5% is drastically lower than the average operating margin of 24.1%. Its P/S is justified when you take into the fact of billings growth + FCF margin because billings growth + FCF margin takes into factor at what cost companies are growing. Yext has a low billings growth + FCF margin in the software industry and their multiple of P/S will not expand if their billings growth + FCF margin does not expand.

Source: EnergyCredit1

Conclusion

Yext processes many products that can help businesses with helping them gain a bigger and better online experience, but that alone does not justify the current valuation. The company has many competitors and those competitors have gotten better reviews and higher satisfaction than Yext. Margins are declining and do not look to be positive for a long time. Compared to its competitors, Yext has a low P/S with billings growth over 25%, but unlike other software companies, they have had a hard time scaling their operations without heavily increasing losses. Things that could change my investment thesis on Yext is if their margins and losses start to improve and if their products start building a moat. Until then, I will remain bearish and will put my capital to work elsewhere.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.