Hershey: Strong Cost Advantages Will Power The Company Forward

by Stefan OngSummary

- Hershey has experienced steady growth over the years due to its large market share in the United States.

- The company has shown a willingness to innovate in online channels and healthier alternatives.

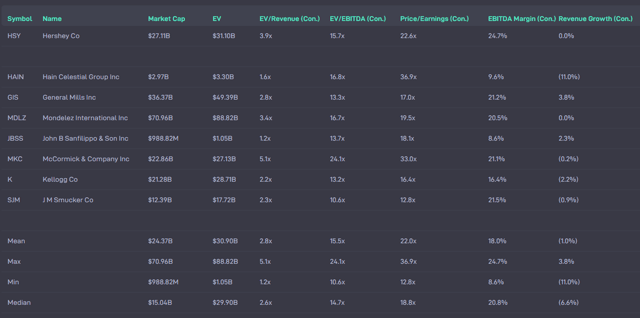

- Hershey appears to be more expensive than its peers due to its stronger consensus estimates.

The Hershey Company (NYSE:HSY) is a strong investment choice due to its high returns on capital stemming from cost advantages. The company also has a steady track record of growth with initiatives in investing for the future. Potential investors would have to pay forward 15.7x EV/EBITDA for a company with a much stronger upside than its peers. Despite some risks navigating through the current uncertainty, Hershey has ample free cash flow ($1B annually) to raise capital if necessary.

Hershey's strong brand has contributed to steady growth

Hershey's has well-known brands throughout the world like Hershey's and Reese's and Kisses. But the company is especially dominant in the United States chocolate market, where it holds over 40% market share. According to research, the company is also ranked 4th and 5th as the most loved brands by kids and parents, respectively.

(Source: Investor Presentation)

With its strong brand portfolio, the company has grown revenues steadily from $5.6B in 2010 to $8B in 2029 at a compounded rate of 3.6% annually. This growth has been powered by Hershey's ability to take share from its competitors. Despite Hershey being categorised mostly as an indulgent product, it shows the company is a trusted brand with customers who are unwilling to risk an unproven competitor.

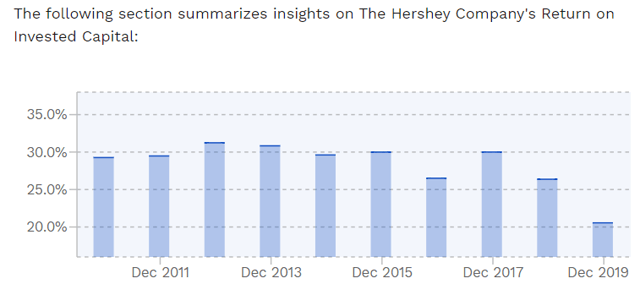

Growth also delivers more value if Hershey's return on invested capital is higher than its cost of capital. Given that the company's return on invested capital has been higher than 20% over the past 10 years, which exceeds its average cost of capital of roughly 7%, growth has been creating value for Hershey's.

(Source: Finbox)

Hershey's also has cost advantages relative to smaller peers

With a high market share in the United States, Hershey's is a crucial partner for retailers. These retailers would not want to risk running out-of-stock situations with startups despite potentially making more money from them. The scale provided by a large retail presence allows Hershey's to invest in products and relationships. With production and distribution advantages, the company is able to negotiate great terms with retailers while strategising methods to maximise retailers' volume and margins through Hershey's own brands. These cost advantages allow Hershey's to replicate competitors' products at a lower cost with larger shelf space, which creates high barriers to entry. With these advantages, Hershey's has gradually grown its operating margins from 17.7% in 2010 to 20.5% in 2019.

The company is investing in healthier alternatives and online presence

Future sales growth will likely be driven by the trend towards consumer preferences for healthy and convenient snacks. Hershey's is also riding on the trend with the acquisitions of Amplify and Pirate brands. These brands are already accelerating within Hershey's portfolio, with Skinny Pop currently the sixth-largest brand within Hershey's.

The company also understands the need to cater to consumers who are shifting their purchases online. Hershey's has innovated on its packaging to appeal to online shoppers to ensure that the product is clearly visible from the web images. The company also focuses on large, multi-pack bars for the impulse buyer online. This provides an indication that the company understands the need for innovating in this online channel despite its close relationships with retailers.

(Source: Investor Presentation)

Impact on long-term prospects

With its track record of growth and ability to invest in future trends, Hershey is likely to see a 3% to 4% average annual sales growth for the next 10 years. Cost advantages have led to a gradual improvement in operating margins, and we believe this trend will continue to roughly 22-23% before it stabilizes. This trend is due to the company managing its operations more efficiently and some leverage from online channels.

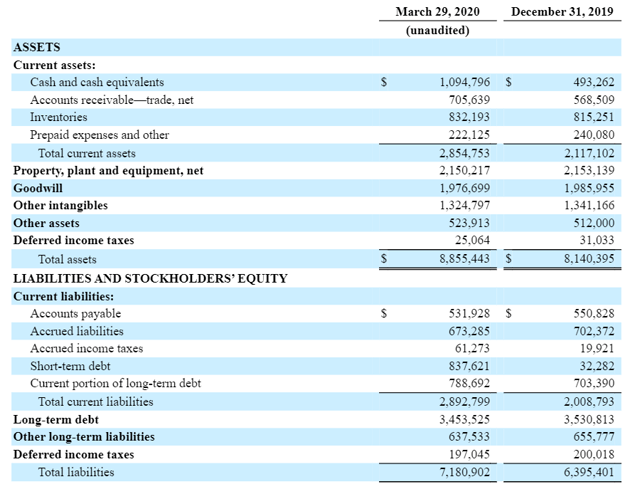

Balance sheet

Hershey's has about $1B in cash, $837M in short-term debt, and $3.4B in long-term debt. Being a mature company, this capital structure is acceptable as seen from their A credit rating. A large part of that rating comes from the strong free cash flow generation ability from Hershey, which exceeded $1B in the past 2 years. Given its long track record of profitability, Hershey's should have no issue raising more capital if needed. Hence, the company should face no liquidity issues in the near term.

(Source: Latest 10Q)

Investment risks

The evolving situation with the current downturn is creating heightened uncertainty for Hershey's. This is expressed in their most recent quarterly report:

Overall, the company's first quarter performance was relatively in line with expectations, with a modest impact from COVID-19. However, retail foot traffic and takeaway have been volatile and consumer shopping and consumption behaviors are evolving in light of social distancing protocols. The length and severity of the pandemic and associated changes to consumer behaviors remain uncertain.

(Source: Press Release)

But the company has 125 years of experience managing through challenging moments in time. Furthermore, being a market leader with ample free cash flows should allow Hershey's to weather the difficulties better than smaller peers.

Hershey's reputation is also highly reliant on the quality and safety of its products. Any negative news relating to product contamination could lead to decreased revenue for the company. The company may also need to recall products and potentially face litigation. This risk is always present in companies dealing with food and has a large impact on Hershey's value.

Valuation

Peer analysis shows that Hershey ranks more expensive than the median-peer group based on EV/Revenue, EV/EBITDA, and P/E ratios. Hershey's pricing appears to be justified as it has better EBITDA Margin and revenue growth rates than the comparison group. Its EBITDA margin of 24.7% is higher than the peer group median's 20.8%, while consensus revenue growth at 0% is higher than the peer group median's -6.6%. With an economic downturn, Hershey should be able to maintain its higher margins and decent growth due to its competitive advantages. As such, potential investors would have to pay a slightly higher price for better consensus financial results relative to peers.

(Source: Atom Finance)

Takeaways

If Hershey's wants to continue its steady performance, the company has to lead the company through this difficult period. With fewer foot traffic and retailers suffering, Hershey's has to maximise the investments in online channels to meet customers' needs. The company's innovation in packaging should also come with consistent product quality as customers are highly sensitive to taste changes. Successful execution would enable Hershey's to maintain its market leadership and continue to enjoy high returns on capital.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.