Ulta Beauty: More Headwinds Expected Due To COVID-19

by Cornerstone InvestmentsSummary

- Ulta Beauty is the category leader in beauty retail and has historically grown successfully through new store openings and increasing sales.

- However, Ulta experienced industry-wide headwinds in recent years due to slow product innovation, waning cosmetics demand, and competition from newer digital-native brands.

- The pandemic will likely result in further headwinds as WFH reduces demand for cosmetics, Ulta's largest category, and ratchets up competition from digital-based DTC brands.

Ulta Beauty (ULTA) is the largest beauty retailer in the U.S. and the company has executed an impressive expansion journey over the last few years. However, along with persistent industry headwinds and likely long-lasting impacts from COVID-19, the business is set to face more challenges in the near-term. Notwithstanding that Ulta's re-rated lower valuation limits its downside risk at current prices, we think investors have better options to gain exposure to growth-oriented names in the retail segment.

Category Leader

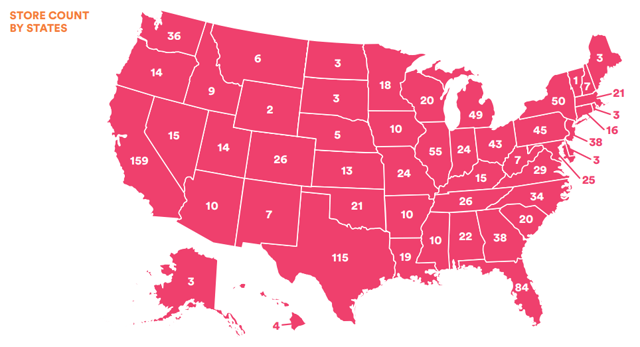

Ulta is the leader in beauty retail with its network of 1,254 retail locations across 50 stares and an online shopping site. The company is a specialty store that provides a one-stop-shop for consumers looking for makeup, fragrance, skincare, haircare, and salon services. The company has built up a network of 34 million active members in its Ultamate Rewards program; member transactions accounted for 95% of total sales which demonstrates the deep penetration among its shoppers. It is safe to say that Ulta's performance is closely linked to the overall health of the cosmetics and skincare industry and it represents more of the traditional distribution channels and brands.

(Source: Annual Report)

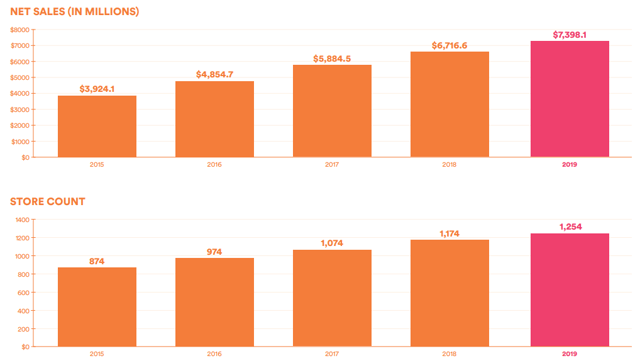

Ulta has historically relied on both comparable sales growth and new store openings to achieve above-average revenue growth. The company opened close to 100 stores per year over the last five years and generated double-digit same-store-sales growth between 2016 and 2018. However, sales have slowed down in the last two years as the industry faces increasing competition from emerging brands and DTC competition. Being disrupted by newcomers and shifting consumer preferences, the traditional players have struggled to regain their growth. We think the pandemic will only accelerate the recent shift towards digital brands and put further pressure on traditional brick-and-mortar players like Ulta even after the virus abates.

(Source: Annual Report)

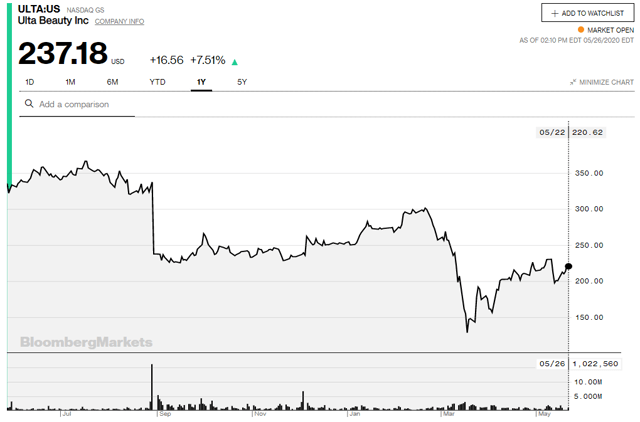

Ulta shares took a 30% dive after it released 2019 Q2 results and lowered its outlook citing industry-wide headwinds. Ulta dialed back its fiscal 2019 outlook including lower growth and operating deleverage which caused a permanent re-rating of its shares. The stock has yet to recover fully from the pandemic-related selloff but it is only ~20% off the pre-COVID levels. We think the pandemic will likely result in additional headwinds for the company which could depress its valuation further, deepening the pressure it faces from the sector-wide slowdown even before this crisis.

(Source: Bloomberg)

COVID-19 Impact

The impact of the pandemic on Ulta cannot be understated because its stores are all shut down. E-commerce represented ~10-15% of its business before the pandemic which means that its shoppers were primarily shopping in-store, whether because of its in-store shopping experience or their habits. Now that most stores remain shut, Ulta is competing with other digital-native domestics and skincare brands for businesses. We think the current situation is disproportionately tilted towards the downside for Ulta for a few reasons. First, the demand for cosmetics could fall on a permanent basis as more people adopt a WFH arrangement thus requiring less makeup. Secondly, for all its customers shopping online now, some of them will undoubtedly try other platforms such as Sephora or DTC brands. If Ulta fails to retain any of these customers, that represents a headwind for its client base. Lastly, looking ahead to the post-COVID world, we think there could be fierce pricing competition from Ulta's competitors as retailers try to lure shoppers and clear inventory. Department stores in particular are likely to flood the market with discounted merchandise as they struggle financially. A number of bankruptcies and potential liquidations will only exacerbate the issue.

The impact of revenue pressure could be particularly acute for Ulta given its large fixed cost base. If revenue declines or growth decelerate meaningfully, Ulta will likely experience operating deleverage which would result in lower margins and profitability. Given Ulta's predominant focus on brick-and-mortar stores and its growth plan that hinges on new store openings, we think COVID-19 represents a major headwind that could persist for the next few years. The competitive environment will also create downward pressure on pricing and consumer demand as the retail sector tries to recover from a historic disruption. The bankrupt companies and digital-native young brands will add to the negative pressure on shifting consumer preferences away from cosmetics to skincare.

Valuation and Performance

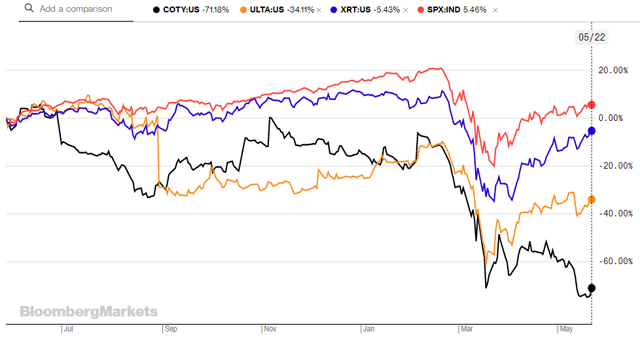

Ulta currently has a market cap of ~$12 billion and trades at an EV/2019 EBITDA of 9.9x. The stock is inexpensive compared to other high-growth retailers such as off-price retailers TJX (TJX) at 12.5x and Burlington Stores (BURL) at 15.5x. We think the discounted valuation can be attributed to its significant deceleration of growth in the last two years combined with fierce competition from newer brands focused on digital channels. The company doesn't have any debt and has bolstered its liquidity by drawing $800 million on its revolver in Q1. The financial risk for Ulta is low which limited its downside risk even during the pandemic.

(Source: Bloomberg)

Looking Ahead

Going forward, we think the potential catalysts for Ulta include the successful reopening of its stores and the return of consumers to its physical stores. While digital sales cannot make up all the lost in-store sales, the company is in an excellent financial position to weather the storm and resume its growth plan after the pandemic eases. We expect Ulta's 2020 growth plan to be impacted meaningfully with reduced store openings and lower capital expenditures, but its discounted valuation should provide support for its share price in the near-term. For investors looking for contrarian plays within the retail sector, we think off-price retailers such as TJX/Ross/Burlington offer the best exposure given their recession-resistant business model and strong financial position to capture additional market amid market turbulence.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.