Blanket ban on recovery impractical, say bankers

by Mayur Shetty(Representative image)

MUMBAI: Despite the government announcement of Covid-related delinquencies not being treated as a default, it would be impractical to provide a blanket protection against recovery action to all borrowers, bankers have said. Also, while the government has the powers to grant businesses protection against insolvency, it is the Reserve Bank of India (RBI) that will need to relax restructuring norms to enable banks to grant relief to promoters without making large provisions.

According to bankers, if the government comes out with a blanket ban against default classification, every business — including those that were stressed before the lockdown — would seek legal intervention to be part of the relief. They say that the relief can be given only when there is a clear measurable impact of the Covid-19 crisis, like on hotels, airlines and retail/malls. If there is a general ban on insolvency proceedings, it could disrupt the recovery process and prevent promoters from exiting a business.

“If there is to be no insolvency proceeding, there has to be a relief package to enable the business to survive. At present, banks cannot enter into a one-time settlement with promoters unless the loan is classified as a non-performing asset (NPA) and a large portion of it written off. Classification as an NPA is costly as banks have to make heavy provisions. While the loan can be upgraded in future, it is a tortuous process and requires a substantial repayment of the loan,” said a bank chief while speaking to TOI.

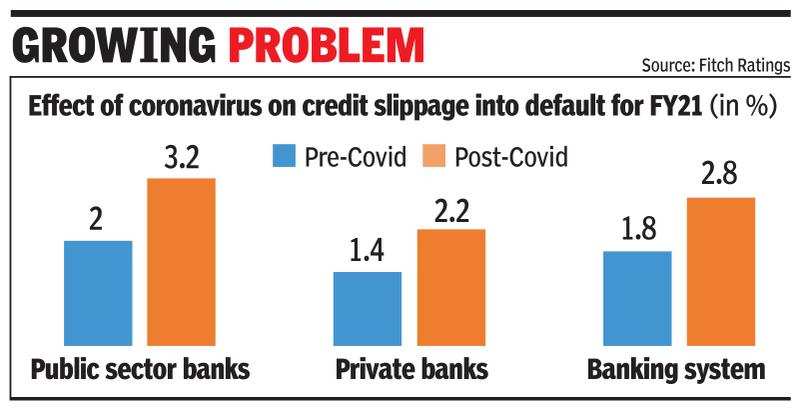

Banking analysts say that even if the government pushed through a notification against classifying any business as being in default, it would postpone the problem for stressed businesses. As against making calibrated provisions starting now, banks would end up with sudden losses if the business proves to be unviable. This would require the banks to raise capital in future.

Banks have said that they can do a case-by-case assessment of all large borrowers during the extended moratorium period and identify the defaulter. The RBI had said in its monetary policy announcement that banks can exclude the moratorium period from the timeline required to initiate a resolution process for the loan. RBI sources said that, while the stand-still permission allows postponing insolvency, it does not protect banks from having to make ageing provisions on the loans in future.

Currently, most of the NCLT benches are not functioning because of the Covid-19 crisis. However, banks say that they will need to start proceedings by June for the smooth functioning of the financial system.