Buy Gladstone Capital For Its 11%+ Yield

by Josh ArnoldSummary

- GLAD has rebounded strongly off its lows but remains well below its prior highs.

- With the distribution having been cut already, the new payout looks safe.

- With a huge yield and relatively cheap valuation, Gladstone looks like a strong income pick.

The turmoil caused by COVID-19 earlier this year seems largely to have abated at this point. Investors appear to be acting like the worst is behind us, and that has created a set of winners and losers in the stock market. One area that hasn't recovered is BDCs, which are companies that lend to smaller, non-public entities that cannot easily access the capital markets. One such company is Gladstone Capital (GLAD), and with shares having rebounded only partially from the early-2020 selloff, I think it offers investors a tremendous yield that appears to be safe at this point.

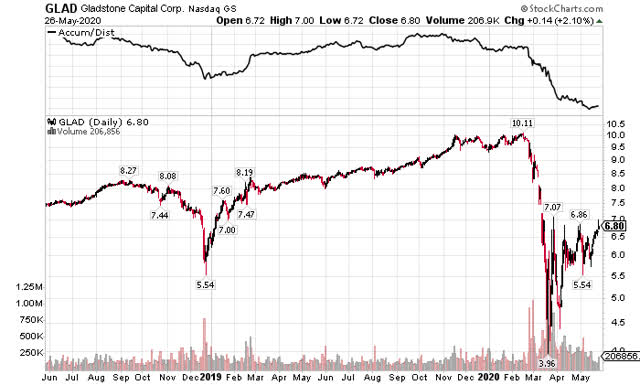

One note of caution before we get to the fundamentals is that we can see on the chart here that Gladstone has been undergoing some meaningful distribution in 2020. The accumulation/distribution line measures divergences between price action - which is rising for Gladstone - and money flows - which are declining - in an attempt to give early warning to investors that a rally or selloff is exhausting. Given the sizable weakness in the accumulation/distribution line, it appears the rally may run out of steam at the $7 area once more, which is just pennies ahead of where we are today.

However, I'll note that my bullishness on Gladstone isn't because I think the share price will soar. I'm bullish from an income perspective as I think the stock offers a great yield that should be safe. The relative strength of the rally is something you'll have to consider for yourself when making the choice to buy or not; I see Gladstone as an income vehicle and will evaluate it as such.

The fundamentals

Gladstone has a portfolio of about $400 million, measured at fair value as of March 31st, with 91% of that in secured loans, with about half of that in lower risk 1st lien loans. The weighted average portfolio yield stood at 10.9% as of March 31st, a figure which has declined fairly steadily in the past few quarters. Lower rates around the world, particularly LIBOR, have caused Gladstone's yield on new investments to fall over time. However, with risk-free rates in the US hovering just over the zero mark in a lot of cases, one has to wonder just how much further they can fall. For this reason, I think Gladstone could be near the bottom in terms of portfolio yield. Gladstone's portfolio is overwhelmingly in floating rate loans, so if rates do rise at some point, the company stands to gain from it.

Gladstone does its best to pick the lower risk, higher-yielding loans to invest in, but the nature of its business dictates that there is some risk. The company generally invests in entities with $3 million to $15 million in EBITDA, but COVID-19 has put some of those companies at risk of declining earnings, or even losses. As with any other BDC, Gladstone has some credit risk in the current environment, which is why the share price declined so precipitously earlier this year.

However, after Q2 results, I see Gladstone as in better shape than I would have thought. Interest income was down only 4%, or $0.5 million, in Q2 as lower average LIBOR rates produced a decline in the weighted average yield on the company's portfolio. There was also a $0.2 million decline in dividend income, and total expenses were up thanks to a $0.8 million increase in the incentive fee from the BDC's adviser.

Net investment income was $6.5 million, an increase of 2%, or $0.21 per share. Importantly, this level of NII covered the distribution in full during one of the worst periods of economic turmoil in US history. Granted that the turmoil was largely confined to March, but given how bad things could have been, I think this is quite extraordinary.

Net assets declined in Q2 by $0.89 per share due to $31.4 million of portfolio depreciation and a $3.1 million net realized loss on investments. The writedowns were due to lower demand from investors for syndicated loans, as well as increasing benchmark yields on which the company's investment valuations are based. The good news is that since conditions have normalized somewhat since then, I'd expect we should see a significant portion of these writedowns recovered in Q3 and beyond. That should help boost NAV back up to prior levels from the current ~$7 per share.

The new distribution should be safe

I realize the irony of stating that the distribution is safe given that Gladstone cut the payout only very recently. The distribution for April, May, and June was cut from 7 cents monthly to 6.5 cents monthly, a decline of ~7%. That puts the quarterly distribution at 19.5 cents and the annualized payout at 78 cents per share.

Keep in mind that Q2 saw a net investment income of 21 cents, with the distribution at 21 cents for the quarter, so NII fully covered the dividend. With net asset values that should rise as loan valuations rebound from the March lows, and with the company's focus on industries that are less impacted by COVID-19 closures, I think the new level should be safe.

Gladstone has a very diverse portfolio of 48 companies in 19 different industries, so I'll reiterate that I think long-term damage will be quite limited. I also think the fact that Gladstone cut the distribution by only 7% is a vote of confidence of sorts from the management team. Dividend suspensions and cuts are all over the place in the stock market today, and Gladstone could have taken the opportunity to slash or stop the payout temporarily. However, a minor cut signals to me that management has a lot of confidence in its ability to continue to make the distributions moving forward.

The bottom line

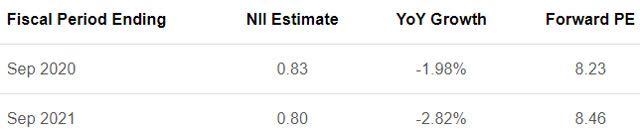

I think Gladstone is pretty cheap, even after the stock has rallied so hard from the March bottom. NII for this year is still expected to be 83 cents per share, with a similar value next year. The new distribution is 78 cents per share, so there is no need for it to be cut again at this point, and with the current payout producing an 11.5% yield, that's reason enough on its own to give Gladstone a look.

Source: Seeking Alpha

The good news is that shares are still cheaper than they typically are at ~8 times NII for this year and next year. Gladstone has averaged ~10 times NII in the past, so it is undervalued based upon that metric as well. There is still obviously some fear among investors that BDCs will suffer in the coming months, and they might. However, it appears to me that Gladstone is well-positioned to continue paying its distribution at the new, lower level, and is undervalued to boot.

Owning a BDC is never for the risk-averse investor, but with an 11%+ yield and cheap valuation, Gladstone looks like a strong pick. It pays distributions monthly instead of quarterly, and with the distribution already having been right-sized for current conditions, it appears safe to me. If 11%+ yields strike your fancy, Gladstone is worth a look.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.