A Selection Of Appealing Nanocaps

by Carlton Getz, CFASummary

- We discuss a selection of nanocap companies with operational and valuation attributes which make them appealing to certain types of investors.

- Three community banks offer decent dividends at steep discounts to tangible book values.

- A small water company trades at a significant discount relative to larger water utility peers.

Our research net occasionally captures various companies that, while intriguing from an investor standpoint, don't warrant a complete overview though they may nonetheless present appealing appreciation and income opportunities for specific investors. In this note, we highlight four small companies - three community banks and a water utility - all of which offer a combination of an attractive dividend yield (though not the highest in their sectors) and incremental potential for long-term capital appreciation based on book and peer valuations.

We should note that given the sometimes thinly traded nature of these companies, it behooves investors to consider the use of limit orders to control purchase and sale prices. In addition, it's worth noting that these companies are best suited to long-term holders rather than traders for the same reason.

Peoples Bancorp (OTCPK:PEBC)

Peoples Bancorp is the holding company for Peoples Bank, a seven branch community bank primarily serving Kent and Queen Anne counties in Maryland's Eastern Shore across Chesapeake Bay from Baltimore. The bank should not be confused with the similarly named PeoplesBank, a division of Codorus Valley Bancorp (CVLY), which serves a region north of Baltimore extending into southern Pennsylvania.

Peoples Bancorp is interesting based on its low valuation relative to book value and its trend of significantly higher earnings over the last several years. The company's tangible book value of $34.07 compares to a market value of $24.57, resulting in a price-to-book value ratio of 72%. The valuation also compared favorably to the company's prior year earnings which came in at an adjusted $2.87, eliminating a benefit from a loan loss provision reversal which added approximately $0.65 to reported earnings per share. The company's return on equity is somewhat below the community bank average at 8.4% in the prior year but quite compelling based on market price with a price-to-earnings ratio of only 8.6.

The bank will almost certainly be impacted by coronavirus related losses even though the majority of the bank's loan portfolio is concentrated in residential loans (46.2%). The bank also has a significant allocation to agricultural and farmland loans (13.2%) which reduces the company's exposure to more volatile commercial lending. In any case, the company would be able to absorb losses of 1.4% of loans per year without impacting shareholders' equity. The company's historical loan loss experience during the last recession caused the company to significantly increase reserves even as net charge-offs, while elevated, did not approach losses experienced by institutional mortgage portfolios or weaker community banks. Granted, the coronavirus is a wholly different event and comparisons are difficult, but our sense is that although the company may incur elevated provisions for potential loan losses, these will be manageable and loan losses will prove modest relative to the broader industry, especially in light of the company's noninterest income operations.

Indeed, the particular attraction of Peoples Bancorp is its sizable insurance agency network which generated 28% of total revenues (interest and noninterest income) in the last year. The company's intangibles and goodwill are almost entirely associated with the recent acquisition of another insurance agency, also located in the Eastern Shore, in 2019. The insurance subsidiary should continue to generate consistent revenues, offsetting periodic volatility in the bank, and additional expansion of the insurance division is likely in the future.

In general, community banks with large noninterest income sources are valued at a premium to the broader market segment and, in the longer term, we expect the company's valuation to better approximate tangible book value.

Peoples Bancorp's dividend yield is not especially high at 2.9%. The dividend, paid semi-annually, was boosted by 48% in the last year, which still resulted in a modest dividend payout ratio of less than 20%, so additional increases in the dividend are likely after the coronavirus situation begins to abate.

Torrington Water Company (OTCPK:TORW)

Torrington Water Company is a small water utility serving Torrington, Connecticut, and surrounding communities in the region northwest of Hartford, Connecticut. Torrington oversees 169 miles of main lines in its communities. The company's market capitalization is $31 million (based on just over 864,000 outstanding shares) and typically only trades a few thousand shares a month often in blocks of a several hundred shares.

Torrington is a very traditional water company with conservative financing, consistent revenues, and persistent if somewhat variable profitability. The company's return on equity averages approximately 8% though annual variability in earnings makes this figure a little volatile from period to period. Interestingly, despite its small size, the company is not averse to small acquisitions in its core service territory most recently of a previously municipally operated water system.

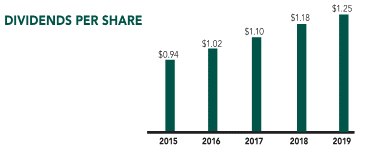

Torrington's attractions are both income and valuation oriented. In terms of dividends, the company's shareholder tagline of "Cash Dividends Paid Every Year Since 1880" succinctly describes the company's dividend record. Torrington pays a secure annual dividend of $1.28 for a decent dividend yield of 3.6%. Moreover, the company has raised its dividend annually for more than 15 years, consistency which any dividend oriented investor would find appealing:

Source: Torrington Water Company Annual Report (2019)

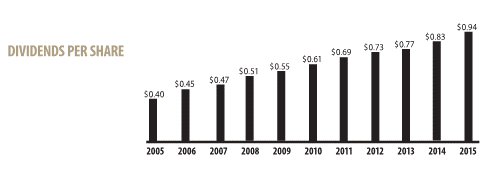

Source: Torrington Water Company Annual Report (2015)

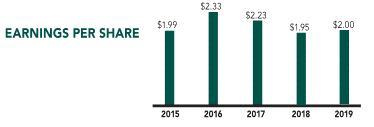

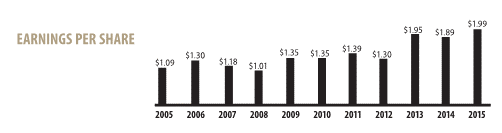

The growth in the dividend has expanded the company's dividend payout ratio as earnings growth has been somewhat less consistent than dividend growth. The dividend payout ratio in the most recent year was just over 60% - up from less than 40% in 2005 - so forward growth in the dividend may be more limited than historical experience. Nonetheless, the company's earnings have reflected an upward if more variable trend, supporting the overall dividend:

Source: Torrington Water Company Annual Report (2019)

Source: Torrington Water Company Annual Report (2015)

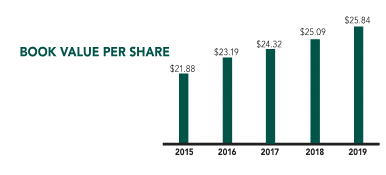

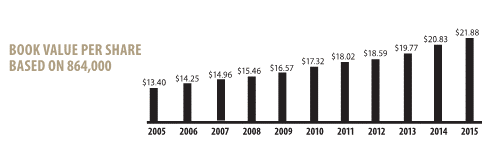

Torrington has also exhibited very consistent growth in book value per share, as reflected in the following tables:

Source: Torrington Water Company Annual Report (2019)

Source: Torrington Water Company Annual Report (2015)

Nonetheless, it's notable that return on equity has averaged a reasonably consistent 7%-9% over time with some years falling below and others above the range. The persistent growth in book value (averaging about 4%-5% per annum) and consistent average return on equity despite periodic volatility will prove valuable to long-term shareholders.

Torrington's present valuation is also well below peer water utilities, such as American Water Works (AWK) and Middlesex Water (MSEX), which often trade at multiples of earnings in the range of 25-30. Torrington trades at only 16-18 times earnings, a discount to the broader water utility industry. A valuation closer to peers would imply a share value of between $50.00 and $60.00, a fully 40% to 65% over the market quotation. The company's dividend yield is also higher than many of its water utility peers (though it would be more in line should valuation return to a level more commensurate with water utility peers) providing an attractive alternative in a rather expensive sector.

Torrington may eventually become an acquisition opportunity for another larger water utility focused on growth through roll up opportunities. In an acquisition, Torrington's shares would almost certainly trade at the upper end of the multiple range, especially given the opportunity for a larger company to realize some cost efficiencies. However, the company's long history as an independent operator (since its founding in 1873) suggests there is little incentive for the company to seek an acquirer. Torrington has, instead, more recently been an acquirer of even smaller contiguous water services in its region, including its purchase of the City of Torrington's water service in 2014 for $350,000. In any case, the combination of stability and valuation compared to peers may be appealing for conservative income oriented investors interested in an optionality for a large, if potentially distant, acquisition premium.

Northumberland Bancorp (OTCPK:NUBC)

Northumberland Bancorp is a five branch community bank serving Northumberland, Pennsylvania, and the surrounding communities near the center of the state.

Northumberland is an interesting mispricing opportunity due to unique circumstances around the company's recent earnings. The market valuation is only 61% of the company's tangible book value despite a price-to-earnings multiple of only 10 due to the company's relatively low 6% return on equity. The low return on equity is attributable to a few factors, including the fact that the company is primarily a residential lender with more than half of the company's loans consisting of residential loans - primarily first lien loans. In addition, expenses have been elevated due to ongoing litigation against the company's former internal audit firm and issues surrounding investigations into the activities of the company's former president by the Comptroller of the Currency. The investigation relates to pricing of trades in trust accounts for which the company paid $1.2 million in reimbursements to trust customers in 2019. Northumberland's earnings may be impacted by additional provisioning for loan losses in line with other community banks in the near term but the decline in expenses associated with run off of the litigation will eventually contribute positively to the company's earnings.

Northumberland also has a record of decent asset quality even in challenging economic conditions. In 2011, the company's nonaccrual and past due loans represented a surprisingly small percentage of total loans while more recent experience has been weaker but not unusual for community banks. The ramifications of coronavirus are inherently uncertain but the company is in a good position to weather any impacts which should, in any case, be relatively temporary in its region.

Northumberland's 3.2% dividend yield is roughly average for community banks.

Northumberland is unlikely to become the next community bank sensation given its rural market position but could eventually be an appealing acquisition candidate for a local or regional competitor keen on improving operating efficiencies. In the event the company were not to become an acquisition candidate, the decent dividend, incremental growth in book value, and reasonable multiple of earnings make the bank attractive for conservative long-term holders while the low price-to-book ratio provides a measure of safety in the share price.

Bank of Southside Virginia (OTCPK:BSSC)

The Bank of Southside Virginia Corporation is the holding company for the eponymous fifteen branch community bank serving the region around Petersburg, Virginia, to the south of Richmond and extending to the North Carolina state line and east towards Norfolk, Virginia, on the Atlantic coast. The market capitalization of roughly $93.0 million, based on a share price of $175.00 with approximately 531,200 shares outstanding, is certainly not among the smallest to attract our attention and the company is surprisingly thinly traded even for a community bank of its size.

Southside is appealing from both an income and valuation standpoint. The company's shares trade at less than 70% of tangible book value and a trailing price-to-earnings ratio of less than 8.0. The current dividend yield of 4.9% based on an annual dividend of $8.50 per share is well secured even should earnings temporarily decline in the current economic and interest rate environment. In addition, our analysis of the company's loan portfolio suggests the company will likely not incur significant loan losses on its loan portfolio despite the concentration in automotive loans though, admittedly, past performance is not necessarily a reliable guide for current conditions.

Southside's market area is a mix of urban, suburban, and rural regions with an equal mix of demographic and population growth characteristics. In some areas, such as Petersburg city, trends are not especially inspiring with minimal and, in some cases, negative population growth in rural regions. However, the county surrounding Petersburg has experienced a degree of growth, balancing the overall geographic picture.

The economic characteristics are varied in the region although government (federal and state) are the largest employers in most of the counties due to the concentration of federal and state facilities around the state capital and throughout the southern Virginia region. Healthcare, retail, and transportation are also leading employers, with hospitality and tourism related business and manufacturing representing comparatively small shares of total employment.

The company's insured deposit market share in its markets varies based on the population density of the specific county. In the Petersburg region, the company holds about a quarter of insured deposits (26%) while in more rural Prince George, Southampton, and Sussex counties the company often holds deposit market shares ranging from 32% to 36%. The rural counties typically have only three or so insured bank institutions with deposits roughly evenly divided between them, resulting in something of a banking triopoly.

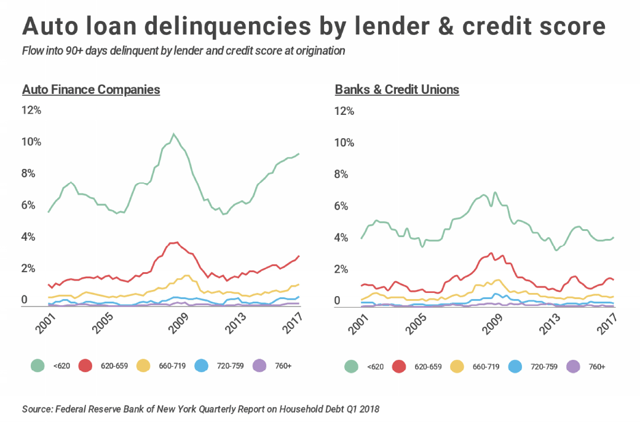

The loan portfolio is unique from a concentration standpoint since a large part of the company's loan portfolio - over 45% - is comprised of automotive loans. Automotive loans have a mixed reputation when it comes to asset quality and performance, especially given the recent rise in delinquencies (even before the advent of coronavirus) in subprime automotive loans despite a purportedly strong economic environment. A concentration in automotive loans, just as a concentration in other historically more volatile loans such as construction loans, warrants additional attention from investors. However, we've found the company's automotive loan portfolio to be of unusually strong quality even during periods of economic distress.

Southside's loan concentration in automotive loans is cause for some concern or, at least, closer analysis. Automotive loans have inherent risks and the growing tendency for more auto loans to exceed the value of the underlying asset and for loan terms to be lengthened to make the loans "affordable" contribute to the potential for deteriorating credit quality in the event of a recession. In addition, automotive loans have historically been more volatile than more traditional commercial and residential mortgages with delinquencies and losses higher during periods of economic stress. Indeed, automotive loan delinquencies had been on the uptrend even before the economic impact associated with coronavirus, as reflected in the following charts:

Southside has not as yet returned our calls seeking additional information on the specifics of the company's automotive loan book. However, we have reviewed the company's past financial disclosures to assess how the company's automotive loans historically performed, especially during the last recession, as a guide for their potential performance as the economy approaches another recession. The comparison is not perfect, of course, as the economic impacts from coronavirus related closures and job losses will differ from those of the previous financially driven recession. Nonetheless, the historical data should at least provide a window into the potential riskiness of the company's automotive loan portfolio.

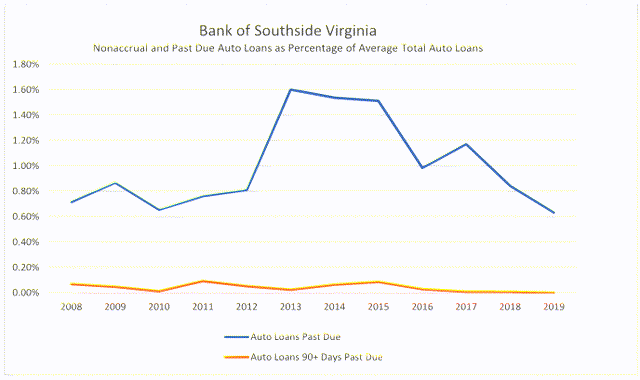

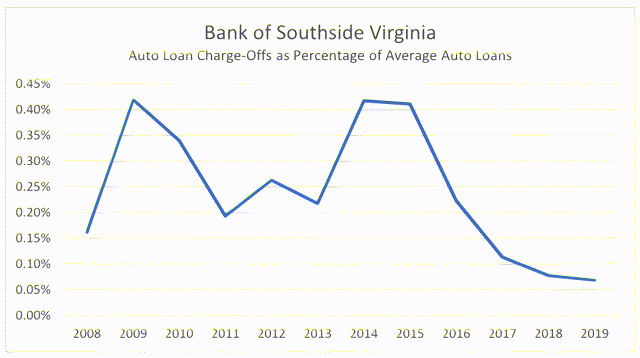

Southside's experience is significantly better than the broader industry average. The company's past due automotive loans as a percentage of total automotive loans most recently peaked in 2013 when, ironically, delinquencies in the above tables from the Federal Reserve Bank of New York were hitting lows, as reflected in the following chart:

Source: Winter Harbor Capital

More importantly, it should be noted that there is a distinct difference between the two charts; while the Federal Reserve Bank chart reflects automotive loans more than 90 days past due, the blue line on the above chart reflects the company's total automotive loans past due regardless of the amount of time. The company's automotive loans more than 90+ days past due are a small fraction of overall past due loans, as reflected by the orange line. In fact, Southside's automotive loans more than 90+ days past due have never exceeded 15% of total past due automotive loans in the last decade and, moreover, typically average less than 5% of total past due and nonaccrual automotive loans. In this regard, the above loan delinquency performance strongly suggests the company's automotive loans are solidly in the top tier of credit scores (760+) or, at least, in line with the performance of such loans which have historically experienced significantly lower losses than weaker or subprime automotive loans.

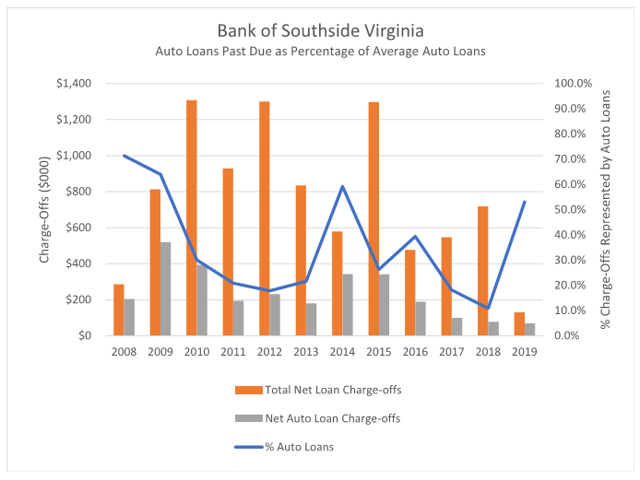

It's possible that a company could maintain a relatively low level of nonaccrual and past due loans by aggressively charging off loans which would raise overall charge off levels. In this respect, Southside has also not experienced unusually high charge offs of automotive loans as the company moves to remove seriously delinquent loans from its loan portfolio. Indeed, the company has experienced quite low charge offs of automotive loans over the last decade including, notably, during the last recession, as reflected in the following chart:

Source: Winter Harbor Capital

The company's automotive loan charge offs have been volatile, ranging between 0.10% and 0.45% of average automotive loans, but have not exceeded 0.45% even during the financial crisis. The loan loss experience on the company's automotive loans is not altogether that much different than average loan charge off ratios for community banks in general outside of the best economic conditions. In comparison, the net automotive finance charge off ratio at Ally Financial (ALLY), a specialist in automotive lending, has averaged 1.3% in each of the last two years, a rate more than ten times that experienced by Southside.

Interestingly, the company's automotive loan charge offs have tended to lead higher charge offs in other loan categories and have never really driven an increase in overall loan charge offs. Southside's charge offs have thus seen more volatility due to credit losses associated with commercial and residential real estate loans than in automotive loans. The result is that in spite of automotive loans being a significant part of the company's total loan portfolio, automotive loan charge offs have actually been a proportionally smaller percentage of total loan charge offs over the last decade than would typically be expected under these conditions, as reflected in the following chart:

Source: Winter Harbor Capital

In essence, automotive loan charge offs have only been a significant percentage of total loan charge offs when credit losses in other categories are unusually low. Typically, one would expect the inverse to be the case, i.e., that credit losses in other categories would generally be more consistent and automotive loans would drive higher losses in periods of economic stress.

The conservative approach to lending and concentration of assets in lower yielding interest bearing deposits and investment securities does, however, limit the company's ability to grow net interest margin and profitability. Southside could generate better returns on assets and equity were the company able to deploy its deposit base into more loans - even of the same type - or more profitable loans. A combination of factors, including the company's lending approach and loan demand in the region even before considering the impact of coronavirus, will likely prevent any such significant shift from occurring in the foreseeable future. In our view, this will probably remain a relatively untapped potential source of growth, limiting the appeal of the company to long-term income oriented investors.

Disclosure: I am/we are long TORW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.