Genesis Energy LP: Too Risky For The Current Environment

by Michael A. Gayed, CFASummary

- Even though it shows some rebound after March lows, Genesis Energy LP remains a risky buy in the current environment.

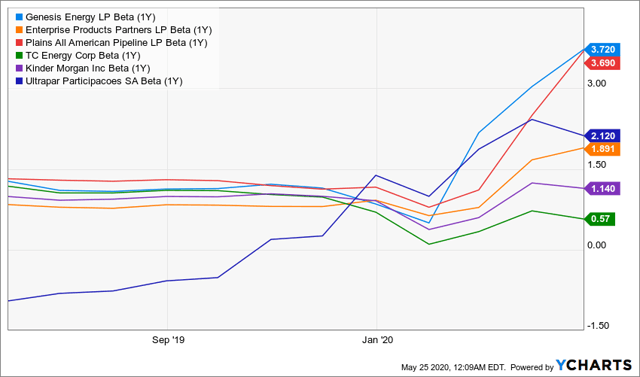

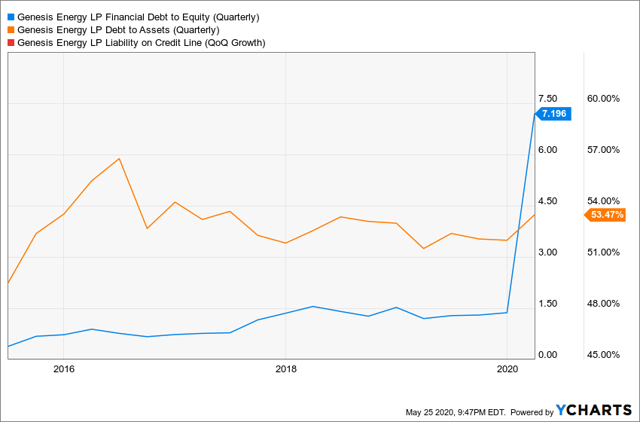

- The stock shows high volatility and a high debt to equity ratio.

- As the struggles in the oil and gas sector may not be over, there are ways of gaining exposure to midstream companies that carry less risk.

"The essence of risk management lies in maximizing the areas where we have some control over the outcome while minimizing the areas where we have absolutely no control over the outcome." - Peter L. Bernstein

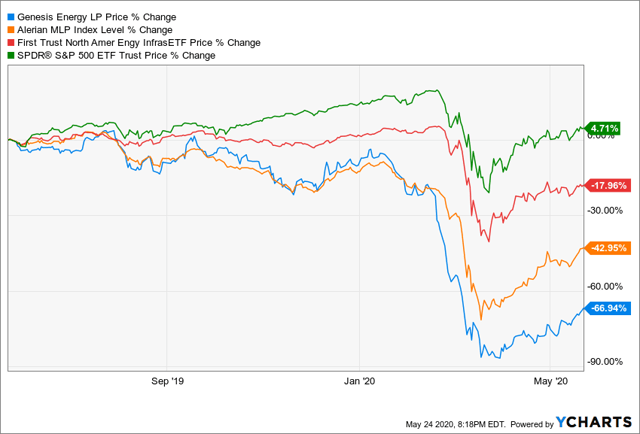

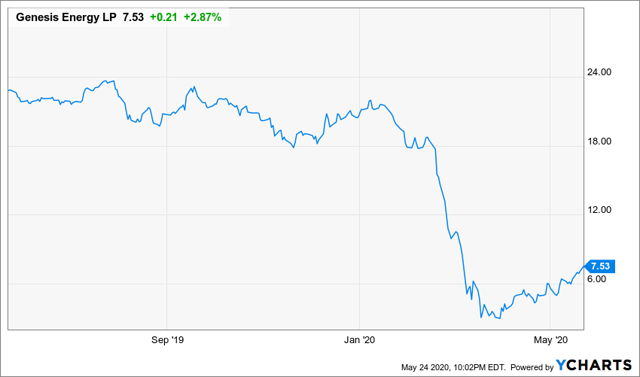

Despite weathering the coronavirus panic relatively well, Genesis Energy, LP (GEL) remains too risky to buy. The Midstream sector has struggled with the rest of the oil and natural gas industry in 2020, even though it has rebounded well from March lows. Midstream companies have underperformed the market, with GEL underperforming industry ETFs. There remain significant concerns about the company moving forward, mainly due to its volatility, leveraging, and the current energy climate. Further, the company recently announced it would be decreasing its dividend to provide further liquidity, making it less attractive to dividend investors. I do not want to be too bearish on this stock, because it is likely there will still be some growth as demand for energy products continues to increase over the summer. However, I believe there are less risky options if you want exposure to this sector.

The company's most significant segment margin is offshore pipeline transportation (50%). It also has substantial operations in sodium minerals and sulfur services (22%), onshore facilities and transportation (17%), and marine transportation (11%). In its Q1 report, the company attributes its resilience to the consistent pipeline volumes out of the Gulf Coast, strong crude-by-rail volumes out of Canada (which discontinued when they became uneconomic), and strong demand for marine transportation across their different asset classes. The company benefits from healthy exposure to Gulf Coast Operations, which have been harmed less than companies dealing in shale oil. However, the company's revenue for 1Q 2020 decreased 13% from Q1 2019, and its cash flows from operating activities decreased by 22.5% in this period. GEL has also shown to be extremely volatile, with a higher one-year beta, which is greater than many of the leaders in its sector.

The risk associated with this company is compounded by uncertainty in the oil and natural gas sectors I wrote on the Lead-Lag Report that the US would need to significantly reduce domestic oil production to prevent a protracted period of sub-$30 WTI. Up until now, offshore producers have been more sheltered than their inland counterparts. GEL has even entered into new transport deals in the last month. If there is another shock to demand, or if prices plateau at a point where the producers will not be profitable, it will impact GEL's business. The other aspects of GEL's business, such as the production of soda ash, the removal, storage, and sale of sulfur products, and onshore operations will also be affected, especially if there is another COVID outbreak or a crash.

Not that all is bad for GEL. With a current ratio of 1.53 and a quick ratio of 1.06, the company is accurate when it says in the short term, it would have no liquidity problems. A reduction of $200 million worth of distributions will also improve liquidity but will reduce dividends to $0.15 per unit. However, with an increase in debt to equity and debt to assets, further shocks to the economy could further disrupt GEL's deleveraging plan. With a possibility of more crashes, I maintain that a stock like GEL is too risky under the current conditions.

If you want exposure to midstream companies, you could do better to buy a company without GEL's leveraging and volatility. ETFs may be the best option over the long term to minimize the risk individual companies like GEL pose. Some expect the price to rise to approximately $10. If GEL is already in your portfolio, it may be worth waiting a little longer and then selling if it gets close to $10. Otherwise, it may be better to play it safe on this stock in favor of the risk protections of an ETF.

*Like this article? Don't forget to hit the Follow button above!

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.