Communications Systems: Needs Sustained Bottom-Line Growth To Move The Share Price

by Individual TraderSummary

- Firm posts negative earnings in the first quarter.

- Once again this showed that the company is absent any real competitive advantage.

- No need to push the boundaries until we see clear evidence that the trend has changed.

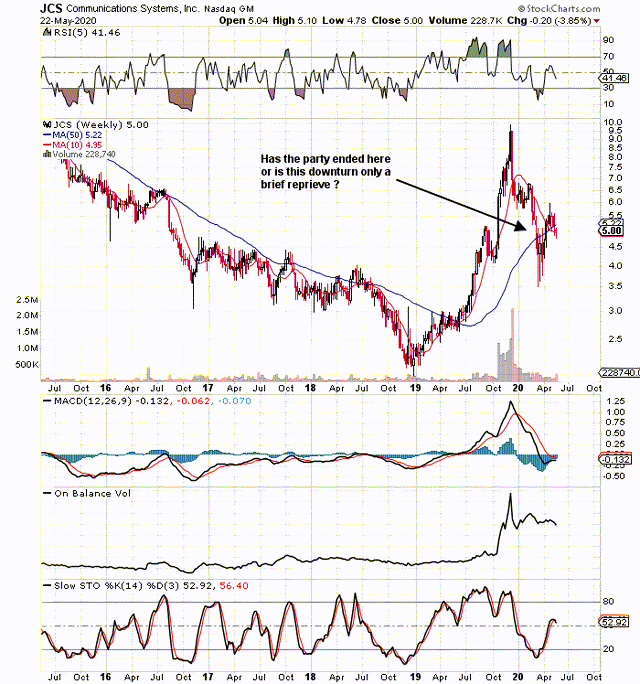

Communication Systems (JCS) operates in the infrastructure connectivity and broadband niches. It produces and markets its products to customers in North America as well as international markets. Shares had been caught in an ugly bear-market from 2011 to December 2018 due to ugly trends in both top-line sales as well as operating margins. The story of JCS changed significantly though from those December 2018 lows. Shares rallied five-fold in 2019 to hit almost $10 a share before finally topping out almost one year later (December 9, 2019) to the day. Due to a combination of factors, shares have backed off significantly since those late 2019 highs and now rest at approximately $5 per share.

As investors, what we want to decipher here is whether the fundamental story has changed in Communication Systems or whether the recent down-spiral in the share price is more market based and less fundamentally based. Irrespective of the price of the shares at present, what we want to decode is whether the company is:

- Projected to sell more high-margin product this fiscal year over 2019

- Profit margins are at a minimum, staying the same if not growing

- Projected to sell even more product in 2021 and beyond

Although the third point above at times can be hard to extrapolate, guidance, technicals, and current trends can help us in projecting future numbers.

The encouraging trend which we saw from JCS in 2019 was a return to profitability. Irrespective of how cheap a potential value play becomes, turning a profit is essential, in our opinion, as it brings stability to the situation. Net profit came in at $6.5 million in 2019. This was the first profitable year since 2014 when the company reported $2 million in net profit. The "Transition Networks" segment grew its EBIT by $2.6 million to hit $5.6 million. This was an 87% increase and if the $7 million NYCDOT project is anything to go by, there should be significant sustained gains on the cards here. CEO, H.D Lacey stated that the 2019 turnaround was due to more focus and resources being lent to these high margin segments along with cost-reduction initiatives and divestitures of non-strategic assets.

In the recent first quarter this year, we saw that revenues dropped by about $2 million to come in at $9.2 million and EPS came in at -$0.09 per share or -$1.2 million in EBIT. This firm may have gotten significantly smaller but segments continue to become more profitable as we saw again in the first quarter. "Transition Networks" led the way with EBIT of $216,000 which was a 266% increase over the same quarter 12 months prior (much faster growth-rate than 2019 as a whole). We acknowledge that earnings of discontinued operations have been beefing up the reported "net profit" but gross margins continue to remain buoyant which is encouraging. In the first quarter, this key profitability metric came in at 40.21% although the $3.7 million in gross profit was not enough to post positive earnings per share.

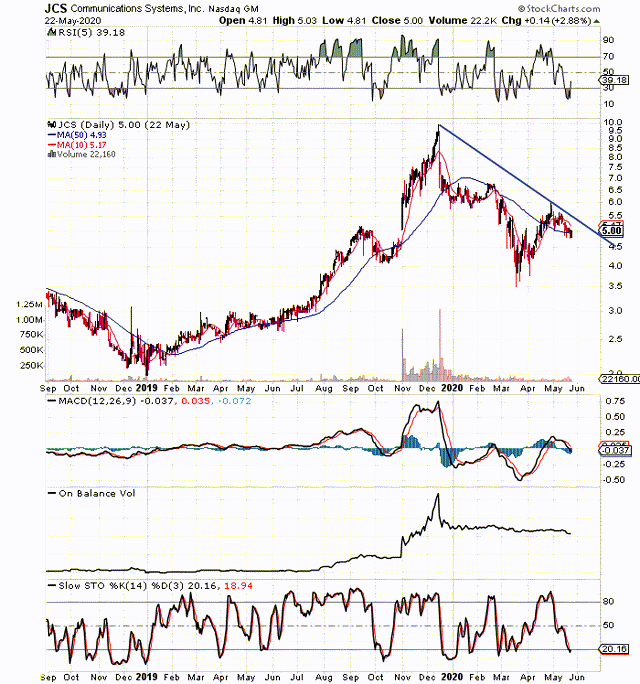

This coming second quarter will most likely be the make or break quarter for JCS in 2020. If it comes in very negative (worse than -$0.07), we will most likely see negative earnings this year. CEO, Lacey cited weakness in international markets along with decreased demand as the reasons for the lower sales and earnings in the first quarter. Being chartists, we believe that all known fundamentals have already been embedded in the technical chart. Therefore, if international markets recover faster than the consensus believes at present, we should see a clear break above that down-cycle break line. That would be our signal to put some long deltas to work.

Therefore, to sum up, from an asset's standpoint (book multiple of 0.95) and a sales' standpoint (0.95 sales multiple), this stock looks very attractive considering how margins have been expanding. There is no debt to speak of on the balance sheet and there is ample cash flow to keep on paying that 1.65% dividend. Considering the fact that shares are almost down 50% in the space of 6 months, there is no need to punch the boundaries here. We will wait for that potential trend-line break before putting any long deltas to work here.

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not stop until it reaches $1 million.

-----------------------

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.