Global stocks shake off concern over US-China tensions

Stimulus plans in Europe and Japan trump worries about Beijing’s moves in Hong Kong

by Adam Samson, Hudson Lockett, Philip StaffordUS stocks staged a late rally on Wednesday as hopes of a faster economic recovery overcame concerns over the relationship between the US and China.

Wall Street’s S&P 500 finished the day 1.5 per cent higher, closing above 3,000 for the first time in 12 weeks. Other global equity benchmarks also rose, with London’s FTSE 100 gaining 1.3 per cent and the benchmark Euro Stoxx 600 closing 0.2 per cent higher.

However, investors and analysts remained wary following signs of a fresh bout of tension between Washington and Beijing over Hong Kong, as the US said it no longer considered the city to be autonomous of China.

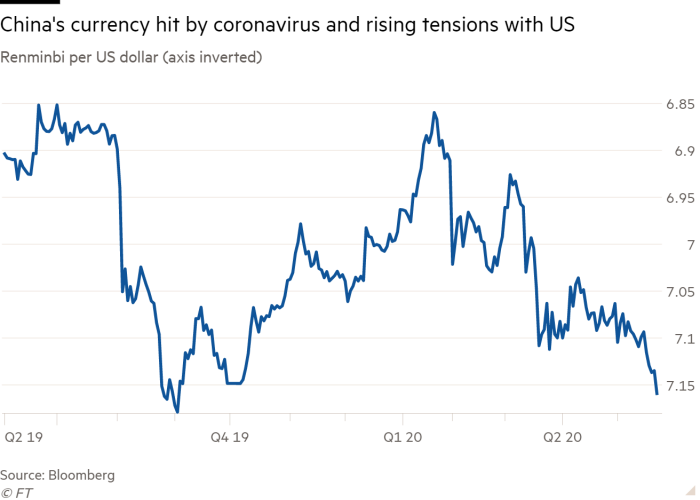

China’s currency fell by the most in three weeks in the wake of the country’s plans to impose a sweeping national security law on Hong Kong. The renminbi weakened 0.46 per cent to Rmb7.17 to the US dollar, its lowest level since September 2019.

“[The lows] should serve as a warning sign of trouble ahead,” said Win Thin, global head of currency strategy at BBH. “We believe this is the worst state of US-China relations since Tiananmen Square in 1989 and set to get worse. We know President [Donald] Trump’s strategy ahead of the election is to blame China for the pandemic and we just don’t think President Xi [Jinping] will be his punching bag for much longer.”

He added that China’s ability to strike back at the US more directly “should not be underestimated”.

In spite of the gains in equities, the yield on the 10-year US Treasury bond fell 0.013 per cent as investors continued to seek out safe assets.

The Federal Reserve’s “Beige Book”, a survey of economic conditions, highlighted the extent of the impact of coronavirus on the US economy and noted that the outlook remained highly uncertain.

Such fears have dulled a little of the optimism of recent weeks that a deluge of fiscal and monetary stimulus measures from countries around the world would help prop up the global economy.

Brussels plans to seek the power to borrow up to €750bn in a vast spending programme to pump money into the bloc’s worst-hit economies.

The yield on government debt from Italy and Spain fell and the euro rallied. The gap between the yield on Italian and German 10-year bonds, which shows the premium traders are demanding to buy Italian debt, fell to below 200 basis points, its lowest level since early April.

“This euro/US dollar move effectively sees the euro playing catch-up with some other big rallies against the dollar,” said analysts at ING Bank.

Also on Wednesday, Japan’s cabinet approved a $1.1tn fiscal stimulus plan, which comes on top of another package already in place.

The proposed spending programmes by the EU and Japan are just the latest efforts by global governments and central banks to prop up economies that have been dealt a serious blow by coronavirus.

Simona Gambarini, an economist at Capital Economics in London, said investors’ expectations for future corporate earnings did not appear excessively optimistic. “While the valuation of the S&P 500 as measured by the ratio of prices to expected earnings over the next year is high by past standards, that arguably reflects investors looking through the current shock.”

Analysts said the cautious easing of lockdowns across big economies and the absence of a much feared “second wave” of infections had also boosted traders’ appetite for assets more exposed to consumer spending in the summer.

Travel and leisure stocks, which have been among the worst hit since the coronavirus crisis began, posted big gains for the second day. Shares in Tui, the tour operator, have surged more than 77 per cent this week, while cinema chain Cineworld has soared 40 per cent. Meanwhile, in the US, Alaska Air, American Airlines and cruise ship operators Royal Caribbean and Carnival led the way higher.

Shares in European banks also jumped on Wednesday, with French lenders Société Générale and BNP Paribas up about 6.5 per cent and 8.8 per cent, respectively, while the UK’s Royal Bank of Scotland gained 6.7 per cent and Germany’s Commerzbank climbed 5.6 per cent. The sector has been hit hard this year amid concerns about how low rates will hurt banks’ profitability and expectations of a sharp rise in loans turning sour.

Hong Kong’s Hang Seng index slipped 0.4 per cent as demonstrators and riot police clashed. Protests that had been kept at bay by the coronavirus pandemic re-erupted following Beijing’s move and a separate law that could result in prison sentences for insulting China’s national anthem.

Oil prices lost some ground after rising on Tuesday following reports that Russia’s energy minister had met the country’s petroleum producers to discuss deeper production cuts in the second half of the year.

Brent crude, the international benchmark, fell 1.1 per cent to $35.16 a barrel, while West Texas Intermediate, the US marker, dropped 3 per cent to $33.26.