WEAT: Further Decline Is Unlikely

by Oleh KombaievSummary

- Wheat is still relatively more expensive than corn.

- It will be difficult for U.S. exporters to look for buyers in the new season.

- The weather can change everything very quickly.

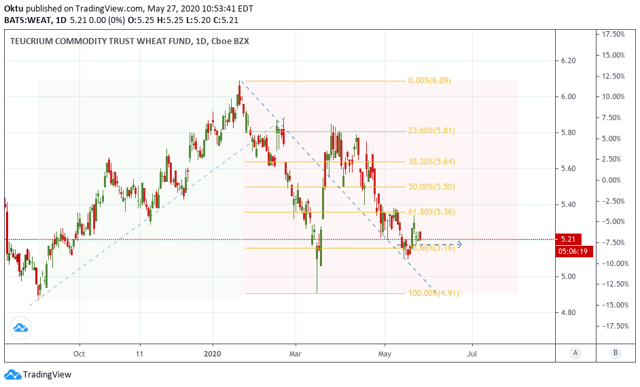

Instrument

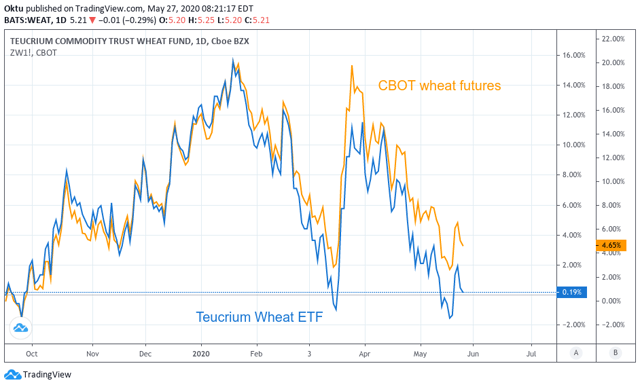

The Teucrium Wheat Fund (WEAT) provides investors unleveraged direct exposure to wheat without the need for a futures account. Therefore, the decision to invest in this fund should be made after analyzing the wheat market.

Seasonality

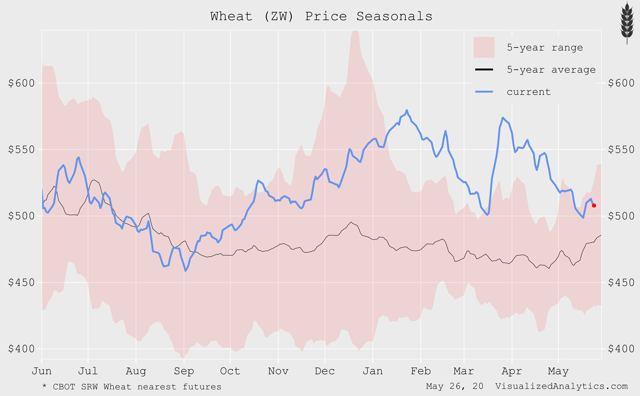

Wheat price has returned to its five-year range. But it is still above its seasonal average. At the same time, the seasonality involves a period of likely increase in the wheat price due to weather risks.

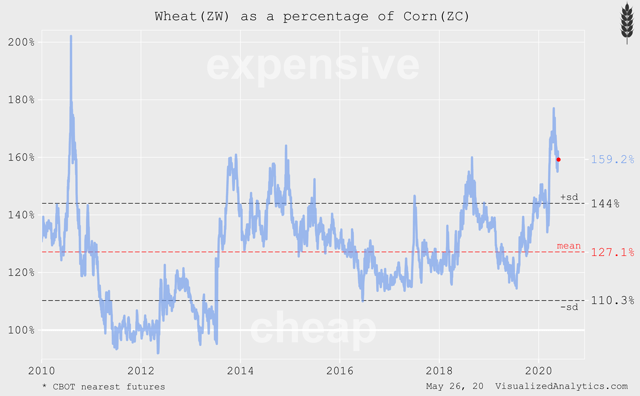

Wheat-Corn Spread

Wheat is still relatively more expensive than corn. All things being equal, wheat will have to fall in price by another 25% in order to achieve a reasonable ratio. But do not expect this to happen in one month.

Supply And Demand

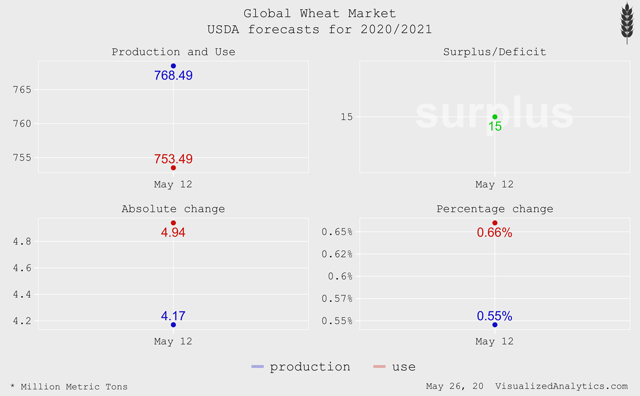

The first USDA forecast for 2020/21 was mixed for the wheat market.

World global wheat production is expected to grow by 0.55%, while consumption will increase by 0.66%. But, despite this, the ending stocks will increase by 15 million tons:

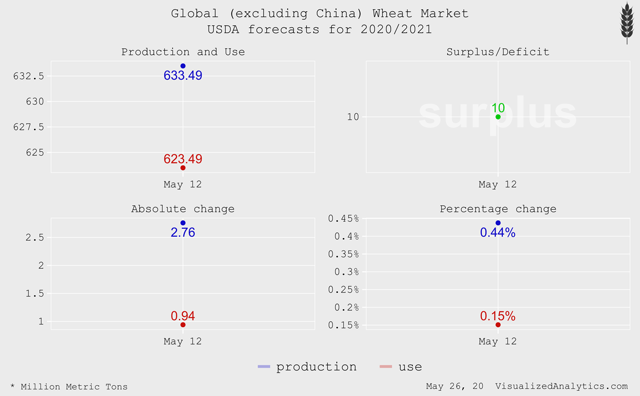

The situation does not change much, even if we exclude China from the calculations. In this case, the surplus will amount to 10 million tons, and the ending stocks will increase by 3.71% to 144.77 million tons:

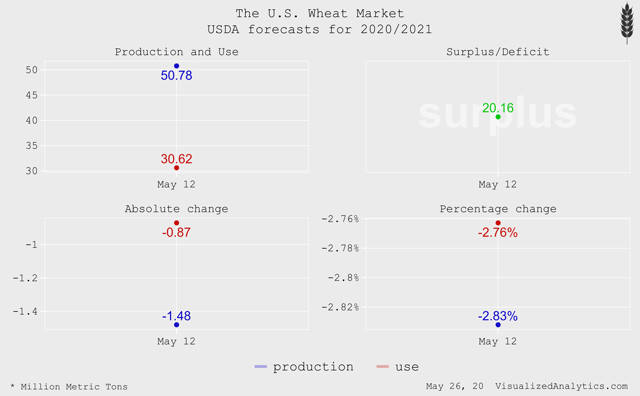

The situation in the US is less bearish. The USDA expects the U.S. ending stocks to reduce by 7% (1.87 million tons) in the current season:

The first forecast indicates that there will be no shortage of wheat on the world market. The situation in the USA is less bearish, but it will be difficult for the U.S. exporters to look for buyers in the new season.

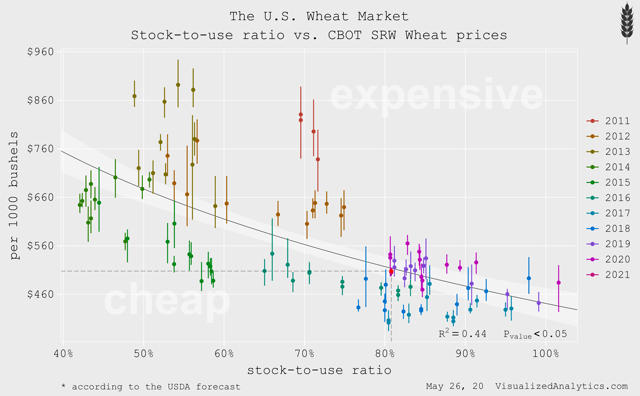

Fundamental Price

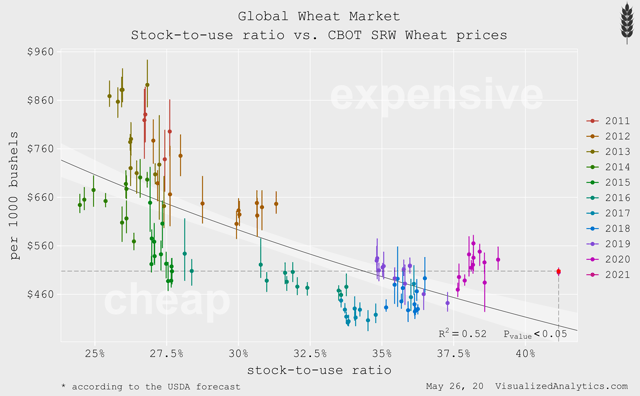

In the wheat market, as a commodity market, the price is formed on the basis of the balance between supply and demand. One of the key markers of this balance is the stock-to-use ratio. Therefore, in the long run, there is the relationship between the values of the stock-to-use ratio and the average price of the wheat futures. It helps us better understand how balanced the market is.

According to the USDA data, the stock-to-use ratio for the global wheat market will exceed 41% in the current marketing year. This is a record for at least the last ten years:

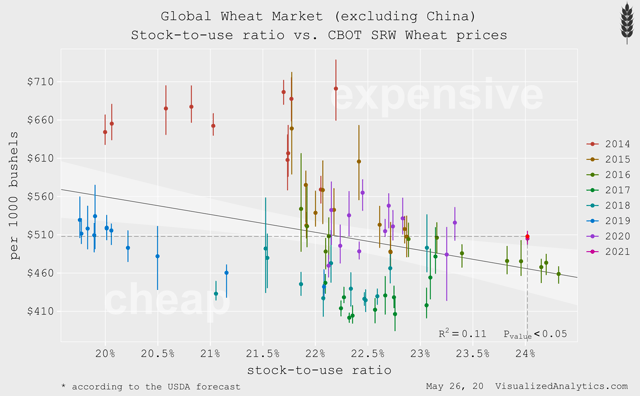

But do not forget that China accounts for about 50% of global wheat stocks, and, therefore, this country substantially affects the world supply and demand structure. I calculated the stock-to-use ratio excluding China and got the following results:

In this case, the value of the stock-to-use ratio is not so high, but still above the balanced level.

Considering the stock-to-use ratio exclusively for the U.S. market, we can say that the price of wheat futures is balanced now:

Bottom line

The main difficulty of the new season is that the USDA predicts an increase in surplus of both the wheat market and the corn market. So far, the overall situation is rather bearish, but do not forget that this is only the beginning of the season. The weather can change everything very quickly.

So, I do not expect further decline in the price of wheat in the coming month. In such conditions, in my opinion, the WEAT ETF will demonstrate a sideways dynamic in the near term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.