Teekay LNG: Attractive Long-Term Cash Flow Visibility Will Move The Needle

by Marel.Summary

- Teekay LNG Partners reported solid results with record-high Q1 2020 adjusted net income (7th consecutive quarterly increase). Importantly, the TGP IDRs were eliminated and a big overhang was lifted.

- Teekay LNG continues to reward investors primarily via a 32% distribution increase as well as opportunistic buybacks, while continuing to pay down debt which remains a top priority.

- This is possible due to the high cash flow visibility (~$9.5Bn backlog) based on long-term fixed-rate 'take-or-pay' contracts (i.e. the customer pays full hire irrespective of their usage of the vessel).

- These fixed-rate contracts are not directly impacted by LNG prices, structural or global imbalances of LNG or possible cargo cancellations.

- Despite addressing the IDRs, Teekay LNG continues to remain an MLP, meaning that the Sponsor, Teekay Corporation, continues to call all of the shots. I believe the final piece of the puzzle is to convert Teekay LNG into a regular C-corp. In my view, the only way to lose here is via charterer defaults (i.e. to lose the backlog).

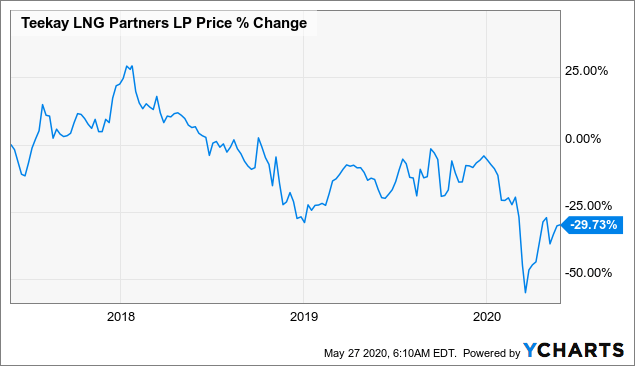

Teekay LNG Partners (TGP) is the gas shipping segment of the Teekay Group. Even though most of my exposure in the Teekay Group is via the parent, Teekay Corporation (TK), I also own a direct stake in TGP. Despite another great earnings report, TGP continues to trade at depressed valuations, down almost 30% over the past three years.

Data by YCharts

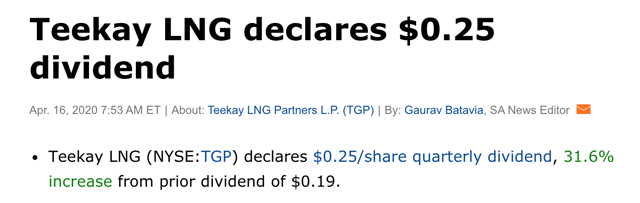

The poor unit price performance doesn't really make sense in terms of company-specific events/progress and is probably a result of the negative stigma in the shipping/energy space, general market pessimism around the coronavirus as well as renewed US-China tensions. Despite this, TGP continues to reward investors via distribution increases (~32% higher compared to 2019) while continuing to opportunistically repurchase units.

Source: Seeking Alpha

Since approving the $100M common unit repurchase program in December 2018, TGP has repurchased a total of 3.63M common units, or ~4.6% of the outstanding common units. These repurchases will partly offset the dilution from settling the TGP IDRs (more on this below).

It is worth noting that the recent distribution increase of ~32% follows a ~36% increase in the prior year. It is really nice being invested in a company with back-to-back distribution increases of more than 30% per annum, with the latest one during the coronavirus, a dark period in which many companies are struggling to survive. This is thanks to TGP's business model, which focuses on long-term fixed-rate contract coverage with high quality customers/counterparties. The contracted backlog stands at ~$9.3Bn, with many contracts providing cash flow visibility until 2045. Importantly, these contracts are 'take-or-pay' i.e. the customer pays full hire to TGP irrespective of their usage of the vessel. These contracts are not impacted by LNG prices, possible cargo cancellations or structural or global imbalances of LNG.

Q1 2020 results were great (no complaints from my side) with Total Adjusted EBITDA up nearly 20% over the prior year to $188.4M and record-high Q1 2020 adjusted net income of $52.2M (7th consecutive quarterly increase). Guidance was reaffirmed with 2020 Adjusted Net Income projected to increase by nearly 50% over 2019, which was up 92% over 2018. It is evident that TGP has reached the much-anticipated inflection point discussed in my previous TGP article in November 2019. TGP booked new time charters for three of its equity-owned LNG carriers and now has 100% charter coverage for its LNG fleet and 94% in 2021. With $9.3Bn in forward contracted revenues and 2020/2021 fully contracted, TGP has high cash flow visibility, which provides ample downside protection during a period of massive global economic uncertainty.

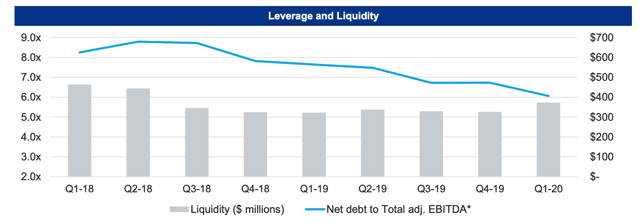

Management has been clear that delevering the balance sheet continues to be a top priority in the coming quarters. TGP has been quite successful in paying down debt, in a phased manner, while continuing to reward unitholders (as discussed above):

Source: TGP Q1 2020 Earnings Presentation, slide 8

Going forward, it is expected that leverage will continue to decline, which ultimately benefits investors, including annualized interest savings of $20-25M through regular amortization and repaying the NOK Bond. It is important to note that TGP's $3.5Bn growth program was completed in December 2019, meaning there are no additional growth CAPEX requirements going forward. This certainly helps in the deleveraging process.

One of the key highlights was the elimination of the TGP IDRs in exchange for 10.75M newly-issued TGP common units to TK. Arguably, this transaction is beneficial to both parties as it simplifies the corporate structure, provides greater alignment between TK (the sponsor) and TGP public unitholders and removes one of the primary uncertainties for investors in TGP. This overhang has now been lifted. That said, TGP continues to remain an MLP (Master Limited Partnership) meaning that TK continues to call all of the shots as the GP (General Partner). In my view, the final piece of the puzzle is to convert TGP into a regular C-corp. In other words, keep it simple.

In closing, despite the coronavirus, TGP's very strong cash flow visibility, supported by long-term fixed-rate take-or-pay contracts, enables the Partnership to continue paying down debt and, at the same time, reward unitholders, primarily via distribution increases. The elimination of the TGP IDRs was a very important milestone (long overdue) and, in my view, the next milestone is to convert TGP into a regular C-corp. As this process unfolds, I expect TGP to continue deleveraging as well as increase distributions. Eventually, the unit price will reflect the true value. Importantly, the Sponsor, TK, is not abusing TGP. On the contrary, TK, which now owns ~42% economic interest in TGP, has been accommodative and sensible, taking the long-term view. Now that the IDRs are out of the way, it seems that we are deeper into win-win territory. I think the only way to lose here is via charterer defaults i.e. losing the backlog.

Disclosure: I am/we are long TGP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am also long the parent Teekay Corporation (TK)