Mohawk Industries: Not A Convincing Investment

by ValueZenSummary

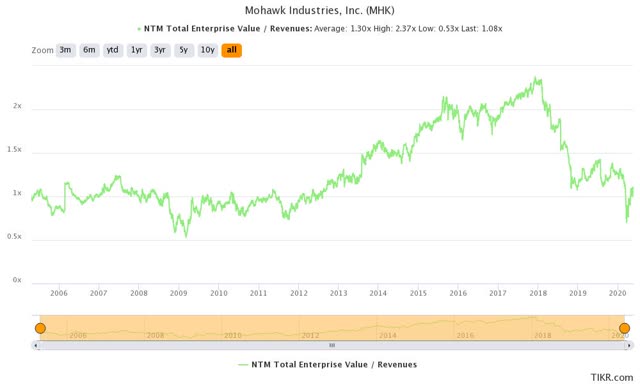

- Mohawk is trading on a forward sales multiple of 1.08, below their long-term average of 1.3x.

- 2018 and 2019 were tough years for the business and industry.

- We believe there is still more downward pressure to come, which could make an investment in Mohawk very volatile.

Mohawk Industries (NYSE:MHK) was already in some unstable ground before COVID-19. Particularly, 2018 and 2019 were tough years for the business and industry.

Gross profit margins have been falling. Mohawk reached its highest gross margins of 32.1% in 2017. Today, they are down almost 5% to 27.8%. Since Mohawk is a capital-intensive business, weakness in gross margins translates to greater erosion in operating income margins. The stock has been punished as a result.

Mohawk is the world's biggest flooring manufacturer (based on management's estimates) with manufacturing operations in 19 countries, followed by Shaw Industries, owned by Berkshire Hathaway (NYSE:BRK.A). The company is highly cyclical, with interest rates and housing starts being the major influences on industry performance. Headwinds should already be reflected by the stock price, which has suffered for the past two years. Shares also look cheap at this point, and with cyclical companies, it is usually a good strategy to buy when the outlook looks the most depressing. However, COVID-19 clouds any visibility and adds lots of risks to the investment. To give some context, in the last recession, revenues dropped 30% between 2007 and 2010. We do not know how things are going to turn out, but we believe we are in the early innings of a recession and are not optimistic about a "V" shaped recovery.

Still, we cannot time the markets and the cheapness in the stock price based on a sales multiple is very appealing. Mohawk is a very speculative investment.

Looking at their numbers

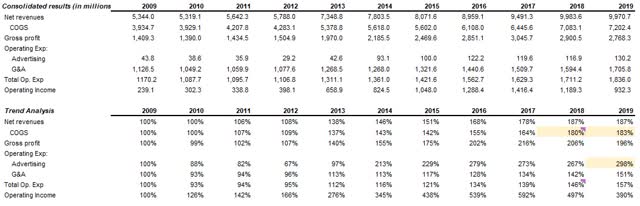

Source: company filings

The operating result at Mohawk looked healthy from 2009 to 2017. We see healthy trends in revenue, gross profit, and operating income growth. We like it when a company can grow revenues while having tight control over its cost structure. It allows for operating income and gross profits to grow at a faster rate than revenues, expanding margins along the way. In the case of Mohawk, we see that to be the case, with sales growing at a 6.6% CAGR while EBIT growth was compounding at a 19% CAGR.

That said, 2018 was the year in which trends started to reverse, starting with a sudden increase in COGS growth outpacing revenue growth and in turn, impacting gross and profit margins. The annual report discloses that the cost of goods sold in 2018 increased due to "dramatically increasing material costs, escalating transportation and energy costs, and constrained chemical supply". That year, the company also saw a tougher U.S labor market, which increased employee turnover affecting efficiencies and increasing training costs, and a surge in competitive imports due to a stronger U.S dollar.

For 2019, the factors impacting COGS remained the same. Increasing ceramic imports due to a strong dollar and decreased production due to changing consumer preferences impacted margins. The shift in consumer preferences pushed the company to restructure the business to aligned capacity with demand in some flooring categories.

Heavy reinvestment in CAPEX and acquisitions

Source: company filings

Mohawk has been reinvesting heavily back into the business, not only by increasing their capital expenditures but also via acquisitions.

Looking first at capital expenditures, the company spent $1.65B in CAPEX from 2004 to 2013 or $183M on average per year. Then, we see a big jump in CAPEX starting in 2013. From 2013 to 2019, Mohawk has spent $4.34B in capital expenditures or an average per year of $621M.

The expenditures in CAPEX from 2013 to 2019 (annual reports linked here) relate to the following investments:

- 2013: Capital projects in fiber innovation, ceramic capacity, insulation board facility in Europe, and significant improvements to the productivity and efficiency in newly acquired businesses to take advantage of pent-up demand in new construction and remodeling in the U.S as well as in the international markets in which they operate.

- 2014: Upgrading their yarn-processing assets to improve quality and drive margin expansion, installing a new production line in their Dallas ceramic manufacturing plant, and begun construction of a new ceramic plant in Tennessee to support future growth.

- 2015: Increased U.S. sales investments to improve market position by increasing service centers, expanding sales personnel, and upgrading distribution partners. Expanded their fiber manufacturing assets, built an LVT (Luxury Vinyl Tile) plant in Europe to increase market participation and upgraded core manufacturing capacity in Italian and European Businesses.

- 2016: Process improvements, equipment upgrades, expansion of LVT capacity, new carpet tile facility in Belgium, and new construction in Russia for a sheet vinyl facility.

- 2017: Expanded residential and commercial distribution in the U.S and Europe and production capacity.

- 2018: Increased production and size capabilities to their Bulgarian plant as well as adding capacity to U.S, Europe, and Russian markets for waterproof laminates. Started operating a new quartz countertop plant in the U.S.

- 2019: Expanded fiber capacity at U.S plants, increase the number of owned and franchised stores in Russia, and invested in vertical integration in many parts of the business.

Mohawks' most important acquisitions were made in 2015 and 2018 when they acquired IVC Group (2015), The Godfrey Hirst (2018), and Eliane (2018). The acquisition of IVC Group positioned the company as a major player in the LVT market. The Godfrey acquisition establishes the company as the biggest flooring manufacturer in Australia and New Zealand markets, and the acquisition of Eliane, a Brazilian company, gave them a leading position in the South American market.

LVT growth is a long-term opportunity, but short-term pain

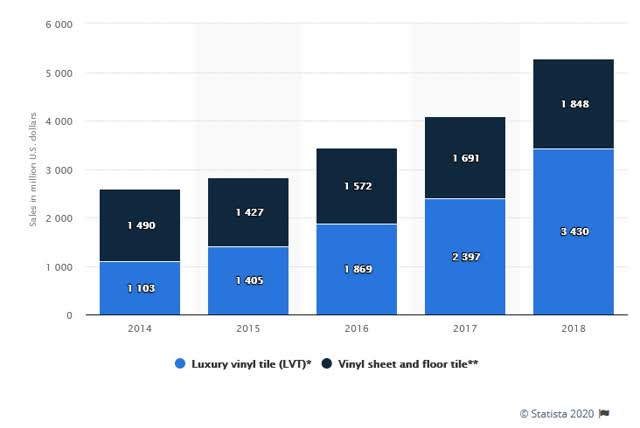

Source: statista.com

The growth in the LVT market has been exponential. As we can see from the chart above, U.S LVT sales growth has gone from $1.1B in 2014 to $3.4B in 2018, for a CAGR of 32.5%. With such a high growth rate, it is probable that growth in the flooring industry is mostly attributed to this new product category.

However, the increasing LVT segment is impacting sales at the other product categories of the company, which started in 2018 and was followed in 2019:

In the US, markets continued to be influenced by the strong dollar and the impact of LVT on other product categories. - Q4 2019 call

Management believes that LVT will continue to take market share from other products and will eventually become a greater part of their portfolio. In the end, that should not impact the top line if revenues from other categories get replace by growth in revenues coming from LVT. However, the short term pain to results comes from the increase CAPEX in LVT manufacturing plants and start-up costs, which the management team encountered in 2018:

Our start-up costs in the period were higher than we projected with LVT production improving slower than anticipated. - Q4 2018 call

That said, the 2020 first-quarter results saw a slight improvement in their LVT category, which saw an increase of 1.5% to operating margins.

With the increasing importance of LVT to future results, the company has been restructuring its other operations and reducing its production and inventories from its carpet, ceramic, and wood products.

Cheap valuation with high risks

Source: tikr.com

Mohawk is trading on a forward sales multiple of 1.08, below their long-term average of 1.3x. Analysts are currently expecting 2020 revenues of $8.1B, 18% lower on a YoY basis.

Usually, a low interest rate environment helps Mohawk, as it fuels growth in housing starts. Recently, interest rates are at their lowest point. However, we don't feel comfortable with the current situation.

There are still no signs of when the COVID-19 pandemic is going to be controlled. Uncertainty is also increasing with the number of COVID-19 cases in Brazil, making them the second most infected country. With the recent acquisition of Eliane in 2018, which operates in Brazil, Mohawk could see more pressure in its operating results. We wouldn't be surprised if more restructuring or impairments charges are already planned.

To conclude, we believe the long-term prospects for Mohawk are still strong. The highly cyclical nature of the business makes peaks and troughs inevitable. We believe there is still more downward pressure to come, which could make an investment in Mohawk very volatile. However, we can't time the markets, and currently, shares in Mohawk are trading below their sales multiple long-term averages. Starting a small speculative position could provide good results.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.